In 2024, Asset Management turns forty.

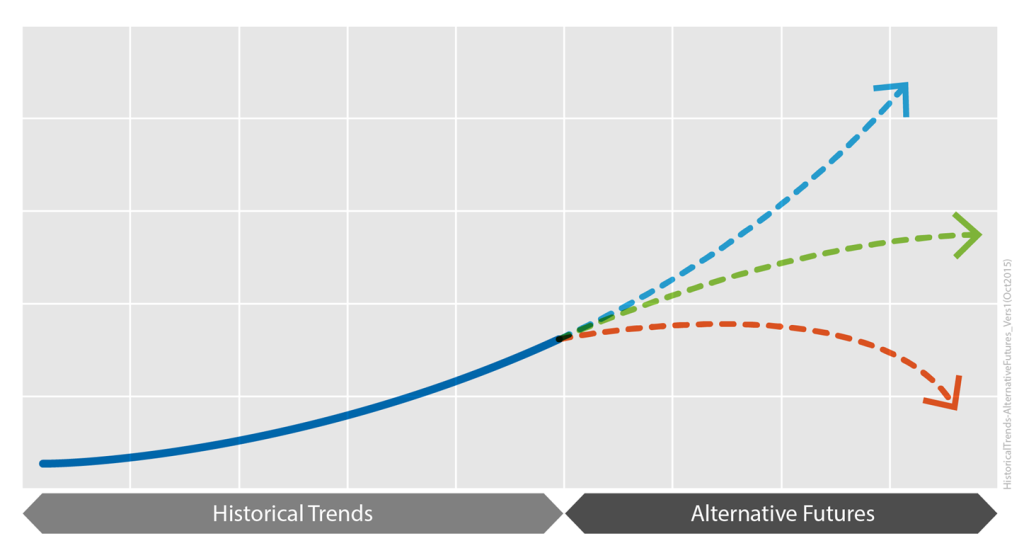

One key question for me this year as an Asset Management practitioner is time itself, and how we act with the future in mind.

The innovation of Asset Management is very largely about time. Penny Burns created AM to look forward in time and consciously choose whether we needed to renew like-for-like, or should manage our assets differently in future.

Forty years ago, we were not thinking about climate catastrophe, and we were only just at the start of the IT revolution. (I had only just seen my first PC, and the world wide web, smart phones and terabytes of data storage for $50 were barely pipedreams.)

But the question of longer-term thinking has in some ways gone backwards in our societies since then, not forwards.

The vast majority of infrastructure organisations still only have very short term asset plans, and almost no asset strategy. More have, must have, 3- or 5-year plans now, thanks to AM as much as anything. But the 15 to 20 years plus strategic view that Penny proposed is still a challenge.

And shockingly few agencies even use life cycle modelling to project the very basic realities about the timings for replacements, let alone a mindset of always asking ‘And then what?’ of our day to day and year to year asset decisions.

I fear as a community we are still underskilled, underprepared for the future: for embracing uncertainty and identifying with the future.

And so, as we celebrate, look back and learn from the last 40 years, Talking Infrastructure plans to act like the future matters.

Starting with a time series of blogs to ring in the New Year. Your contributions most welcome!

In April 2024, it will be 40 years since Penny Burns started the whole thing. Talking Infrastructure plans to party like it’s 2024, all year.

2024 also marks milestones for the Global Forum for Maintenance and Asset Management (update of the AM Landscape), ISO (10 years since ISO 55000), and the Institute of Asset Management (30 years since it was founded): there will be a lot happening.

The need for more considered decision making for our future infrastructure has only grown and become more urgent. Asset Managers everywhere know this. Our 40 year celebration will be an opportunity to take this message not only to managers of infrastructure but also to those who decide, design, construct, fund and vote for our infrastructure.

Like infrastructure itself, our purpose is to support the wider community. There is a lot of satisfaction to be had in this and we invite you to join us, and enjoy it too. What area of Asset Management and decision making particularly interests you?

We are looking to develop a circle of advisors, who, through their interests and work, can have the fun of keeping Talking infrastructure up to date with current issues, and setting its future directions.

Your ideas for celebrating our 40th are also needed and much welcomed. This will include events across Australia in April, and presence at AM conferences and articles wherever and whenever we can.

What did we learn in the last forty years? Where do we need to go in the next 40 years?

© https://www.dreamstime.com/ image120059878

I love a friendly alien. Some of us – possibly the less military minded – have long preferred stories of good contact experiences, from ET and Close Encounters of the Third Kind to Arrivals. Indeed, the grandmammy of them all, The Day the Earth Stood Still, which is about the shortcomings of militarism.

There’s a new generation of sci-fi with what can only be described as positively cuddly species from other planets. The close encounter in A Half-Built Garden, by Ruthanna Emrys, echoes The Day the Earth Stood Still in that the aliens have come to save humanity from itself. But the ‘dandelion networks’ are already saving the planet through direct democracy based around watersheds, to them the natural way to organise.

And it could not be more cuddly: the first human to meet the aliens is woken by water pollution alarms in the Chesapeake in the middle of the night, and hurries out to check what is happening taking her baby with her. Turns out the aliens don’t trust anyone who would not bring their babies to a key negotiation.

The principle the dandelion networks use in decision-making about infrastructure and other technology is: will what we are building be at least as benign as a cherry tree? With evident, multiple benefits and few costs, and a net positive impact on the environment?*

If not, don’t build it.

Is there anything we are building today that would pass the cherry tree challenge?

*Ruthanna borrowed the metaphor from Cradle to Cradle: Remaking the Way We Make Things by William McDonagh and Michael Braungart, 2009.

Not Neom – more AI!

Asset Management just took an interesting right turn. Neom, the city of the future planned to cost $550 billion, is currently hoovering up Asset Managers.

Some people I hugely respect, including Mark Sexton and AMCL, Rhys Davies (previous chair of the technical committee for ISO 55000) and Stacey Jones, ex-BHP, have committed to time in Saudi Arabia to ensure AM is properly incorporated as Neom’s design and construction develops.

At one level, this is progress: that a mega mega mega project takes whole-life Asset Management very seriously from the start.

Ever since I interviewed some Asset Managers from Enron twenty years ago – not long before Enron ate itself – I have understood that AM can only be as progressive as the objectives it is aligned to. We are not automatically on the side of the angels.

When we talk about ‘future friendly assets’, the starting point is that someone has thought through how much a shiny new asset will take to operate and maintain in practice. But it must mean more than this: what will the impact of the asset be, starting with whatever materials it uses, and extending into the impact on ecology and long-term pollution, including CO2.

When, if ever, is it a better idea to build new than to maintain the infrastructure we already have? Can we build our way out of trouble?

A fascinating time to look at the different directions we might take from here. Neom as opposed, for instance, to the commitment to biodiversity in infrastructure at the Blue Mountains City Council.

For the moment, Neom is an Asset Management magnet, with consequences probably far beyond the Middle East.

It’s worth looking Neom up on YouTube, if you have not already.

Or, making sure we always ask who truly benefits by a new infrastructure project.

Infrastructure investment always attracts several groups with particular interest in the projects themselves.

There are the construction companies where it is all upside (work for them) and no cost, at least to them. They probably won’t even be around when the assets are in use.

There are internal project engineers who want cool things to build, whose interest in the assets once constructed can be minimal. That is to say, they don’t necessarily worry about handover of as-builts or how well the assets work after ten years. Their job is to do shiny news things!

And of course there are developers, whose interest extends to how much they can exploit the infrastructure – and with a long, long history of lobbying to the point of corruption.

I am not sure if the people who fund it always think about this. Assuming, of course, they have not already been captured by the lobbying and mindsets of construction companies and developers.

A lot of people like to see money invested in their neighbourhoods, at least until the construction noises start.

So, wearily, we have to take this on as infrastructure Asset Managers and stewards.

Like mad-eyed prophets calling out in the wilderness, and not necessarily honoured in our own country, nobody maybe wants to hear: Cui Bono?

I work with a variety of organisations in several countries who are attempting to implement good Asset Management. Some are just starting out. A few are quite sophisticated. And one or two are even tackling the question of infrastructure decision making in our communities.

I was struck again this month by how hard this all sometimes seems.

Organizations who are just starting out have interesting challenges, of course, including no-one much understanding what AM is and, usually, a lack of resources. One half time resource without much authority, for example, can’t do much to radically transform their business.

But surely it doesn’t have to be that hard, conceptually, to sort out a basic asset inventory, classic Wave 1? Plenty of organisations have already sorted that – it is, as my old colleague John Lavan put it, a puzzle, for which there is an answer already known, not a problem we haven’t yet solved.

And yet many people just don’t seem to have good sense about asset information. And want to reduce the problem to basic IT, which they also don’t do very well. (I am feeling a bit grumpy about this: can’t someone please donate good-enough asset hierarchies and principles into the public domain, or even write the book so no-one ever has to reinvent those particular wheels? TJ, Dave Ulrich, I am looking at you guys here.)

Wave 2, strategic AM and better all-round asset decision-making also depends on something rather more than technology – and that, I am sure, is why organisations struggle. It involves people! Culture! And politics, small p, and sometimes Big P too!

Where Asset Management is effective, infrastructure Asset Managers can then get caught up in Wave 3. And however smart and well-resourced they are, it’s big.

A great current example is electric buses, something the US Federal government wants to throw money at as part of ‘decarbonization’ of transport. But the questions of how, and why, to invest with all the interconnecting issues of the infrastructure for the buses themselves, performance and customer satisfaction, and whether this will even give the right carbon-reduced answer…

Asset Managers get it. But they are a small drop in a large ocean of greed and love of shiny new things.

I asked a buddy who’s simply caught in too many stupid business decisions in a utility whether he might just bring in some additional resources to tackle more of them… But he said, quite rightly, where from? Who gets it, and all the diplomacy, strategic thinking, experience, intelligent use of what data there is that is that’s required, all at once?

ISO 55000 doesn’t help it all that much.

In a new series of blogs, I want to look with your input at some of the challenges we see in every Wave. Of course we love challenges. But I also see rather too many Asset Managers at every stage drowning in the sheer size of the job.

Series to include: asset information, risk, networking, attitude change, and more.

© 2023 Bill Wallsgrove

Some of my best friends are AI – in literature, at least. Ships Behaving Badly in Iain M Banks’ Culture novels for example, which led a human friend to say they couldn’t make a worse job of running the world than humans.

I am sad to say I expect less in reality, and any technology under the control of the rich few. But should we fear conspiracy or cock-up more, I wonder?

I seem to have become a luddite about ‘smart technology’ in managing infrastructure, delivering less and threatening more than enthusiasts are claiming. Systems too complex to manage, or to understand the potential implications of; and products that don’t offer much except big price tags.

But I had to smile at this image, the first result of my brother using an AI art app to create images for me of duck-billed platypuses.

Most simple definitions of Smart Cities include goals along these lines:

- Improving transportation

- Enhancing sustainability

- Promoting economic development

- Improving public services

- Improving quality of life

There can be more, or fewer goals (I have compiled a non-exhaustive list of 78 that fall under the smart city umbrella) in part because smart cities mean different things to different people:

- For a politician, a smart city address the challenges facing urban areas, improves the quality of life for its citizens, creates new economic opportunities and drives economic growth and development. It also provides an opportunity for politicians to demonstrate leadership and innovation by using technology to improve the lives of citizens.

- The economist sees an integrated approach to urban planning and development that uses technology and data-driven approaches to improve performance and sustainable economic opportunities, growth and development with new business and investment opportunities, and improved competitiveness.

- Civil engineers may see improvement in the performance and sustainability of the city’s infrastructure.

- The planner, a way to identify and address key urban challenges and optimise the functioning of the city’s systems and services.

A dummies definition:

Smart Cities use technology to make cities more livable, efficient and sustainable.

But wait – these goals have been the aim of city administrators form time immemorial. The only difference is the addition of “technology”, and the use of technology in very specific ways:

- Measuring things that matter in a way that allows for timely and rational decision making.

- Providing meaningful access to information for citizens and stakeholders.

The introduction of technology and data analytics in a smart city setting allows for the implementation and achievement of city goals in a more efficient and effective way. It allows for informed policies and programs leading to better infrastructure decision making based on a more accurate understanding of the city and its needs.

Technology and data analytics in smart cities can also allow for better monitoring of progress towards goals, and improved transparency and citizen engagement.

So Smart Cities are simply those that find ways to achieve their goals through the application of technology.

Except it’s not simple.

No single project has the necessary budget to implement enough smart city technology to achieve its own goals. Traditional project funding arrangements do not yield smart cities. They give “projects with cameras”. The city part of Smart City is the key. To achieve a smart city all projects and activities, large and small, need to have a city-wide focus. Where there is opportunity to extend a protect to further the technological goals of a city’s progress to smartness, these opportunities must be seized and exploited. This can generate significant organisational stress, as funding priorities are analysed. A playground that gives 100% fun may need to give 80% fun, and 20% smartness – a difficult pill for some to swallow; and 20% smart might not be enough for the boffins, so they have their own bitter pills. This internal stress requires strong policy and leadership if a smart city state is to be achieved, and “smartwashing” avoided.

Smartwashing, like greenwashing, and other washings, refers to “projects with cameras” being presented as achieving smart goals for political and grant funding reasons.

Leadership, understanding, and communication pave the way to rational decision making through adoption of appropriate technologies, leading us to a smart city.

Digital twinning in the context of asset management and smart cities refers to the creation of a digital replica of our heroes of physical infrastructure, such as buildings, transportation systems, or pumps, with the goal of simulating and analysing asset and system performance.

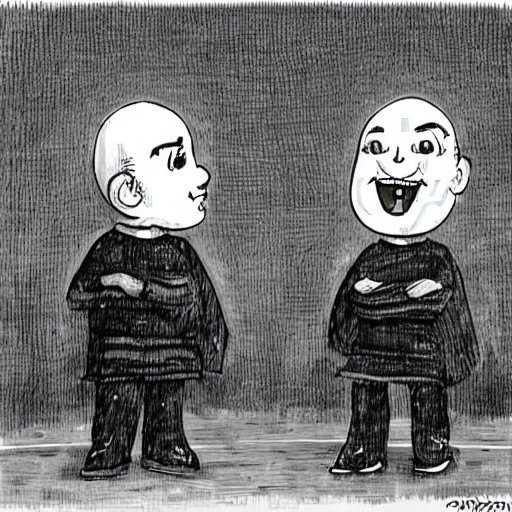

In fiction, the “evil twin” is an identical copy of our hero, but with malevolent, or prankster intentions. Like an evil twin, the digital twin initially appears helpful or friendly, but as the story progresses, their true malevolent intentions become clear. The evil twin tries to manipulate thinking by posing as Our Hero and causing distrust and confusion among those who know and love them. The Evil Twin suggests things that don’t seem quite right, but friends and families accept them; the Evil Twin is very plausible.

These suggestions are increasingly divergent from Our Hero’s true nature, yet family and friends continue to accept them, even as the results place everyone in an increasingly perilous situation.

Eventually there is a confrontation between Our Hero and the Evil Twin, where the true nature of both is revealed, and Our Hero prevails… Or the story ends in tragedy for all.

But seriously

Digital twinning is a great tool for asset managers and for supporting smart cities project implementation, but it essential that the twin is understood for what it is, simply a tool. Putting the tool in place will not solve any problems. The interpretation and analysis of the tool is where value lies. Twinning our assets in a generic way is unlikely to yield future benefits. The need to understand our assets and systems remains key.

Know what matters. Measure what matters. Analyse what matters. Integrate what matters. Do this, or you may create an Evil Twin that misrepresents assets and misleads decision makers.

Recent Comments