How do we get AM into decisions and projects for new assets?

I fear we haven’t quite got there yet. The lure of shiny new things means that even in those organisations where Asset Management is almost business as usual… any thinking about the whole ‘lust to dust’ lifecycle management, even basic on-going costs, goes out the window as soon as opportunities to access money for new (such as Biden’s 2021 Infrastructure Plan) arise.

It’s almost as if organisations can tolerate Asset Management – as long it does not impinge on their fun.

And so we continue to build long-term liabilities.

Wave 3 is ensuring that Asset Management, and Asset Managers, have their seat at the top table in decisions about growth and shiny new things. And once we are there, to ask very hard questions about both of them.

I would like to explore how we get to be at that table, and that ‘future friendly assets’ start, but don’t end, with a healthy scepticism about building anything new.

- What are they really going to cost over their whole life?

- Who really benefits from them?

- What do we rule out by investing in them, as opposed to something else?

- And what might we actually destroy in the process?

How do we make sure we are at the table to be able to ask them?

For a longer article on what goes wrong when Asset Management is not on the table, please see:

An Asset Management friend recently emailed me that her CEO had challenged her view of the importance of AM to their whole business strategy. “So asset management is improving our passenger experience? Asset management is improving employee engagement? Asset management cures cancer?”

While, on the other hand, even plenty of people with ‘Asset Manager’ in their job title act like their job is to manage the list of assets in an IT system.

ISO 55000 makes bold claims, that I think it cannot substantiate. That the same principles we apply to managing physical assets hold true to managing anything else of value, like financial assets, or people. I suspect that the good folks who wrote ISO 55000 may have no idea what that even means – or, put it this way, would you necessarily go to an engineer to tell you how to manage people?

So I do in practice think there’s a limit.

However, managing physical assets clearly is a huge part of running an asset-intensive organisation such as transit or power, or even a city. It’s certainly most of their budget and resources. If you can get that right, many good things should follow, like profit, customer service and, yes, engaged workforce.

But perhaps the real point is that to manage the physical assets well, you have to think about profit, customer service, and engaged workers.

To me, it’s obvious that it matters – it matters hugely that we do manage our essential infrastructure well, that not merely our economy but quality of life and planetary health depend on it. So we need a wider vision, an understanding of interconnections and dependencies, ‘the bigger picture’.

Asset management will not cure cancer. It has boundaries.

But managing the physical assets that underpin our society effectively is probably wide enough scope to be getting on with, don’t you think?

Hedgerows in the Lincolnshire countryside near the small village of Aslackby. Photograph: Steven Booth/Alamy

Not everywhere in the world uses hedges. But Britain has about 500,000 km of hedgerow – despite losing half of them since 1945, as industrial scale farming has taken hold here. One of my very earliest memories is being driven through a patchwork, hedged landscape in the middle south west of England. And it was magic.

Hedges are not just fence-equivalents, worth the investment for that alone. They also store carbon, of course, as linear (if metre high) woodland.

“Hedgerows help slow down the runoff of water, guarding against flooding and soil erosion, and act as barriers to help prevent pesticide and fertiliser pollution getting into water supplies. Studies show they can improve the quality of air by helping trap air pollution.

“They are perhaps the largest semi-natural habitat in Britain, refuges for wild plants and corridors for wildlife to move through, often in barren farmland landscapes.” Paul Simons, the Guardian, 18 Aug 2021

For these reasons, the UK Climate Change Committee recommends planting 40& more hedgerows by 2050.

They are only semi-wild, of course, because they are trees manipulated (‘laid’) by humans, and so require effort, and skill. They are very definitely infrastructure.

And magic.

Thinking about Waves 3 and 4 of Asset Management, this quote from a recent novel struck me:

“It is difficult for anyone born and raised in human infrastructure to truly internalize the fact that your view of the world is backward.

“Even if you fully know that you live in a natural world that existed before you and will continue long after, even if you know that the wilderness is the default state of things, and that nature is not something that only happens in carefully curated enclaves between towns, something that pops up in empty spaces if you ignore them for a while, even if you spend your whole life believing yourself to be deeply in touch with the ebb and flow, the cycle, the ecosystem as it actually is, you will still have trouble picturing an untouched world.

“You will still struggle to understand that human constructs are carved out and overlaid, that these are the places that are the in-between, not the other way around.”

– Becky Chambers, A Psalm for the Wild-Built (Monk & Robot Book 1), 2021

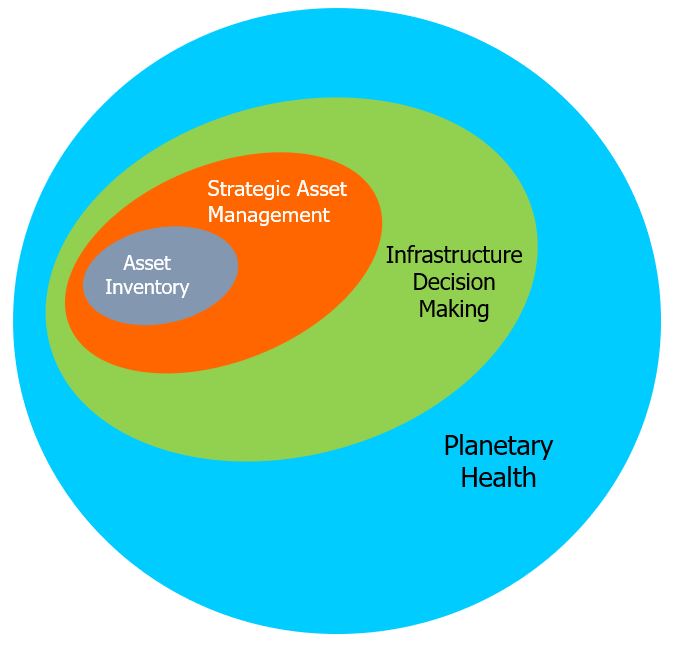

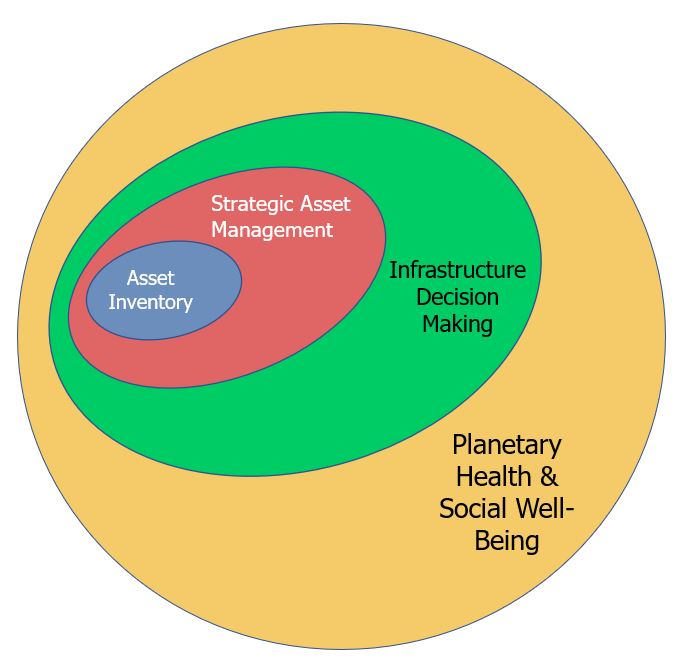

In a previous post, there was a diagram showed how each of our ‘waves’ could also be conceived of as particles, embedding and building on each other. .This is our latest version, to capture the ideas of ‘grey assets’, as opposed to green and blue assets.

For the last 40 years the economic focus has been on growth.

And so infrastructure decisions have also focused on growth. But now this growth focus is changing as we realise the damage we are causing – and so asset management and infrastructure decision making needs to change, too.

We are now at a pivot point.

We have been at pivot points before. This is what Talking Infrastructure’s THE ASSET MANAGEMENT STORY is now documenting.

At each pivot point in Asset Management (the beginning of each wave), we have expanded our understanding of the world we operate in. Starting from simply maintaining and recording in Wave 1, we moved, in Wave 2 or Strategic Asset Management, to using this information to optimise decisions concerning our existing portfolios.

Then, in Wave 3, we look to take on a bigger role, infrastructure decision making, where we go out into our communities to work on whether the size and shape of our portfolio is what it needs to be. Wave 4 extends our understanding of our asset portfolios to the impact we are having on society and planetary health, and actively seeks to improve these impacts. The task in Wave 4 is to make all infrastructure decisions ‘future friendly’.

Wave 4 is the challenge that Talking Infrastructure was surely set up to address.

It is our most critical pivot point yet in asset management. This is the challenge that Talking Infrastructure CEO, Jeff Roorda, is leading at the Blue Mountains City Council where he is Director of Economy, Place and Infrastructure services. The city’s focus is on Planetary Health and Social Wellbeing. And we will be reporting what the City, and others with whom it is working, learns so that everyone can move in a saner direction than we may have done in the past.

If this interests you, watch this space, for a new series of blogs about infrastruture and biodiversity.

And, of course, become an active part of the dialogue on Talking Infrastructure.

In May 2018, Penny Burns and Jeff Roorda wrote here about three ‘revolutions’ in Asset Management – later renamed ‘waves’, because that captures better the idea that one wave doesn’t supersede another.

Since then, we have discussed with each other and many others how Wave 1, ‘Asset Inventory’, is more successful if you already have in mind the vision of Wave 2, ‘Strategic Asset Management’ and how you are going to use all of the information you collect.

We have looked at what Asset Management practitioners need to develop to move on from this, to be able to look beyond our own organisations, to a bigger role in supporting our communities. We called this Wave 3, supporting better ‘Infrastructure Decision Making’.

We have even begun to imagine Wave 4.

As Penny puts it: whereas Wave 1 looked at WHAT we had, and Wave 2 looked at HOW we needed to manage it, Wave 3 started to ask WHO we were serving by our efforts. This has brought us now to start thinking more deeply about this question and about the next move, looking at the critical question of WHY.

As Asset Management practitioners, we have to ensure we are in the right positions of influence to be able to challenge existing infrastructure assumptions, which is what I think Wave 3 is all about. To look ‘up and out’, as Lou Cripps of RTD puts it.

But we can already spot that there is no point in being able to ask hard questions, if we don’t have the right questions to ask….

What do we mean by ‘better’?

What is a better question?

The tag line for Talking Infrastructure is ‘generating better questions’. Ruth’s brilliant last post reminded me that I had never defined a ‘better’ question. So let’s do that.

Very briefly, a ‘better’ question is one where the answer creates new information, or in the words of Michael Port (Heroic Pubic Speaking) it’s a question that Google can’t answer!

More than that, it generates new capability, allowing us to do new things, or old things in a better way.

Are these ‘better’ questions?

The first volume of our story of Asset Management, ‘Asset Management as a Quest’ consists of a search for the answers to the following series of questions. (You can read Part One of this volume – and our search for answers to the first two of these questions – here)

1: How much does it cost South Australians to get their water services?

2: What is the likely cost and timing of renewing water assets?

3: What is the cost and timing of renewal for all state infrastructure: Public Housing, Hospitals, Schools and Colleges, Highways,Transit, Power and Water?

4: What can be done to contain costs?

5: How do we instill an AM mindset?

6: How do we spread the word about asset management and its benefits?

7: What are the consequences if AM is not understood?

8: Are our tools and data up to the challenges we now face?

9: How do we advance the narrative but also keep it focused?

10: How did NSW move the story forward and what can we learn from its actions?

Your View

Q: Are these ‘better’ questions? Why or why not?

Q: What other questions were being considered in this early perid of our history (1984-1993)?

Asking Questions

And, if you would like to know more about question asking, here are two great books

‘Questions are the Answer’ by Hal Gregersen, and

‘Curious’ by Ian Lewis (recommended by Lou Cripps after reading Ruth’s post)

I teach people about Asset Management – up to 1000 a year – and I get to see a wide range of reactions. Best is when someone in class decides Asset Management is what they have been looking for their whole career, its mixture of technical and people and business challenges exactly right for them. Or the maintenance guy who, by the end of the course, was explaining to everyone else to “do the math” for optimal decisions.

For some, on intro courses, it’s mildly interesting, at least as long as their leaders tell them it is.

Sometimes, however, people resist.

I taught a class of design engineers a few years ago, who argued the toss on everything, and failed the exam afterwards. I think we can take it that they didn’t get it because they didn’t want to. (I have also taught a class to project engineers who had understood AM was the way forward for them personally and had got together to sign up for it.)

Recently, I was working with an organisation – an early-ish adopter in the USA – where they were keen enough on AM to create a series of jobs for ‘Asset Manager’. Not necessarily what I, personally, would call Asset Managers, but rather engineering roles to develop priorities by asset class for replacement capital projects.

The way we teach AM, following the lead of Richard Edwards and Chris Lloyd (two very smart UK pioneers) is top down. If strategic AM is aligned to organisation priorities and levels of service targets, we start with what those targets are, with external stakeholders interests, the role of top management, and demand forecasting. In other words, context and goals. I warn everyone about this right at the start – and also make it clear that nothing else matters if we don’t understand what we want the assets for in the first place.

I was struck, this time, by the lack of curiosity the class had. No-one knew what their level of service targets were, they stumbled to think about who their key regulators were, where demand was heading, even who might have a legitimate interest in what assets were being replaced, outside of engineering and operations. It wasn’t just that they didn’t know, they also didn’t much care. They were not stupid.

I was struck by how weird it is, really, that we have to teach anyone about alignment. That smart people working with assets don’t stop to ask what their organisations are really doing with those assets.

What a good Asset Manager really needs more than anything is curiosity – asking all the questions about why and how and how we can do it better in future.

But some people just aren’t very curious, for some reason. They are not much fun to teach!

A new world, new questions

Today is the 5th Anniversary of Talking Infrastructure. It was created in July 2016 to consider the new world we are now in – and the new questions this world and its challenges requires.

It is now massively evident that whereas a focus on competition to secure the success of individuals and individual companies has generated much that we enjoy today, it has also generated serious problems, of which climate change and social inequity are just the most visible.

Infrastructure – problem or solution?

While we may be reluctant to admit it – infrastructure has been a large part of the problem! Every infrastructure does considerable environmental damage. And not every infrastructure generates commensurate community benefit. A few months ago, I said’ Goodbye to our Talking Infrastructure Guy’, – and explained what was wrong with our current attitudes to infrastructure. Today he is formally replaced as our icon.

So welcome our new icon – the Australian platypus – symbolic of the collaboration we so badly need. The platypus was originally regarded as a joke, for it was considered an impossibility, being so many different animals all in one. And this version of the platypus reflecting our aboriginal culture is particularly appropriate. The Australian aboriginals are the oldest civilisation in the world sustaining the land for over 50,000 years. That’s resilience! And they have done it by a focus on community, rather than self, and a veneration for the land that supports us.

If we want a future that will support our children and theirs, we need to embed these iconic qualities of community, resilience, and sustainability in all of our decisions – and especially in our long term infrastructure decisions – from new and renewal to ongoing maintenance and even to eventual withdrawal.

What questions do we now need to ask ourselves in order to secure this future?

Hint: They are not the questions that we started with in asset management and which I discuss in volume 1 of our series, The Story of Asset Management. Consider the ten questions I pursued in the first 10 years (1984-1993) which you can find here Or, to see the questions in context, see “Asset Management as a Quest – contents”.

After you read these questions, consider to what extent we have already solved (or at least know the solution to). Then ask yourself what the questions for the next ten years should be.

And, if you would like to see how I came up with these questions to start with, you may enjoy the first chapter of “Asset Management as a Quest” which you can find here. The full volume will be available in the New Year.

What do you consider the most important questions? Please add them below.

Our latest project! The Story of Asset Management

I hope you have been enjoying Ruth’s platypus posts on our blog as much as I have – and reflecting on the interesting and critical question she has been exploring, namely, what does it mean to be an asset manager?

This is not a simple question to answer. Which is why it needs thinking about. I have been doing much thinking about it over the past few months as I have worked on the first volume of Talking Infrastructure’s 4 volume narrative, ‘The Story of Asset Management’.

Each of the four volumes covers one decade, starting in 1984, to be finished by the end of 2023. Each volume has its own theme:

- Asset Management as a Quest. 1984-1993

- Asset Management as an Opportunity. 1994-2003

- Asset Management as a Discipline. 2004-2013

- Asset Management as a Business (and beyond?) 2014-2023

Team work

As Ruth has shown in her recent posts, Asset Management needs a team.

Our story of asset management is the story of how those teams developed, how they came together over key ideas, how they fought with each other and supported each other – and became the very special kind of multi-disciplinary, multi-national tribe we are all part of today.

You are wanted!

If you would like to be part of the story we tell, become a member of Talking Infrastructure today and we will let you know more.

Recent Comments