The latest good book on long-termism – The Long View: Why We Need to Transform How the World Sees Time, by Richard Fisher – has an intriguing section on language and different metaphors for time.

I did my project on one common metaphor for time for a trainer training course some years ago, on using space: as in, looking forward, leave the past behind, back in time. (So ubiquitous a metaphor I don’t normally even notice it.)

Other cultures, quite reasonably, picture the future as behind them, because they can’t see it, not having eyes in the back of their heads.

The evidence suggests that if you think of time as a line extending away from you, the long future seems physically distant – and what’s physically distant is also known to seem less important, or at least much less vivid.

Put this together with a challenge we have in Asset Management with uncertainty and data, and I wondered if we need better language, starting with the difference between the past and future.

To put it bluntly, we can have data about the past, about things we’ve already observed or recorded, but we can’t have data about the future. We can only project forward from what we know, and must do so with an ever-present sense of the uncertainty of our projections. We don’t know what is going to happen to our assets tomorrow, let alone fifty years’ time. And yet we must act, in any case, because not to act is to make a decision with consequences in itself. (Annie Duke is very good on this.)

Asset Management confronts short-termism all the time, and even too often builds it in to our planning: short term AMPs that only look out five years, or less. But the assets we build, or fail to build, maintain or fail to maintain may still be the reality in 20, 50, a hundred years from now. And all of these decisions and actions in the context of slow-burn changes like climate catastrophe.

Fisher himself suggests, among other things, that we consciously try out the shoes of people in the future. To imagine being one of my own step-grandchildren looking back at what we did or failed to do in 2024. Or the Joanna Macy exercise of communicating what we did do with a descendant.

I have wondered for a while if we also need terms that bring out the uncertainty of the future.

In a creative set of sci-fi novels, Michael Coney told stories from the Ifalong. About how an action, a decision, will switch the happentrack. A universe in which it matters what decisions you make now, because it creates the actual track in the multitude of possibilities.

Asset Management has to live in the Ifalong, understanding probabilities the best we can, always trying to make an effective happentrack. That’s our job.

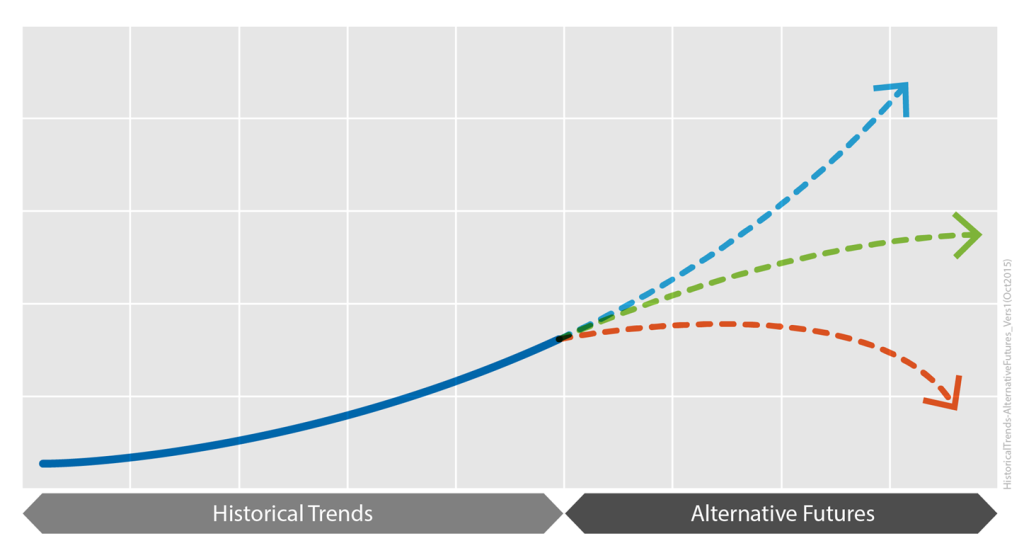

What images, models, metaphors for time, the future and uncertainty do you find useful? The diagram at the top is one we use at AMCL in teaching.

Recent Comments