What will happen next?

In the last post I suggested that we shouldn’t be shy about questioning assumptions. But what? ALL assumptions?

Assumptions serve a purpose, otherwise they wouldn’t have lasted so long. They enable us to take shortcuts. Suppose I assume it is going to be sunny and don’t take a coat when I walk to the neighbourhood shops and get caught in a downpour. What are the consequences? I get wet and I am uncomfortable. But it doesn’t last long, and I am the only one affected. True, it would have taken but a moment or so to check my iPhone, so I probably also feel an idiot. But that’s it. Cost is small, temporary, and impact is limited.

Now consider an infrastructure decision where:

- the costs are large,

- the consequences last a long time, and

- they impact many people.

So when the consequences are low, by all means save yourself the effort if you wish, but if they are high – and particularly when the consequences are to be borne by others – we owe it to them to check, to question, to verify.

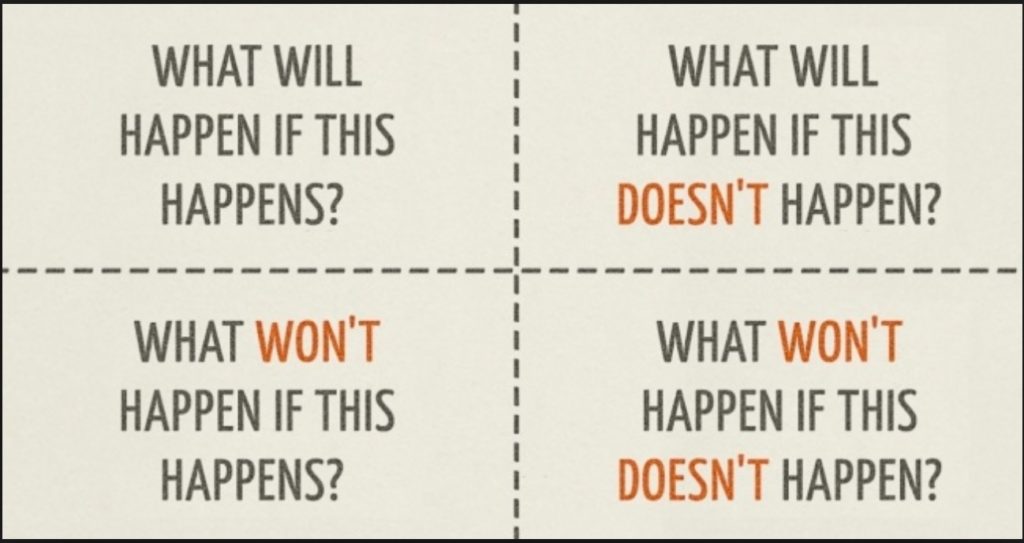

The DESCARTES SQUARE is a useful tool to ensure that ALL consequences are considered:

Desert island

An engineer, a physicist and an economist are shipwrecked on a desert island. All they have is a tin of baked beans but how are they to open it? The engineer considers hitting it with a rock, the physicist suggests heating it over a fire. The economist, however, smiles and says: ‘Let us assume we have a tin opener’.

I am an economist, so assumptions come very easily to me, I know how useful they can be. However, I have also learnt to be wary of their uncritical use – and there is an awful lot of uncritical use around today. Why is this? To understand, we need to ask

What are assumptions and where do they come from?

I once assigned a problem to an engineer working for me. I told him that he could solve the problem any way he liked, just so long as he documented all the assumptions that he made. After a couple of weeks, he supplied his solution. “And where are your assumptions?” I asked. “Oh, I didn’t make any!” he replied.

I pointed to a number of the assumptions in his solution and said “What about this – and this?” “They are not assumptions” he repied indignantly, “they are the results of my years of experience!”

And that, in a nutshell, is why assumptions are so valuable – and, at the same time, so dangerous. Our years of experience enables us to take shortcuts to get the work done but only when doing things the way we always have. When change comes, doing – and thinking – ‘the way we always have’, stops being a shortcut, and becomes a fast track to disaster.

When change comes, we need to rethink our assumptions but years of conditioning makes this very hard, if not impossible.

To succeed in a changing world, we must learn to question assumptions.

Question: But how?

Collection of differences

When I was an Economics Honours student, our small class was visited by John Stone, who later became Secretary to the Treasury. He was on a Treasury recruitment mission. Early in his talk he referred to the Karmel Report on Education and how poor it was. Prof Karmel had been our Head of Department so I felt honour bound to take up the challenge: “Professor Karmel is a highly regarded economist, so how come this report is as bad as you say it is?”

Consider the Committee!

He did not go on the defensive, instead he gave us a pen picture of each member of the Committee that had produced the report. I remember one fellow being described as ‘a businessman who believes that there should be ten people lined up outside his factory gate for every vacancy he has available’.

As a student I had naively looked at reports as objective statements of fact, carefully argued. But after that visit, I saw that all reports are in fact a compromise of the various views of the members comprising the Committee. Before the visit I had thought that an ‘independent’ report meant it was independent of the government, but then who chooses the committee?

Unless we know who is on the Committee and the way they see the world, it is hard to appreciate the conclusions reached. Often the titular head of the committee, the one whose name is associated with the report – as Prof Karmel was in this case – is chosen for his reputation, but the committee is chosen for their views (and there are more of them!)

Filling up from water trucks. Courtesy: Planet Thoughts.

In Australia, our regional cities are struggling for lack of activity and our capital cities are at risk of becoming disfunctional, particularly on the fringes, because of too much activity! The activity I speak of is infrastructure investment.

Why are we so hell-bent on developing mega cities? Big does not mean strong. It does not mean resilient. There is a lot of evidence world wide. Consider:

A horror story – current and continuing

The problems of Mexico City. See Mexico City, parched and sinking, faces a water crisis, an interactive report by the New York Times.

Now ask yourself, what lessons could we learn from this – and how many of the problems being faced there are exacerbated, even created, by high urban densities. And if water is not enough of a problem for you, consider transport, social and environmental issues. How many of our problems do we bring on ourselves? And how could we better manage by re-directing our growth efforts?

Saw this book title “What would you do if you knew you couldn’t fail?”. My instinctive response was “Nothing! What would be the point?” I am not suggesting we should court failure, but we definitely shouldn’t be afraid of it. Of course, we all want things to go ‘according to plan’. But when was the last time you actually learnt anything when it did? Without the possibility of failure, can you really succeed?

Saw this book title “What would you do if you knew you couldn’t fail?”. My instinctive response was “Nothing! What would be the point?” I am not suggesting we should court failure, but we definitely shouldn’t be afraid of it. Of course, we all want things to go ‘according to plan’. But when was the last time you actually learnt anything when it did? Without the possibility of failure, can you really succeed?

‘Disruptive change’ is today’s mantra. Along with rapidly increasing technological change, the economy has also seen a large increase in the number of ‘solo entrepreneurs’. This is not coincidence. The latter, no doubt, has a lot to do with downsizing in large companies, and by government, but it also reflects a greater willingness to assume risk, especially by the young. They interpret risk not as ‘a risk of failure’ but rather as ‘a risk of great success’. And the world is benefitting by it.

However, can solo entrepreneurs, or at least small businesses, make a difference in infrastructure? Is this not a game in which only the mega-large or mega-rich can play? For large scale production this is probably still true. However for advice on policy, assessment of project proposals, improving decision or production flows, and many other aspects, small is definitely beautiful – it is nimble, can move quickly, is not bound by the need to protect past decisions. And technology is now making large scale production (large, centralised, physical infrastructure) no longer the obvious ‘go-to’. So whether you are an organisation looking for an infrastructure solution or a solo entrepreneur in this space; small, customisable, and niche is the way things are going.

PS. If you are a solo entrepreneur in this space, you may enjoy a blog and podcast which I have recently discovered. It is “Flying Solo” – everything you want to know about being a solo entrepreneur. Its tag line is “work for yourself – not by yourself”. I am enjoying it so have a look or a listen and tell me what you think.

How did you go with Friday’s Puzzle to make sense of the statement:

How did you go with Friday’s Puzzle to make sense of the statement:

“The transition to a lower emissions economy is underway and cannot be reversed. Ensuring that the transition is smooth will require major investments in assets with long life spans.”

In this statement I think that there are two correct statements, another that requires a certain value proposition to be acceptable, and one that definitely shouldn’t be accepted without considerable further argument and evidence. Why? Here goes:

- ‘The transition to a lower emissions economy’ is underway. I would consider this undisputable as we have a lot of global evidence as well as experience from home.

- ‘Cannot be reversed’? Well, it is highly unlikely given our international commitments to lower emissions in the Paris Agreement.

- ‘Ensuring that the transition is smooth’? Now it starts to get tricky. Here the writer assumes that intervention to ensure a smooth transition is something that we must do, something that is innately desirable. But is it? We don’t intervene in all market adjustments. ‘Free-market’ advocates usually argue vociferously that we shouldn’t! It’s desirability and nature in this case needs to be carefully argued, not assumed.

- ’will require major investments in assets with long life spans’ . Although presented as if this is an obvious conclusion from the preceding statements, it isn’t. Closing down large (coal burning) plants does not imply they need replacement with other large plants (which Chapter 3 assumes). Demand is decreasing, production is becoming more efficient and our options are rapidly increasing. We need to examine them. The need for large, long-living, plants is no longer obvious.

Any of us can be guilty of stating something as a ‘fact’ when we should be recognising it as a ‘proposition’ to be argued, and the more passionately we believe in what we are doing, the more likely this is to be the case. So if you catch me doing the same – which is entirely likely – please call me on it, in the comments section below.

And I would love to see other examples. If we get enough we can have a special puzzle page!

It is true and, whether deliberately or not, many policy and political statements nowadays sometimes contain elements of supposition masquerading as fact.

It is true and, whether deliberately or not, many policy and political statements nowadays sometimes contain elements of supposition masquerading as fact.

As an undergraduate I was taught to parse statements for those elements that were factually true and those that were either incorrect or purely supposition. It was one of my favourite exercises and I think it is time we brought it back into all curricula and into our daily thinking.

The following is an excellent example. It heads up Chapter 3 of The Preliminary Report of the Independent Review into the Future Security of the National Electricity Market | Department of the Environment and Energy, a chapter that deals with the transition to a lower emissions economy.

“The transition to a lower emissions economy is underway and cannot be reversed. Ensuring that the transition is smooth will require major investments in assets with long life spans.”

Innocuous? Not so. This is a case where we have three statements that we can probably accept trying to force our acceptance of a fourth, that we really shouldn’t.

Try parsing it for yourself – and come back Tuesday for my take on this.

Have fun!

Is it time?

Is it time?

It used to be the case that we elected people to govern us and then trusted them to get on with the job – while we got on with ours! But the world is changing. For one thing, we are getting smarter! According to the Flynn Effect, IQ scores are increasing by about 3% every decade. We are also more educated and continue to learn. In Australia, more graduate and more continue to study throughout life (especially women!). Access to digital technology also means that we can be more aware.

The upshot is that many are no longer prepared to let others make decisions for them. They want to be more involved in decision making. Sure, smart phones can be used to report light outages and potholes, and individual data can be collected for community improvement. But is it enough?

According to the Economic Intelligence Unit in their report ‘Empowering Cities’. in a study of 12 cities around the world, the majority of citizens want to contribute to decision making – especially in healthcare, education, pollution reduction, environmental sustainability, and waste collection, treatment and recycling – but they don’t know how.

These are areas in which citizens – as users of the services – could have much to contribute. These are also areas in which infrastructure features heavily – and where, at the moment, the views of infrastructure providers prevail over the views of users. Would greater citizen discussion of infrastructure issues lead to improved outcomes?

Talking Infrastructure believes so. What do you think?

We’ve all heard the joke of the traveller asking a local how to reach a certain town and being told ‘Well now, you can’t get there from here’. We laugh, but when it comes to infrastructure sustainability, our starting point also determines where we can arrive.

We’ve all heard the joke of the traveller asking a local how to reach a certain town and being told ‘Well now, you can’t get there from here’. We laugh, but when it comes to infrastructure sustainability, our starting point also determines where we can arrive.

At a time when I was an advisor to the Minister of Construction, a new dam was proposed. I looked into the proposal. It did not permit extension of the growing area, nor, because of the weather conditions, did it permit extension of the growing time. At best it would provide a fall back for famers in case of drought. However the benefits of that for the few farmers involved came nowhere close to covering the costs involved. No matter which way I looked at it, on economic, social or environmental grounds I could not make it stack up. What really puzzled me was that the major advocate for the dam was no idiot. He was, in fact, a Rhodes Scholar. I said it was a money losing proposition – and he agreed with me!

“Then why on earth do it?” I exploded in frustration.

“Well”, he said, “the money’s going to be spent on something, so it might as well be here!”

Today we tend to start from the assumption that we have to build something which we can see by the fact that governments determine their capital budgets separately from their recurrent budgets. And we often hear anxiety around the notion that ‘we have to keep up the pipeline of construction projects’.

Why? Why is it important to keep UP the capital spend, but keep DOWN the recurrent spend? Is it even possible?

If we want sustainability, maybe we need to look at where we are starting from.

Recent Comments