174608439 | Milton Keynes © Mr Paul Hanley | Dreamstime.com

I live in an old town, Newport Pagnell, best know for two road transport icons: the second motorway service station in Britain, and Aston Martin.

Newport is also part of the first new city in England, Milton Keynes. MK is famous for its roundabouts, over 130 at last count.

Roundabouts are fascinating infrastructure. They take up more room than traffic lights but they are much more efficient.

They raise questions about what good infrastructure looks like. Someone had the technical idea for them well before MK, but they also require changes in people’s behaviour. They are hard to retrofit.

What is the role of technical innovation in infrastructure? What are all the other things that have to go with the introduction of a technical innovation? What changes have to be forced on people for the technology to work?

I have driven around a Dutch roundabout while they still ran with priority from cars entering, not the vehicles already on it. Totally biased, this seemed like a very bad idea to me.

I have driven on a brand new roundabout in a central Washington town that was also scary, because I knew many drivers wouldn’t understand how they work: they take getting used to, with plenty of warning signs about priority.

I’ve sat at US four way stops and admired the discipline – British drivers really struggle with them – but, as I waited, also calculated that a roundabout would be faster.

I drive on Roundabout City’s roads, where inhabitants know they do not have stop, and everyone knows how to judge gaps. Out of towners run the risk of being rear-ended.

Curiously, small roundabouts on housing estates slow the traffic down. But the main, grid roads with large roundabouts at every main junction can be driven at 60 miles per hour. And you can drive straight through this city of a third of a million people and never see a single house.

Milton Keynes people love their roundabouts – but have to be warned about how traffic light systems work.

What would I advise someone who wants to get more involved in Asset Management? Who would I suggest they talk to?

I could start with a negative: don’t look to AM if you are really a techie. Or want clear role definitions and a well-trod career path.

Don’t look for certainty.

On the other hand, I am one of the chosen who, having found AM, I never looked back. It was just the right combination of middle-chunking for me: not swamped in technical details, not airy abstractions. Grounded (in physical realities) but exploratory. Always learning, thinking new thoughts, using different parts of my brain and experiences. And in asset world, somewhere up the food chain: creating strategies rather than delivering them.

Maybe not quite high enough, when dealing with short-sighted CEOs? But I personally didn’t want stupid organisational politics. There is something idealistic about the right people in AM.

Who I would listen to – apart from Penny Burns, of course (go to source)?

Who would you suggest?

More than a decade ago, Chris Lloyd and Charles Johnson wrote in the Seven Revelations of Asset Management that we must “embrace uncertainty”.

This year we want to build on good practice to help our profession do this.

Let’s cut to the chase: our role as asset managers is to develop plans for the future, and yet the future, even next week, is uncertain. (Particularly at the moment.) We can’t not plan because we don’t know everything. In fact, uncertainty makes it even more essential to have plans.

Chris and Charles were right: we have to leap in.

It’s better to be roughly right than perfectly wrong. And there is no other option. Aiming for certainty is how we would ensure we are adding little value to asset decisions.

Board member Todd Shepherd has worked in North American power and water to develop a better approach to infrastructure risk and uncertainty, based on good practice in other professions and sectors. It’s not about a new tool, not software, but a more fundamental understanding of what managing uncertainty requires.

It requires not even trying to get a perfect answer.

Because the cost of perfect information is infinite – impossible. And good decisions don’t need it. What’s needed from us is practical ways to reduce our organisations’ uncertainty.

We’re currently drafting a much longer piece about how we make better decisions through better estimating and grasp of probabilities. And how it is, in the end, easier to deal with uncertainty than some of the weird things we do in infrastructure at the moment.

Are you in with us?

(We’d love to hear from you on risk.)

Our mission at Talking Infrastructure is to promote the good practices of Asset Management Wave 2 and develop thinking on Waves 3 and 4.

It’s an evolutionary model: you need the solid processes of whole life costing, sophisticated risk thinking, and longer-term asset planning both for the sake of your own organisation’s ability to deliver and to underpin (to ground) decisions on new infrastructure and new types of assets.

So we plan to:

- Continue to promote better strategic Asset Management, Wave 2, through re-emphasising the core AM tool of longer-term asset planning as well as development of more sophisticated asset risk and decision-making concepts

- Develop a guidebook to the AMP, to restate and update Penny’s original vision for the changing contexts of the 2020s, with case studies such as Grant County PUD

- We would also like to see campaigning for infrastructure regulators to have more teeth through AMP requirements and audits to encourage agencies to plan ahead

Plan for work on Wave 3, infrastructure decision making especially on new and renewed assets includes:

- Promote work already done, such as the UK Projects and Infrastructure Project Routemap module on Asset Management, https://projectdelivery.gov.uk/library-product/project-routemap-asset-management-module/ and our latest book Legacy: A Decision Maker’s Guide to Infrastructure

- There is a still a long way to go to shift from a construction delivery and short-term profit focus to planning the right assets and asset strategies in the first place. Shout out to Louise Hart working on how to succeed at infrastructure megaprojects (linkedin.com/in/louisehart750), and Johannes Paradza of Infrastructure Asset Management South Africa on how asset managers help meet the challenge of Cape Town’s infrastructure.

Resources on Wave 4, starting with Jeff’s work as Director of Infrastructure and Biodiversity at the Blue Mountains City Council

For all of these, we aim to build on friendly alliances with like-minded people and organisations.

Your input, please, on:

- In your experience, in what ways is Wave 2, strategic Asset Management, still not yet where we should be?

- Anything you already know of on Wave 3, better infrastructure decision-making in our communities?

- Inspiring examples on resilience, biodiversity, radically sustainable thinking on assets – away from grey assets?

What’s in your plan for 2026?

Just because it reminded us of the computer in the original BBC Hitchhiker’s Guide to the Galaxy

This year, Asset Management turns 42. And we all know what that means…

Is there one, main thing we can do in organisations that will lead to good Asset Management?

On the one hand, 39, now 40 subject areas, ISO 55000 clauses, and AM maturity assessments with tens if not hundreds of questions all suggest there are many things we have to do.

On the other, some of us suspect AM is a paradigm which may only need one assumption to be thoroughly overturned to flip the system.

If I had to bet, it would be the concept of an asset lifecycle model – a model not really about money, but what we need to do to an asset, or an asset class, to effectively manage it over time to meet demand.

However, the evidence for this is more, as they say, in the breach: most infrastructure organisations haven’t yet got explicit whole of life models. Have not tried this switch.

But watch this space…

Next comes a blog summarising what Talking Infrastructure needs to do in 2026. How about you?

Happy New Year from the Talking Infrastructure Board!

In our ongoing campaign to educate everyone about platypus tails: forget Perry the Platypus, they do not look like beaver tails!

Platypuses have furry prehensile tails, in other words they can grasp objects with them. This still from a reel isn’t very clear, but she is carrying twigs.

“When female platypuses are making nests, they will grab bunches of vegetation with their flat little prehensile tails and drag the foliage into their burrows.”*

Yet more platypus versatility.

Another reason they are my totem animal and symbol of Asset Management at work.

Seasons’ greetings and a very happy 2026 to all platypuses & Asset Managers

*See podcast Ornithorhynchology (PLATYPUSES) by Alie Ward for more platypology

ID 26212151 | Child In Shallow © Pavla Zakova | Dreamstime.com

When we look back at the history of Asset Management, there is one curious feature.

In a world in which many people go on about data, many act like the revolution of AM is the discovery of asset data.

Why?

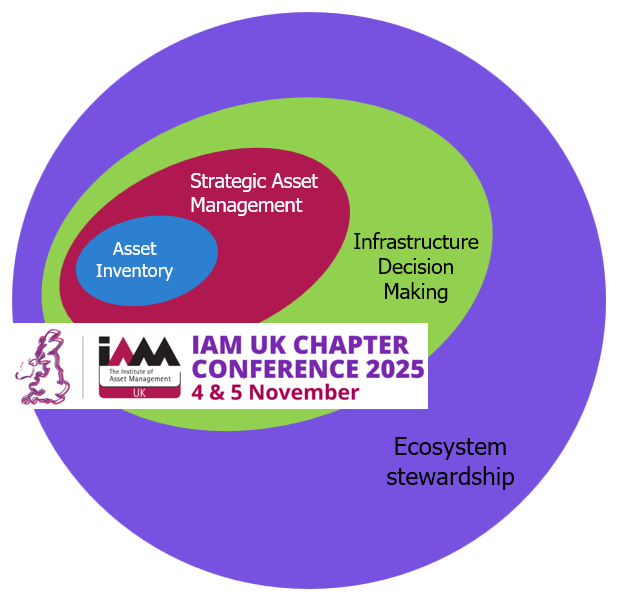

Penny many years ago made the point – well, that the point is making better long-term decisions about assets. Wave 1, ‘asset inventory’, only has any value when we use such data to make better decisions, in Penny’s Wave 2: strategic asset management. As Penny says, when you focus on the decisions, you have a much clearer idea of what data you actually need. Wave 2 improves Wave 1.

But there must be some kind of reason why organisations seem to have to go through Wave 1, collecting and organising data, first.

Cynically, we might think it’s because it’s easier than questioning decision-making: something middle level asset managers can do without challenging business at the top level. Or, and/or, there are plenty of suppliers willing to sell you help in collecting data or implementing the transactional IT systems to put it in. Few that actually know how to make better decisions.

But I come to suspect that, weirdly, asset-centric data is more radical than it sounds. What suggests this is how hard other teams kick and scream about collecting and handing on asset inventory, the very basic data on what assets we have where. (Capital projects, IT, even some maintenance teams.)

It doesn’t seem to help to stress that we cannot manage what we don’t know we have. Is the problem that they don’t understand that we do have to continue to manage assets into the future?

Or is it – back to basics – that the whole concept of an asset is the first revolution?

Other people manage projects, budgets, sites, even value on the balance sheet. Only Asset Management believes the fundamental unit of management is the operational asset.

Can we rewrite the advice on implementing Asset Management to get us to decisions faster?

Are too many organisations still not making that very first leap into the water?

Memorial to Jules Verne, Amiens, ID 381624172 © Linda Williams | Dreamstime.com

One way to put my life in context is: when I was born, Robert Heinlein was king of science fiction.

Not that I knew this until ten or so years later, when I started to read my family’s collection of sci fi Penguins. We, naturally, also favoured British writers, who, if not noticeably more female or non-white, were at least less American gung-ho.

Now, the world of the future is very different, with some ‘non-binary’ writers, Afrofuturism, and radical ecologies. And good aliens, my favourite.

Between then and now, there have been a lot of post-apocalyptic dystopias, which I tend to keep away from. Post-scarcity anarchism is much more my thing (see Ursula K LeGuin, and Iain M Banks’ ‘Culture’, for example).

And hope.

If one defining feature of good Asset Management is developing longer term planning, and infrastructure urgently requires a future vision, can hopeful science fiction help us?

What’s your most inspiring example of a fictional future?

And a vision of future infrastructure?

Just after Penny Burns and Jeff Roorda wrote about the revolutions or ‘waves’ of Asset Management in 2018, I realised how useful this was for surviving Asset Management conferences.

Sitting through yet another presentation about asset data, I thought: too many of us are still stuck in wave 1, asset inventory. Oh, for more papers on wave 2 and actually using information for making better strategic asset decisions! It’s not just my problem!

I had the great pleasure of attending a conference this month when not only did I not sit through anything on data, BIM, digital twins or AI, but we actually looked forward to waves 3 and 4.

The IAM UK conference, curated by Ursula Bryan – I really have to give her the credit – including an AM professional talking about how to use AM to solve Cape Town’s infrastructure challenge. That is truly wave 3 looking up and out. And another presentation about using AM to redefine coasts: a vision of wave 4.

At the conference I only addressed wave 2 with my US AM mob, about how most organisations still have to implement lifecycle based longer term planning.

But it was fantastically heartening to put this in the context of more ambitious Asset Management. Shout-outs to Johannes Paradza of Infrastructure Asset Management South Africa, and the always visionary Joe Inniss and Ashley Barrett of their Centre for Asset Studies!

See ‘Amphibious Infrastructure’, https://www.centreforassetstudies.co.uk/articles

Excavation at Star Carr in Yorkshire, bbc.com

If I had the brain capacity, I’d write a book called something grandiose like Infrastructure and Civilisation. To bring out just how important working infrastructure is to us.

You can’t have ‘civilisation’ – people living in towns and cities – without it. How did it grow, from the earliest actions to build shared causeways? We are handy, but it must be more than that.

I just read an interesting book called Inheritance: The Evolutionary Origins of the Modern World. It’s by Harvey Whitehouse, an anthropologist who also conducts psychology experiments on small children and co-compiled a database of hundreds of cultures already studied by anthropologists and archaeologists to analyse for key factors – as I said, interesting.

It made me reflect that both modern society and physical infrastructure require two things: co-operation between people (to build and maintain far larger social and physical structures than one person or even family could do) and sanctions, in other words ways to get people to do, or not do, things.*

Both have their origins well before homo sapiens, of course. Primates are largely social co-operators – and have strong views of what’s not fair, that they will go out of their way to punish. Sanctions for anyone not behaving well don’t have to involve written laws or dedicated police: for a social animal whose life depends on co-operation, disapproval works well on its own.

I grew up with a just-so story about competition being the motive force of progress, but it is much, much more interesting to look at how people work together.

It’s certainly my experience of infrastructure. 99% co-operation with some rules and regulation to force social-mindedness where necessary.

(And my current read is Progress, A History of Humanity’s Worst Idea!)

What’s the required balance of co-operation and rules for sustainable infrastructure?

*Whitehouse talks about why slavery did not in the end work out – why it’s more effective to get people to co-operate, when you grasp our basic psychology.

Recent Comments