Our mission at Talking Infrastructure is to promote the good practices of Asset Management Wave 2 and develop thinking on Waves 3 and 4.

It’s an evolutionary model: you need the solid processes of whole life costing, sophisticated risk thinking, and longer-term asset planning both for the sake of your own organisation’s ability to deliver and to underpin (to ground) decisions on new infrastructure and new types of assets.

So we plan to:

- Continue to promote better strategic Asset Management, Wave 2, through re-emphasising the core AM tool of longer-term asset planning as well as development of more sophisticated asset risk and decision-making concepts

- Develop a guidebook to the AMP, to restate and update Penny’s original vision for the changing contexts of the 2020s, with case studies such as Grant County PUD

- We would also like to see campaigning for infrastructure regulators to have more teeth through AMP requirements and audits to encourage agencies to plan ahead

Plan for work on Wave 3, infrastructure decision making especially on new and renewed assets includes:

- Promote work already done, such as the UK Projects and Infrastructure Project Routemap module on Asset Management, https://projectdelivery.gov.uk/library-product/project-routemap-asset-management-module/ and our latest book Legacy: A Decision Maker’s Guide to Infrastructure

- There is a still a long way to go to shift from a construction delivery and short-term profit focus to planning the right assets and asset strategies in the first place. Shout out to Louise Hart working on how to succeed at infrastructure megaprojects (linkedin.com/in/louisehart750), and Johannes Paradza of Infrastructure Asset Management South Africa on how asset managers help meet the challenge of Cape Town’s infrastructure.

Resources on Wave 4, starting with Jeff’s work as Director of Infrastructure and Biodiversity at the Blue Mountains City Council

For all of these, we aim to build on friendly alliances with like-minded people and organisations.

Your input, please, on:

- In your experience, in what ways is Wave 2, strategic Asset Management, still not yet where we should be?

- Anything you already know of on Wave 3, better infrastructure decision-making in our communities?

- Inspiring examples on resilience, biodiversity, radically sustainable thinking on assets – away from grey assets?

What’s in your plan for 2026?

Just because it reminded us of the computer in the original BBC Hitchhiker’s Guide to the Galaxy

This year, Asset Management turns 42. And we all know what that means…

Is there one, main thing we can do in organisations that will lead to good Asset Management?

On the one hand, 39, now 40 subject areas, ISO 55000 clauses, and AM maturity assessments with tens if not hundreds of questions all suggest there are many things we have to do.

On the other, some of us suspect AM is a paradigm which may only need one assumption to be thoroughly overturned to flip the system.

If I had to bet, it would be the concept of an asset lifecycle model – a model not really about money, but what we need to do to an asset, or an asset class, to effectively manage it over time to meet demand.

However, the evidence for this is more, as they say, in the breach: most infrastructure organisations haven’t yet got explicit whole of life models. Have not tried this switch.

But watch this space…

Next comes a blog summarising what Talking Infrastructure needs to do in 2026. How about you?

Happy New Year from the Talking Infrastructure Board!

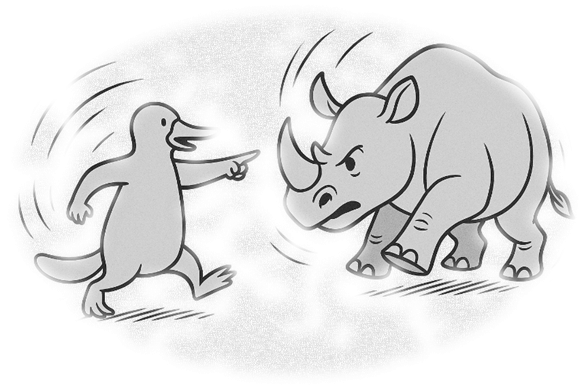

My last post examined Thomas Kuhn, who gave us the language of paradigm shifts, here, I’d like to look at a book by Michele Wucker* who gave us the image of the Gray Rhino: a massive, obvious threat we can see coming but still fail to confront.

Where Kuhn focused on how systems break and are replaced, Wucker draws attention to the crises we recognize but still choose to ignore.

Asset Management exists at the intersection of these two frameworks.

Asset-intensive organizations are surrounded by gray rhinos. Infrastructure gaps, aging systems, climate vulnerability, workforce attrition, regulatory pressure: these are not surprises. They are slow-moving, well-documented challenges that, if left unaddressed, will overwhelm the system we rely on.

Yet for all their visibility, these threats rarely trigger the level of change they demand. Instead, they are absorbed into routine. Budget cycles roll forward. Work orders are prioritized by urgency rather than consequence. The language of Asset Management is invoked, but its paradigm is never fully adopted. We name the problem but struggle to act on it.

Asset Management offers an approach precisely designed to engage these looming risks. It asks us to plan, to prioritize, to see beyond the emergency response. It invites organizations to realign their values, moving from reactive service delivery to deliberate, long-term stewardship.

But as Kuhn would note, this requires a change in the underlying logic, a shift in how organizations understand value, success, and time.

Until that shift happens, Asset Management remains vulnerable to reinterpretation. The system continues to operate within the old paradigm, where short-term efficiency trumps long-term value, and where the urgency of today erodes the preparation for tomorrow.

This is not a failure of awareness. It is a failure of transformation. We see the gray rhino, and we have a framework for responding to it. But our systems, both technical and cultural, are still optimized for a different reality.

So, what do we do with this tension?

We start by recognizing that paradigm shifts don’t come from force. They come from readiness.

And readiness grows in moments of discomfort, when the cracks in the current system become too wide to ignore. When organizations feel the weight of the gray rhino pressing closer, they become more open to doing things differently.

Asset Management must be positioned as more than a practice. It must become a way of seeing the world around us. Using a lens where the familiar takes on new meaning and is a guide for what to do when the warning signs are no longer abstract.

Most importantly, Asset Management needs its champions. People who can not only name the gray rhino and frame the conversation but offer a path forward that is both pragmatic and bold.

Change can be slow, but it is also inevitable. Those that prepare will be the ones best positioned when the shift finally takes hold.

The gray rhino is here. The question is whether you will continue to ignore it or finally take action to avoid being trampled.

*The Gray Rhino: How Recognize and Act on the Obvious Dangers We Ignore, Michele Wucker, 2016

This is a follow-up to Julie’s and my first post. This comes from discussions with Ruth, as we are both fans of Kuhn and approaching Asset Managment from a Systems Thinking bend.

Asset Management isn’t failing, but it is struggling. It’s struggling because it asks for something most organizations aren’t ready to give: a change in worldview.

In his seminal work The Structure of Scientific Revolutions, Thomas Kuhn argued that progress in science doesn’t move forward in smooth, logical steps. Instead, it lurches forward through upheaval.

An existing model, what Kuhn calls a paradigm, organizes how people understand and act in the world. When that model starts to break down under the weight of anomalies it can’t explain, a crisis forms. Eventually, a new model takes hold. Not by refining the old one, but by replacing it entirely.

Asset Management isn’t a toolkit upgrade. Asset Management is a paradigm shift.

The prevailing paradigm in many organizations see assets as cost centers. Value is measured in terms of budget variance, performance is gauged by how fast we respond to failure, and success means keeping operations running despite broken systems and shrinking resources. This is the logic of firefighting, not foresight.

Asset Management offers a radically different frame. It suggests we treat assets as value-producing systems. These decisions should be based not only on today’s conditions but on long-term impacts. That success means reducing failure, not merely reacting to it quickly. And that the ultimate responsibility of an organization is to deliver reliable, sustainable service—not just to manage budgets.

But here’s the problem, and Kuhn would recognize it: paradigms don’t go quietly. The existing mindset fights back. Asset Management is often taken in and translated through the old lens. We say we’ve adopted Asset Management, but we’re still rewarding short-term fixes. We talk about lifecycle value, but we still plan one year at a time. We build dashboards and risk models, but we still defer investment until failure forces our hand.

This is normal. According to Kuhn, when a new paradigm first appears, it doesn’t make sense within the old logic. People struggle to see its relevance. They may accept some of its tools, but not its worldview. The old questions remain, and the new answers seem off-topic.

Real change happens only when the organization starts asking new questions. Not just, “How do we save money this year?” but “What will this decision cost us over the next 30?” Not, “How fast did we respond to the outage?” but “Why did the outage happen at all?”

That’s when a shift begins.

A true Asset Management transformation doesn’t begin with data, or systems, or even leadership mandates. It begins with discomfort, when the old paradigm can no longer explain the failures piling up around us. When firefighting becomes too exhausting, too expensive, too visibly ineffective. Then, and only then, do people become open to a new way of thinking.

So, the task isn’t just to implement Asset Management. It’s to create the conditions where the old worldview can be questioned. That means:

- Telling stories that expose the cost of reactive practices

- Measuring success in ways that reward foresight

- Giving voice to people who see the long game

- Protecting Asset Management from being reinterpreted as just another compliance exercise

Paradigm shifts are hard. They are political, cultural, and emotional. But they are also the only way real progress happens. Asset Management doesn’t need to fight harder. It needs to be ready to lead when the cracks in the old system finally become too big to ignore. It needs to be there to offer a better forward.

Link to Ruth’s article: AM, Capital-ism and Shifting Paradigms | Talking Infrastructure

Julie and I produced this after a recent discussion with Ruth. I think it’s a discussion we’ve been having for years.

Todd Shepherd & Julie DeYoung

Once upon a time, or so the story goes, Asset Management started to take sprout at our organizations with a bold promise. It came to guide us toward long-term thinking, to help us look beyond next year’s budget and into the decades ahead. It came with principles and frameworks, a philosophy that assets are not isolated items, but interconnected parts of a whole. The decisions we make today shape the quality of life for future generations. It was a different way of seeing how investing in the right place, at the right time, could save money, and public trust.

But then Asset Management met The System. And The System did what it always does: it absorbed the new idea and bent it back into something familiar.

Instead of being a strategy for long-term stewardship, Asset Management became a new label for what we were already doing. We turned it into a more refined version of the same habits: squeezing the last bit of life out of aging assets, reacting quickly to failures, and deferring investment until the next crisis hit. We framed these actions as efficiency, as cost savings, as smart business. But they were just survival tactics. And so, when Asset Management started to bloom, it was quietly, subtly, reshaped.

What was meant to be transformational became transactional.

Long-term planning? That would have to wait. We needed to fix the latest failure, explain the recent cost overrun, patch the emergency before the news cycle caught wind. The capital planning calendar was full of yesterday’s fires. Asset Management was drafted into service as a better way to react.

Rather than change The System, Asset Management was absorbed by it. It was translated into the language of short-term cost savings and immediate returns. “Get more life out of your assets” became a directive, not to optimize lifecycle value, but to defer replacement as long as humanly possible. And The System applauded. Budgets tightened. Work orders increased. Failure response times improved…until they didn’t.

This isn’t a failure of individuals. It’s what happens when a new idea runs headlong into The System. The System reward firefighting over fire prevention. It promotes leaders who solve today’s crises, not those who quietly prevent tomorrows. It allocates resources to what is visible, immediate, and politically expedient. And so, Asset Management is quietly reshaped until it fits.

A discipline focused on resilience and long-range value becomes a sophisticated way to do what we’ve always done: squeeze, stretch, defer, and repeat.

Asset Management, instead of being a disruptor, became domesticated.

The truth is, Asset Management requires a paradigm shift. It requires a new way of thinking about value, responsibility, and time. It asks us to see past short-term wins and start building for long-term resilience. It asks leaders to stop managing symptoms and start addressing root causes. It asks organizations to measure success not by how fast they respond to failure, but by how rarely failure occurs at all.

That’s a hard shift to make. It means unlearning habits, changing incentives, and having the patience to invest in what won’t pay off this quarter. It means making space for new voices, new metrics, and sometimes uncomfortable truths.

But if we want Asset Management to be more than a buzzword, we need to protect it from the status quo. We need to give it space to grow before we ask it to perform. And most of all, we need to let it change us before we change it.

To do that, leaders must become designers of systems, not just managers of outcomes. They must ask: What behaviors are we rewarding? What stories are we telling? Are we building a future, or just managing decline?

Asset Management didn’t fail. It simply wasn’t given a chance to take root. But the story isn’t over. It’s still being written. And if we’re willing to change the system, we might just change the ending.

At this end of 2024, I am more convinced than ever that the whole point of Asset Management is Planning.

Planning, as opposed to delivery – which we have been doing for decades, if not centuries. Asset Management is about thinking through what we need to deliver across our asset base, Plan before Do. (Don’t just do something, sit there.)

That is what Penny created Asset Management for.

And the central concept was lifecycle modelling, supported by cost-risk-optimisation, matched to understanding demand. When is the right time to replace, renew, maintain? What don’t we need to do?

The AMP has been the centre of Asset Management since the very beginning. As captured in state and federal requirements, as documented in the International Infrastructure Management Manual from the IPWEA.

We need Planning – and it is not going to happen without us.

But it is too often still – after 40 years! – fragmentary, driven by vested interests (even the understandable wish by people on the ground to get money for their own assets).

It doesn’t look at what happens next: ‘And then what?’

And I can count the organisations I work with that actually do lifecycle cost modelling or cost-risk optimisation on the fingers of two hands.

To do the maths on all the major costs, risks and benefits of different options across the lifecycle, and demonstrate that (for example) building back rural roads like for like after they have been washed away for the fourth time in five years simply doesn’t add up.

Time for a Campaign for Honest Asset Management Planning?

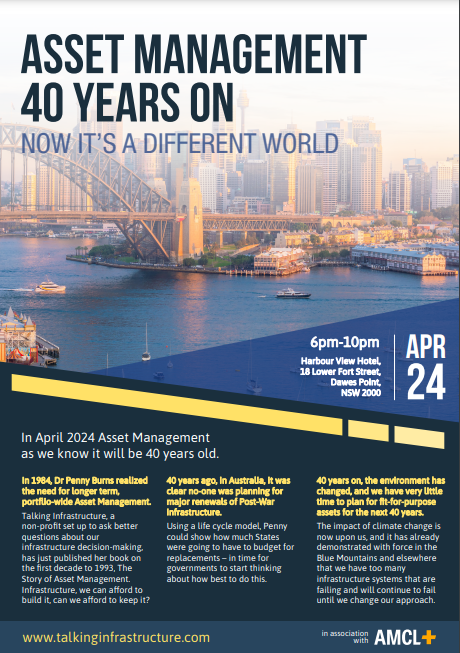

Join us at the Harbour View Hotel in the Rocks and help celebrate with finger food and drinks – plus Penny and Jeff on what we have learnt from the last 40 years to help us meet the challenges of the next 40.

Many thanks to Richard Edwards, Lynn Furniss and Matt Miles of AMCL

In April 2024, it will be 40 years since Penny Burns started the whole thing. Talking Infrastructure plans to party like it’s 2024, all year.

2024 also marks milestones for the Global Forum for Maintenance and Asset Management (update of the AM Landscape), ISO (10 years since ISO 55000), and the Institute of Asset Management (30 years since it was founded): there will be a lot happening.

The need for more considered decision making for our future infrastructure has only grown and become more urgent. Asset Managers everywhere know this. Our 40 year celebration will be an opportunity to take this message not only to managers of infrastructure but also to those who decide, design, construct, fund and vote for our infrastructure.

Like infrastructure itself, our purpose is to support the wider community. There is a lot of satisfaction to be had in this and we invite you to join us, and enjoy it too. What area of Asset Management and decision making particularly interests you?

We are looking to develop a circle of advisors, who, through their interests and work, can have the fun of keeping Talking infrastructure up to date with current issues, and setting its future directions.

Your ideas for celebrating our 40th are also needed and much welcomed. This will include events across Australia in April, and presence at AM conferences and articles wherever and whenever we can.

What did we learn in the last forty years? Where do we need to go in the next 40 years?

From Bill Wallsgrove

AI continues to not quite to get what a platypus is – just as many people still don’t understand what Asset Managers do.

I could tell two miserable current stories of Human Resources not getting it. A major power utility with ISO 55000 certification where HR led a structure reorganisation, and failed to include any Asset Management (and the saddest part was how much effort the AM team had put into trying to bring HR along with them). A transit agency where HR insist they know better how to recruit good Asset Managers – again, after years of effort from the AM team on what to look for.

But lamenting HR failures is like shooting fish in barrel: too easy.

And we are all still working it out.

For example, looking at AM teams where they have really done interesting things, I see how much difference ‘professional’ information skills have made. The most impressive Asset Managers I know include a librarian, an ex-military intelligence veteran, and a teacher of data science. I wonder if good Asset Management is even possible without information nous.

And the perennial questions of whether you can learn to ‘embrace uncertainty’, or think strategically. Are good Asset Managers born, not made? I don’t want to believe so.

I certainly don’t have it all and have depended through my career on other people with complementary skills to mine.

As the Institute of Asset Management (IAM) starts its review of its Competency Framework, to update and expand the original work led by Chris Lloyd, I get the feeling more than ever that it isn’t just a matter of hiring people with certain skills, but of encouraging those who think about the world in particular ways.

I’m on the Competences Steering Group for the IAM. This is a plea for input: what is your experience on the most important skills, experience, aptitudes, attitudes for good Infrastructure Asset Management?

What have we learnt about good people in the nearly 40 years of Asset Management?

I work with a variety of organisations in several countries who are attempting to implement good Asset Management. Some are just starting out. A few are quite sophisticated. And one or two are even tackling the question of infrastructure decision making in our communities.

I was struck again this month by how hard this all sometimes seems.

Organizations who are just starting out have interesting challenges, of course, including no-one much understanding what AM is and, usually, a lack of resources. One half time resource without much authority, for example, can’t do much to radically transform their business.

But surely it doesn’t have to be that hard, conceptually, to sort out a basic asset inventory, classic Wave 1? Plenty of organisations have already sorted that – it is, as my old colleague John Lavan put it, a puzzle, for which there is an answer already known, not a problem we haven’t yet solved.

And yet many people just don’t seem to have good sense about asset information. And want to reduce the problem to basic IT, which they also don’t do very well. (I am feeling a bit grumpy about this: can’t someone please donate good-enough asset hierarchies and principles into the public domain, or even write the book so no-one ever has to reinvent those particular wheels? TJ, Dave Ulrich, I am looking at you guys here.)

Wave 2, strategic AM and better all-round asset decision-making also depends on something rather more than technology – and that, I am sure, is why organisations struggle. It involves people! Culture! And politics, small p, and sometimes Big P too!

Where Asset Management is effective, infrastructure Asset Managers can then get caught up in Wave 3. And however smart and well-resourced they are, it’s big.

A great current example is electric buses, something the US Federal government wants to throw money at as part of ‘decarbonization’ of transport. But the questions of how, and why, to invest with all the interconnecting issues of the infrastructure for the buses themselves, performance and customer satisfaction, and whether this will even give the right carbon-reduced answer…

Asset Managers get it. But they are a small drop in a large ocean of greed and love of shiny new things.

I asked a buddy who’s simply caught in too many stupid business decisions in a utility whether he might just bring in some additional resources to tackle more of them… But he said, quite rightly, where from? Who gets it, and all the diplomacy, strategic thinking, experience, intelligent use of what data there is that is that’s required, all at once?

ISO 55000 doesn’t help it all that much.

In a new series of blogs, I want to look with your input at some of the challenges we see in every Wave. Of course we love challenges. But I also see rather too many Asset Managers at every stage drowning in the sheer size of the job.

Series to include: asset information, risk, networking, attitude change, and more.

Recent Comments