My team makes use of premortem thinking: as part of planning action, immediate or long term, consider how it might go wrong. We think ourselves into the future looking back at a project (or a meeting). Humans are surprisingly good at this time-travelling.

For me, this is part of a principle Asset Managers should embrace: the principle of reversibility. It’s not just about understanding the consequences of our decisions, but also about planning for the ability to undo or reverse their effects if needed. Sure, you can’t un-ring a bell, but we can find ways to get as close as possible to the pre-action state and minimize the impact if we think about it right from the start.

Do our plans have exit strategies or an undo button? None that I have seen, why not?

This is especially crucial in infrastructure projects, where large investments and long lifespans magnify the potential impacts. How would they be delivered differently if that was required? Would that requirement cause us to better maintain the infrastructure we currently have? I think so.

Let’s face the hard questions: Can we put rare earth metals back in the ground? Can we undo the energy consumed in building something new?

By embracing the principle in Asset Management and infrastructure decision-making, we can strive for resilient and adaptive systems that serve the present while safeguarding the future of generations to come. We navigate challenges with eyes wide open.

We ask tough questions, anticipate consequences, and face the answers with truth – and then we create our plans and strategies.

Penny and Ruth at AM Peak gala dinner, April 16 2024

Since I last posted I have spent a month celebrating 40 years of Asset Management in Australia with Penny, Jeff and Gregory; gone to one of my favourite conferences in Minneapolis; taught an advanced AM course to some sophisticated AM practitioners in Calgary, as well delivering to as a post ISO 55000 certification client in California.

I have been thinking about where AM needs to go next, at the same time as worrying that things have not moved far enough.

And it just keeps coming back to: We Need to Raise our Game. And not because what Penny kicked off four decades ago hasn’t made a huge difference already.

But I want us to do more.

First, to effect what Penny set out to do through Talking Infrastructure: to look up and out, to make a difference to key decisions on what infrastructure we really need.

Secondly, as I start to unwind from delivering basic AM training – something I have loved doing for nearly 14 years now – I reflect on our competencies.

This kicks off a series of questions and reflections on what we want to change, and how to do it.

How to interest existing AM practitioners in upskilling on risk, data analysis, culture/ system change, persuasion, strategic thinking?

How to find people who want to challenge the status quo on infrastructure projects?

What can we best offer from our collective experiences to support better decision-making?

I am looking forward to this!

Come and meet Penny and Talking Infrastructure in person! Watch this space for additional details, but here’s the programme so far:

April 15 & 16 AMPeak, Adelaide. Penny and Ruth will be at AMPeak.

April 18, Stantec, Brisbane

April 19, PACoG, Brisbane. Asset Institute, QUT, 11am- 12.30, followed by lunch. Join Joe Mathew and Kerry McGivern along with Penny and Ruth to discuss what we’ve learnt in 40 years – and look forward to the next 40. Includes a look of what is happening with asset management internationally, in this big year for AM.

April 23, Blue Mountains City Council, Katoomba, 10am to noon. Seminar with Jeff Roorda on Blue Mountains City Council planetary health and disaster recovery experience, plus update on the new advocacy project underway by IPWEA Roads and Transport Directorate (IPWEA RTD – NSW/ACT), on Lessons Learned from Disaster Recovery, to assist NSW Councils work with Local, Strate and Federal Government Agencies.

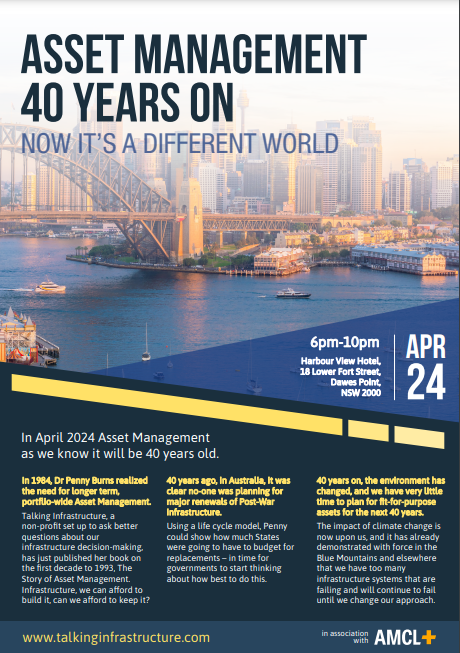

April 24, Sydney event, Dawes Point. 6-10pm Harbour View Hotel, 18 Lower Fort Street, Dawes Point, NSW 2000. Using the recent experiences of the Blue Mountains City Council, Talking Infrastructure is holding an event in central Sydney to call for urgent changes in all of our asset mindsets and tools to ensure planetary health, biodiversity and climate change resilience. Meet with Penny, Jeff, Gregory and Ruth, plus local IPWEA. Food provided thanks to AMCL.

April 30, IPWE, Melbourne. Presentation by Penny. Penny and Ruth will be at IPWE until May 3. There will also be a dinner out in Melbourne for TI friends and colleagues – please let us know if you would like to join us. And bring along your copy of Penny’s book to get signed!

If you are planning to attend our Sydney celebration, please RSVP to: amis40@talkinginfrastructure.com so we can keep an eye on numbers – limited to the first 60! Event is free, includes food and discussion with Penny Burns and Jeff Roorda and a whole heap of old friends and colleagues.

Full update of the 40th year celebration events shortly!

Join us at the Harbour View Hotel in the Rocks and help celebrate with finger food and drinks – plus Penny and Jeff on what we have learnt from the last 40 years to help us meet the challenges of the next 40.

Many thanks to Richard Edwards, Lynn Furniss and Matt Miles of AMCL

Penny Burns and Talking Infrastructure will be on the move in April to celebrate 40 years of Asset Management, and look forward to the next 40.

Adelaide April 15 & 16, Penny and Ruth will be celebrating at AM Peak.

Brisbane events April 17-19

Sydney April 24, venue TBC: Asset Valuation in a time of Climate Crisis. Including Jeff Roorda on how Blue Mountains City Council is taking a radically new approach, as well as Penny on how we must rethink our AMP modelling.

Melbourne April 30, IPWC. Penny speaking on the opening morning of IPWEA conference

Wellington May 4-6, events to be announced

Let us know if you are interested in meeting up in any of these cities.

See you in April! #AMis40

Someone I work with in the UK nuclear industry asks in despair, how come project engineers don’t feel that the whole point of building something is for it to operate? In other words, that construction projects only exist to create something that will be used to deliver products and services.

Why aren’t they interested in the long-term use that comes after construction?

If it really is all about use, they really need to consider what is required to use the asset. They should be interested!

This isn’t just to focus on what service we need to deliver. The asset has no point unless it delivers a service that is needed. Even project engineers can get that.

What we continue to struggle with is getting asset construction engineers and project managers to consider what is needed in order to use it successfully. And this includes providing as-built data – what assets are there to operate – and thinking ahead on operating strategy, and maintenance schedules. It’s designing and building with the operations and maintenance in mind. Designing for operability and maintainability.

In infrastructure, the asset ‘users’ are often not the customers, who may never touch or even see the assets. The people who use the assets are the operators; the people who touch the assets, maintenance.

An engineering design goes through many hands before it impacts on the customer – and if those hands in between are hamstrung by designs that are poor to operate, hard to maintain, and by the incomplete thinking that ‘throws the assets over the wall’ at operations (as we used to say in the UK) without adequate information – what is the point, really?

I believe there may be something called project time, where there is no ‘after’. No ‘and then what?’ – just onto the next shiny thing to build.

Thanks again to Bill Wallsgrove

Human beings may not naturally be good at thinking about the future.

One thought is that, just like with charity appeals for current disasters, we should focus on an individual. Think ourselves into the shoes of some one as they experience the future.

It could be ourselves, a grandchild (if we have one), a ‘descendant’ – or anyone we can picture.

A startling powerful example of this appears in the first chapter of Kim Stanley Robinson’s The Ministry for the Future, published in 2020. The author specialises in thoughtful, ‘realistic’ depictions of the future, for example in colonising Mars.

The Ministry for the Future starts by describing the experience of one Western man in a climate catastrophe, when twenty million people in northern India die in a heat wave. Many millions in a faraway country in the future: a newspaper headline. And ‘Frank May’, who works in a clinic near Lucknow, who nearly poaches to death in a lake full of people, where the water is above the temperature of blood.

I could not get the image of him out of my head for a lot longer than a headline.

I realised when watching the final episode of Planet Earth 3 last month that the image of Frank May was so vivid that it felt it was happening right now. It was not hypothetical, despite being fiction.

We may overdo the image of threats to a panda or polar bear or orangutan, to be invited to imagine a world without them. Just like we stop reacting to doe-eyed young children in charity ads. But I suspect we simply need this emotional connection.

Maybe like the Japanese traditionally put on the garment of a descendant, to feel how they will perceive the results of what we are doing now. We too could do this, to really feel it when we make a decision now about their infrastructure in fifty years’ time.

A technique to consider next time we are involved in long term asset decisions?

My colleague Todd Shepherd and I had a brainwave* last year to restructure how we teach Asset Management – not as a line that starts with investigating capital needs, the conventional beginning of the asset life cycle, but from where we are now. That is, right in the middle of maintenance. We are always deep in maintenance needs.

It makes more sense of the history of AM, straight off. It was not people writing business cases, or design engineers, who realised the urgent need for something different. It was maintenance, post World War 2, and then Penny Burns and the problem of unfunded replacements and renewals in the 1980s.

If Asset Management has waves, we might suggest what Wave Minus 1 was. Wave Minus 1 was hero engineers, from the Industrial Revolution on, building heroic infrastructure – Bazalgette and London sewers, Brooklyn Bridge. Sewers and bridges are both good things. But they are not quite such good things if they leak or fall down because they are not maintained or renewed.

With infrastructure, it is not enough to start; you have to see it through.

Penny used life cycle models to understand the extent of renewals, and increasingly I don’t feel anyone is really doing Asset Management if they do not use such models. Of course it is called life cycle for a reason. There isn’t an end, only another cycle.

But now I fear that starting at the beginning of one lifecycle in our teaching still makes it sound as though it is the creation of infrastructure that’s the important thing. We have not really got the cycle bit across enough, at least to the average engineer we teach. What comes after construction is still a vague future state, that is someone else’s problem.

And, not at all coincidentally, that’s also the point of the circular economy concept. There is no meaningful product end, and we are right in the middle of the mess we already built.

It is not a straight line into the future, where we set assets in motion and let them go. Longer term thinking, long-termism, has to think in cycles.

*Almost certainly it was Todd’s brainwave, which I managed to catch up with.

Thanks to my brother Bill Wallsgrove

Board member Lou Cripps and his team at RTD are great Asset Management practitioners – and that is largely because of their attitude to time.

For example, the team prepares carefully for meetings with key stakeholders, not just the CEO but engineers, IT, maintenance, HR. They think carefully about what they want to effect through the meeting – their objectives – and then project forward what the possible response/s of the others will be, based on their previous interactions. They can then work on what will most connect and make a win:win outcome likely.

Lou’s team also makes full use of red-teaming and pre-mortems, to imagine what could go wrong with an initiative so they can prepare not to go there. Risk assessments and risk plans, essentially, but exploiting the human ability to project forward and then ‘look back’ in our minds. (“Imagine it’s six months’ time and we are doing a post-mortem on what went wrong.”)

Lou refers often to ‘future me’ and ‘future us’: that is, stepping in the shoes of himself in a year or ten years’ time. This is not just to feel how fed up he might be then about what he failed to do now, but also to consider what future him would care about more widely. It is empathy with a future self. And it does not even need to be yourself. What about someone in the community in a hundred years?

This is good Asset Management for infrastructure, in particular, as infrastructure decisions we make now should always be assumed to have lasting implications. The assets we build now may still be in use in a hundred years. And the things we don’t build because we’re building something else. The lost opportunities, and future debts. What we fail to maintain, so will have to be built again…

Lou’s team last year relentlessly analysed the data to work out the likely costs – the total costs, now and into the future – for a proposed project to buy more electric buses. They worked out that this particular set-up would cost their transit agency approximately $2 a mile extra on every electric route for the next 50 years. It wouldn’t even save on carbon, because the electricity supply proposed was fossil fuel burning generation. (It was not a good proposal, and the Board duly turned it down thanks to their analysis.)

To build and not think ahead is a dereliction of duty. Principle number one for an Asset Manager: always ask, “And then what?”

Making full use of the past, in order to think ourselves into the future.

How do you this in your team?

Recent Comments