In 2024, Asset Management turns forty.

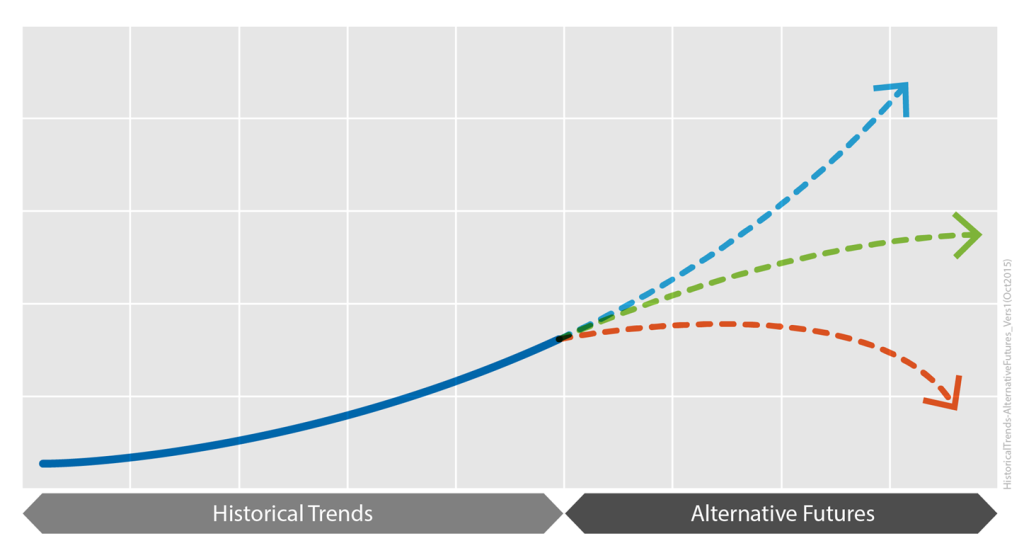

One key question for me this year as an Asset Management practitioner is time itself, and how we act with the future in mind.

The innovation of Asset Management is very largely about time. Penny Burns created AM to look forward in time and consciously choose whether we needed to renew like-for-like, or should manage our assets differently in future.

Forty years ago, we were not thinking about climate catastrophe, and we were only just at the start of the IT revolution. (I had only just seen my first PC, and the world wide web, smart phones and terabytes of data storage for $50 were barely pipedreams.)

But the question of longer-term thinking has in some ways gone backwards in our societies since then, not forwards.

The vast majority of infrastructure organisations still only have very short term asset plans, and almost no asset strategy. More have, must have, 3- or 5-year plans now, thanks to AM as much as anything. But the 15 to 20 years plus strategic view that Penny proposed is still a challenge.

And shockingly few agencies even use life cycle modelling to project the very basic realities about the timings for replacements, let alone a mindset of always asking ‘And then what?’ of our day to day and year to year asset decisions.

I fear as a community we are still underskilled, underprepared for the future: for embracing uncertainty and identifying with the future.

And so, as we celebrate, look back and learn from the last 40 years, Talking Infrastructure plans to act like the future matters.

Starting with a time series of blogs to ring in the New Year. Your contributions most welcome!

In April 2024, it will be 40 years since Penny Burns started the whole thing. Talking Infrastructure plans to party like it’s 2024, all year.

2024 also marks milestones for the Global Forum for Maintenance and Asset Management (update of the AM Landscape), ISO (10 years since ISO 55000), and the Institute of Asset Management (30 years since it was founded): there will be a lot happening.

The need for more considered decision making for our future infrastructure has only grown and become more urgent. Asset Managers everywhere know this. Our 40 year celebration will be an opportunity to take this message not only to managers of infrastructure but also to those who decide, design, construct, fund and vote for our infrastructure.

Like infrastructure itself, our purpose is to support the wider community. There is a lot of satisfaction to be had in this and we invite you to join us, and enjoy it too. What area of Asset Management and decision making particularly interests you?

We are looking to develop a circle of advisors, who, through their interests and work, can have the fun of keeping Talking infrastructure up to date with current issues, and setting its future directions.

Your ideas for celebrating our 40th are also needed and much welcomed. This will include events across Australia in April, and presence at AM conferences and articles wherever and whenever we can.

What did we learn in the last forty years? Where do we need to go in the next 40 years?

© https://www.dreamstime.com/ image120059878

I love a friendly alien. Some of us – possibly the less military minded – have long preferred stories of good contact experiences, from ET and Close Encounters of the Third Kind to Arrivals. Indeed, the grandmammy of them all, The Day the Earth Stood Still, which is about the shortcomings of militarism.

There’s a new generation of sci-fi with what can only be described as positively cuddly species from other planets. The close encounter in A Half-Built Garden, by Ruthanna Emrys, echoes The Day the Earth Stood Still in that the aliens have come to save humanity from itself. But the ‘dandelion networks’ are already saving the planet through direct democracy based around watersheds, to them the natural way to organise.

And it could not be more cuddly: the first human to meet the aliens is woken by water pollution alarms in the Chesapeake in the middle of the night, and hurries out to check what is happening taking her baby with her. Turns out the aliens don’t trust anyone who would not bring their babies to a key negotiation.

The principle the dandelion networks use in decision-making about infrastructure and other technology is: will what we are building be at least as benign as a cherry tree? With evident, multiple benefits and few costs, and a net positive impact on the environment?*

If not, don’t build it.

Is there anything we are building today that would pass the cherry tree challenge?

*Ruthanna borrowed the metaphor from Cradle to Cradle: Remaking the Way We Make Things by William McDonagh and Michael Braungart, 2009.

Note: Print copies of The Story of Asset Management are available, go here and choose the direct Amazon link for your location. (and my thanks to Matthew Hughes who drew my attention to the fact that this was not at all obvious.)

A writer for the Guardian described ‘The Story of Asset Management’ as the ‘inside story of a major change’. She said: “While discussions about government reforms make take centre stage, the behind-the-scenes processes of problem-solving and innovation remain less documented” and this is very true.

I am grateful to her for this insight, for it tells me that this story of how AM grew, can also be used as a rough guide to growing any idea. I can’t say that I knew this at the beginning, but looking back, I think that there are three keys to growing an idea. 1. You have to be fully committed to your idea which doesn’t mean knowing exactly how to do it, but rather having, and believing in, a direction you want to move in. 2. You can’t expect others to do the work, you have to be prepared to do much of it yourself. 3. But while you are doing this, you must actively share the excitement, fun – and the credit – as widely as you possibly can.

As you read the many anecdotes in this story I would be interested to hear from you whether you believe this to be true. I hope you enjoy the story, simply as a story, our story. But I would be very pleased if you were able to use it fo further an idea of your own, either in asset management or elsewhere.

Penny

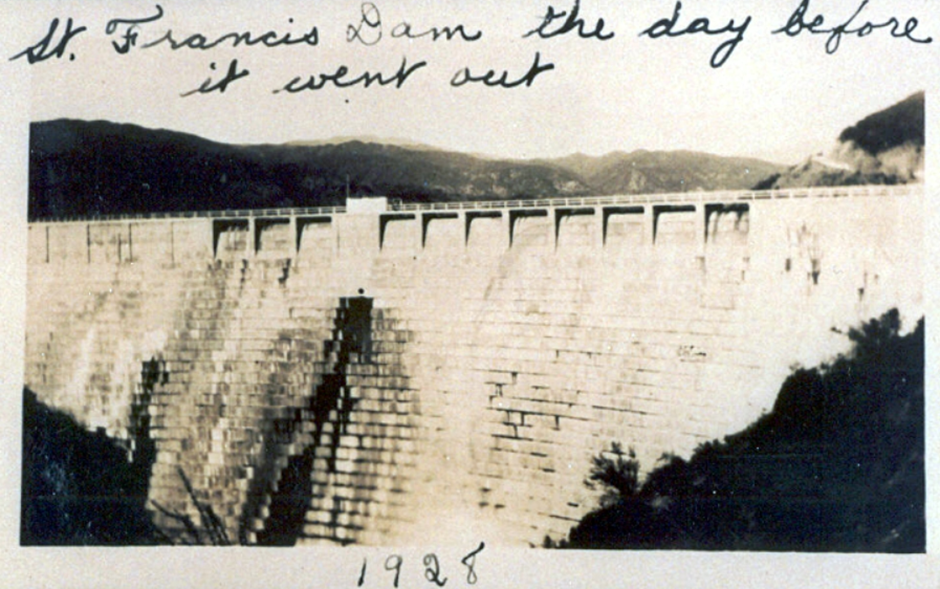

Last known photo of St Francis Dam before it collapsed, © scvhistory.com

You know when you hear something you never noticed before, and then hear about it again the very next day? (It’s known as the Mandela Effect.)

I mean, I saw Chinatown many years ago and so understood that there was a rotten heart to Los Angeles’ water supply, but I never thought about where the water comes from – or understood how it trashed a valley and its communities in the 1920s.

Originally called Payahǖǖnadǖ, meaning ‘place of flowing water’, Owens Valley is a now dry valley north of LA.

I work with enough hydro dams to be curious about dam failures – there have been a few catastrophic failures in the 20th century – so wanted to watch a PBS documentary about the total failure of St Francis Dam in the valley. It failed because of hubris. It did not make it past its first day in operation. But the documentary was about much more than the immediate collapse and the hundreds of people who died that day.

Los Angeles basically stole the water, buying up water rights surreptitiously and sometimes illegally. For some reason I can’t comprehend, it even memorialises the engineer responsible for the dam failure (and the overall aqueduct, which does still exist): Mulholland, of the Drive.

And the day after I watched the documentary, I read a review of a book titled Dust, by Jay Owens, using the Owens Valley as a 20th century example of humanity creating arid dust bowls where there were once thriving ecologies.

Metropolitan LA is a funny old place. I have spent plenty of time there as my brother moved to Azusa in the late 1970s, and retired to Orange County to the south. It was hailed as the city of the future once, but water is the big question mark, still. You would have to conclude that the LA basin is well beyond its carrying capacity, and perhaps always was.

Owens Valley, and St Francis Dam, seem suitable reminders of the challenge of sustainability. enshrined in the original BSI PAS 55 definition of Asset Management. The valley and its people – original and immigrant – paid the price for the development of a vast city region.

Not the first and surely not the last example, but a sobering reminder that water engineering is both hard, and not always on the side of the angels.

Thanks to Chad Dulac of Chelan County PUD, WA, for this steam-punk platypus

I just dutifully waded through a dismal history of the last five decades of British economic policy. Plenty of government mistakes, and nothing that really got past missing an empire. (The Tyranny of Nostalgia, by Russell Jones.)

Despite a less than adequate grasp myself of the mechanics of money supply and exchange rates, I wanted to learn lessons for we should be doing in future. And try to keep up more with Penny Burns, of course.

The book itself focused most on economic stability, and how that encourages good things to happen. Or at least doesn’t scare the horses. And something beyond short-termism and political self-interest.

But, at the very end, the author did have to conclude that successive British governments have done less and less on what truly underlies the ‘economy’: on developing skills, encouraging new ideas, and supporting infrastructure. On how to enable people to do interesting things, really.

And here is where talking about infrastructure comes in.

The physical infrastructure of water and waste water, power, transport and telecommunications isn’t something in its own right, assets for their own sake. It’s about enabling us to do what we need and want to do. Along with agriculture, education and health, it has to start with supporting Maslow’s hierarchy of needs. No-one too hungry or cold or isolated or poorly educated to reach for self-realisation.

In a country increasingly of “private wealth and public squalor” – used originally to refer to the United States – I come back to the sheer waste of potential in Britain, along with the heartache of poverty and lack of opportunities. It’s not like we don’t have plenty of really interesting challenges to apply our collective energy to.

Obviously no-one in the current British government has any kind of vision for community beyond their rich mates.

But what is our vision?

It may be hard now to imagine a time when we didn’t have asset management so let’s go back almost 40 years ago to when it started, a time when our spending on assets was hand written on file cards, before AIS existed, before fax machines (remember them?), and before computers were everywhere. How did we go from practically nothing to where we are today? Well, it has taken 40 years. This is the story of the first ten: how it all started – and why.

Here we go behind-the-scenes to see how the idea arose and grew and how it was influenced by the economic, political and administrative changes taking place at the time in the Australian government and, indeed, around the world. We look at the challenges, successes and setbacks – and many of the funny things that happened along the way. So join this journey into the past and gain a deeper understanding of the foundation on which contemporary asset management principles are built.

Available both in print and ebook versions from Amazon (kindle) and other on line booksellers (epub). All proceeds support the work of Talking Infrastructure.

Also see The Asset Management Story Page for more

Not Neom – more AI!

Asset Management just took an interesting right turn. Neom, the city of the future planned to cost $550 billion, is currently hoovering up Asset Managers.

Some people I hugely respect, including Mark Sexton and AMCL, Rhys Davies (previous chair of the technical committee for ISO 55000) and Stacey Jones, ex-BHP, have committed to time in Saudi Arabia to ensure AM is properly incorporated as Neom’s design and construction develops.

At one level, this is progress: that a mega mega mega project takes whole-life Asset Management very seriously from the start.

Ever since I interviewed some Asset Managers from Enron twenty years ago – not long before Enron ate itself – I have understood that AM can only be as progressive as the objectives it is aligned to. We are not automatically on the side of the angels.

When we talk about ‘future friendly assets’, the starting point is that someone has thought through how much a shiny new asset will take to operate and maintain in practice. But it must mean more than this: what will the impact of the asset be, starting with whatever materials it uses, and extending into the impact on ecology and long-term pollution, including CO2.

When, if ever, is it a better idea to build new than to maintain the infrastructure we already have? Can we build our way out of trouble?

A fascinating time to look at the different directions we might take from here. Neom as opposed, for instance, to the commitment to biodiversity in infrastructure at the Blue Mountains City Council.

For the moment, Neom is an Asset Management magnet, with consequences probably far beyond the Middle East.

It’s worth looking Neom up on YouTube, if you have not already.

Dr Monique Beedles ran a fascinating webinar for the Institute of Asset Management on September 6 on why we should not talk about people as things you can put on a balance sheet.

As she put it, we of all people should recognise that people and assets are not interchangeable. People are ends, not means, with value independent of our economic utility.

Her intention is to rehumanise the discussion about people and work. A ‘people first’ strategy.

But this fits with her view on what’s really needed for good Asset Management, too: her hierarchy of what’s required starts at the bottom with Tech Smarts, through Biz Smarts, to what she calls Street Smarts at the top*. Or the qualities we need to bring to the table of humility, empathy and integrity.

I was particularly taken with her terms we should cut from our vocabulary: productivity, human resources, human capital.

I love the idea that those of us who manage things are in a particularly good position to spell out that people are not things. That people first is, of course, the right approach to physical infrastructure.

And though she didn’t capitalise it as a slogan:

Build Community, not Capital!

www.moniquebeedles.com for her AMP Peak paper, ‘Leadership in Asset Management: Why Your People are Not Your Greatest Assets’

*See her book Leadership Assets, A Whole-of-Life Plan for your Asset Management Career (2021)

Recent Comments