Photo by Ahmed Aqtai from Pexels

“Growth does not mean size!”

This is the kind of comment that you might expect from a new economics, or a new age group, but you probably would not expect to hear it from a major multinational. Yet that was how the new CEO of Suez Environment, a major global water and waste organisation, opened his announcement of the company’s 2030 Vision. He was referring to physical size for he went on to speak of reducing capital (physical structures) and increasing IT, of focusing not on ‘growth’ as such, but on selecting just those areas in which they could add most value. In other words, to grow performance and profit. And yes, profit is a ‘good thing’, if it is a reflection of good performance.

I have a feeling we are about to see more of this kind of growth take place from now on. We can contrast this approach to the older approach where companies seek to grow simply by amalgamations and mergers. In the recent past, there has been a lot of this ‘growth’ but it really isn’t growth at all, because nothing has been added by the merger (despite claims to the contrary). It is just a re-packaging of what already exists. This has been particularly prevalent in engineering and consulting, and yes, also in asset management, companies. Yet it seems that every time a merger occurs, not only do we add more ‘administrative’ levels (i.e. more cost) but many of those employees who are most able and innovative, leave the mega businesses and set up their own businesses as small, more flexible, more imaginative units – and thrive.

So is ‘size’, as such, a good indicator of company strength? What examples do we have of growing ‘smarter’ rather than simply larger? If we are in future to focus on growing ‘smarter’ rather than ‘larger’, what would we measure, what indicators would/should we focus on? How does ‘big data’ and algorithms offer opportunities for smart growth?

And the important question:

How can strategic asset management contribute to such ‘smart growth’?

Photo by Miriam Espacio

It is rare to come up with 5 new directions from a single conference after 30 years of attending. But the last 2 days at the Sydney ‘Asset Management for Critical Infrastructure’ conference, I did, and I am both excited and grateful. There is nothing like a nice idea to wrap your head around. Here, in brief, is early notification of what I will probably be thinking and writing about in the next several weeks (even months). Please join me in exploration.

1. Business Cases

I made a disparaging comment about the quality of business cases and was taken up on the issue. “Why so bad?” he asked. I thought that there was probably three reasons. 1. We come at them with the wrong attitude. We don’t ask, ‘is this project justifiable?’ and then seek the information on costs and benefits that would enable us to answer the question, instead we start from the biased position of ‘how can we prove that this project should go ahead?’ Under these circumstances it is not surprising we have a tendency to overstate the benefits and understate the costs. 2. It is a genuinely difficult thing to figure out the benefits of infrastructure, for they usually reach way beyond the immediate recipients of the infrastructure service. I have also found, surprising as this might sound, that there is genuine difficulty for many in determining what is a benefit and what is a cost. 3. There is a lack of independence. I was told (who by?) that in Germany the C/B studies are done independently. This would be a great help if we were to adopt that here. It would overcome the first two issues and enable all projects to be considered on an equal footing as well as allowing the evaluation body to develop real evalution skill.

2. AM Ethics

Ashley Bishop had asked, in a comment to an earlier post, how AM could develop as a profession. I had given a keynote address on this many years back, but not covered one particular aspect that a fellow raised yesterday (who?). He said that we couldn’t become a profession until we developed a set of professional ethics. Fascinating! I started to wonder what such a set of professional ethics might look like? I would love to hear from anybody who also finds this an interesting question.

3. The Boom that never ends

Andrew O’Connor, KPMG had made it clear that we are currently experiencing a boom in infrastructure spending. Except that it isn’t! At least it isn’t if we are to believe new Infrastructure Australia CEO, Romily Madew, who argued that this level of spending is now ‘the new normal’. Booms come to an end, that is the nature of a boom, they don’t become the ‘new normal’. Capital spending over the next 10 years is about double that of the previous ten or around 100% growth. Justified by population increase? But that is only expected to be less than 25%. If this level is to be the ‘new normal’, it means we will continue to spend on infrastructure at about 4 times the rate of population growth! Does this sound normal? Let alone necessary and possible? And I am only looking at continuation of the level, if we look at continuation of the ‘rate of growth’, the problem assumes an even scarier dimension. What on earth are we thinking here? – to be explored.

4. Selective projections

All spending projections focus on capital costs. But every time we build a hospital, the recurrent costs (medical staff, cleaning staff, medical consumables, as well as the infrastructure operations and maintenance costs) easily come to about 40-50% of the capital costs, and they do this every year. Schools and Universities also have a high recurrent to capital ratio. Utilities less so, and probably roads the least of all, nevertheless even at the lowest level we are looking at around 10% of the capital cost as an ongoing recurrent cost. These costs continue even when the ‘boom’ has passed. Tom Carpenter said that in Japan, forecasts include both capital and recurrent. This is a much safer management process. If they can, why can’t we?

5. Infrastructure Debt and national security

Where are we getting the money from for this infrastructure spending? And how much are we paying for it? Already the University sector is financially dependent on China (as reported in the AFR, 21 August). How soon before all sectors are? Romily Madew, CEO, Infrastructure Austraia, said that this question was not within her remit. She thought it maybe was being done in the Treasury. Who is keeping an eye on this? The University sector has become dependent on Chinese funds simply because the Federal Government took short term decisions. It didn’t see today’s consequences. Maybe it is about time we took a serious look before this all gets out of hand. To be explored – does anyone know where this is being examined?

If any of these ideas intrigue you and you would like to work with me to see where these ideas can go – please write to me at penny@TalkingInfrastructure.com.

Photo by Matheus Bertelli

“How did you get involved in asset management?”

I asked this question some years ago and this answer blew me away! For sheer excitement and enthusiasm, it is a marketing masterpiece. I haven’t been able to improve on it – can you?

Michael Brendali wrote: “My involvement and keen interest in asset management began in the second-half of 2008. I was a mechanical design engineer finishing up a long and enjoyable stint on the Sydney Desalination Project when I was asked to contribute to a project we (Sinclair Knight Merz) were undertaking to evolve the asset management strategy for a major urban water utility’s critical infrastructure.

“The fun of complex decision-making from

physical to the business effectiveness”

I was initially meant to work for about one month on the project as my knowledge of their corporate databases would prove useful for one aspect of the project, but once I became involved I found the asset management field entirely engrossing. This was a world of complex decision-making, dealing with everything from the physical properties of pipes and soils, to the regulatory environment of the utility, to the effectiveness of internal business processes and knowledge management systems. A world that requires you to see the big picture while understanding the intricacies of the minutiae.

A world where on any given day I can be working with operators, maintenance crews, scientists, economists, planners, asset managers or general managers. I was hooked! I was able to expand my role on the project and so that original one month turned into a new career direction

“a collaborative environment”

I have worked in asset management ever since and am currently completing a Masters of Science degree in Water Services Management at UNESCO-IHE in Delft, the Netherlands. This degree focuses on the integration of legal, economic, institutional, organisational and technical considerations for the successful provision of infrastructure services. I am currently undertaking my MSc Thesis, which I am using to research the nature and effectiveness of the collaborative environment for sharing and progressing (strategic) asset management within the Australian urban water sector.

“taking ownership of challenges, even relishing them, and

sharing wisdom for the progression of the discipline”

The human factor of asset management strongly appeals to me. In the current era where we have available a multitude of software, tools, applications and models (which have their value), the indispensible nature of educated professionals with sharp minds cannot be forgotten. Indeed, I think that is one of the great strengths of the asset management community – it contains many talented individuals who take ownership of the challenges they face (perhaps even relish them) and willingly share their wisdom for the progression of the discipline. It is a community that makes me want to actively participate too.

“where you can enjoy debates at many levels”

I truly enjoy the many challenges present in asset management and the debates they spur at all different levels – qualitative versus quantitative analysis; prescriptive standards versus supportive guidelines; structural reform of utilities or the encouragement of voluntary alliances; maintenance or renewal; compliance versus innovation. I have come into the industry at a very interesting time and have been particularly fortunate to have had the guidance and encouragement of a very talented senior practitioner within my firm, as well as the support of my organisation. I can wholeheartedly endorse the value of mentorship on the development of a younger engineer.

“influencing decisions representing

hundreds of millions of dollars”

If I sound overly excited by asset management, it is because I find working in asset management deeply satisfying. I value the fact that the work I do contributes to the sustainable provision of essential services and that, thanks to strategic asset management, decisions influencing hundreds of millions of dollars of (often public) spending can be made prudently.

I look forward to the challenges ahead!”

Well, what do think? Is there anything that Michael has missed out? or new things that have come up since?

PS Michael, wherever you are now and whatever it is that you are doing I hope you still find work exciting. Do let me know what you are doing and I will update this post with your current details.

Tuesday afternoon (30 july), in addition to the topics listed in our earlier post, we will also have the following, lead by Sally Nugent, former CEO of the Asset Management Council, now Director, Sallyent Pty Ltd, and currently working on a new book on asset management, culture and leadership,

1. How and What to ask: do you know what decision model you are using for your project or plans, and what questions to ask? For example

- Why is it important to make decisions promptly? (The Consequences Model)

- How do we identify the ‘next big thing’? (The Hype Model)

- Why does the printer always break down just before a deadline? (The Results Optimisation Model)

Reference The Decision book Fifty models for strategic thinking

2. Have you considered the context of your project or required solution with ‘open systems’ in mind. How does context influence the questions you ask?

Margaret Wheatley (2006, Leadership and the new science: discovering order in a chaotic world) points out that much of the current thinking in management science is based on Newtonian mechanics – an approach primarily based on reductionism – the best way to understand the whole is to break it up into smaller parts and understand those individual parts. The premise being that if you understand how the heart works and the liver works, you will understand the entire body. The problem is that two critical elements are missing

-

- understanding the individual parts doesn’t provide any understanding of how the parts interact.

- very few organisations operate in an environment where they are closed off from external factors.

Also

I am also hoping to add a discussion on real options analysis.

So if you find sitting and listening to others in conferences a bit passé, join us on Tuesday afternoon, where you get to take part in the entertainment!

Sign up in the comments, or better, write me at penny@TalkingInfrastructure.com

And I will send meeting details.

Just before my father died, he drove to visit me, then cheerfully walked down the road to have a haircut. He had been mostly bedridden for over a year and it was hard to recognise in this strong and happy man, the person I knew to be so ill. Within days he was in hospital and a week later he was dead. I found out later that this last burst of energy from a dying person is not at all unusual.

As with people, also with ideas?

As I watch the attempts of politicians to promote the use of coal fired generation, I think the same may apply to ideas. The fight for the dying idea of fossil fuel generation is so strong with some that it seems to outweigh all the death indicators, like the facts that solar is now far cheaper as well as environmentally more sustainable, that banks are not interested in supporting new construction and insurers are withdrawing their support.

And Rail?

What other examples can we see around us? I am a train buff. I enjoy travelling on trains, especially the London and Sydney tube lines, and my library contains many books of rail journeys and videos documenting the development, operations and maintenance of underground rail, so it hurts to think that this latest burst of rail construction might be another death rattle. However with the arrival of trackless trams, automated driving, and potentially reduced demand with greater use of video conferencing, and increases in the number of people working from home rather than central city offices (despite increased populations), one has to ask the question. On any rational assessment the need to cope with a rapidly changing future would seem to argue in favour of transport infrastructure that is lighter and more adaptable.

And yet the rapturous reaction to the proposal of a Melbourne Suburban Rail Loop, with hardly a voice raised in opposition, challenges this rationality. How much of this support is fuelled by the heady expectation that, with the rail loop, Melbourne will become another ‘London’ with all the status that implies? How much is it because we are familiar with this means of transport and therefore can easily visualise such a future whereas other options are perhaps still in science fantasy land? At this stage, these are just questions.

Professor Graham Currie

So I am greatly looking forward to my interview this Friday with Professor Graham Currie on the Melbourne Suburban Rail Loop. Professor Currie is Director of Monash Infrastructure, Chair of Public Transport, and Professor in Transport Engineering. He is a renowned international Public Transport research leader and policy advisor with over 30 years experience. He has published more research papers in leading international peer research journals in this field than any other researcher in the world.

(I don’t know whether this impresses you, but it impresses the heck out of me!)

Professor Currie is also founder and Director of the Public Transport Research Group at Monash University which was identified as the 3rd top academic research group in the world in an European independent review of the field in 2015.

I could go on about his numerous best paper awards and countless other achievements, but you get the picture. This is a person who knows what he is talking about when it comes to public transport.

You will be able to hear this interview on the September episode of our podcast.

YOUR CHANCE TO ASK YOUR QUESTIONS

If there are questions that you would like me to put to Professor Currie – be quick, put them in the comments section and I will do my best.

PS For those in Melbourne

If you would like to join us for AM exploration on the theme of how AMgrs can support their organisations in a changing future, be advised that Monday and Tuesday morning are now full but we have three spaces left Tuesday afternoon, 30th July. Email me at penny@TalkingInfrastructure.com – but do it quick!

Today’s Asset Management Strategists

Today’s Asset Management Strategists need to ask new and different questions. We can no longer rely on answers that served us well in the past, nor the questions that generated those answers. We need to develop new question asking skills and explore new directions.

Over the last 30 years we have concentrated on efficient production, or ‘getting the job done right’ and done really well with that. Now we need to tackle the next task ‘getting the right job done’.

With so many technological options now opening up, and economic, social and environmental demands, as well as public and governance attitudes changing so rapidly- it may be a very, very, different job!

But it doesn’t have to be overwhelming.

We just need to know where to start.

In my last post I reflected on the public service in the late 1980s where I rejoiced in finding many others willing to co-operate in problem solving – before ‘competition’ rather than ‘collaboration’ became the ethos of the day.

However, there are now signs that the tide is again turning, so can we provide a vehicle for collaborative discussion? Let’s try!

Melbourne Workshops

I will be in Melbourne at the end of this month to conduct interviews for our podcast series and while I am there, the Talking Infrastructure Melbourne Team is organising a series of free workshops (coffee provided!) to explore new questioning techniques.

Here is what is on offer – Two hour workshops will be held at the Istana next to the Queen Vic Markets between Saturday 27 and Wednesday 31 – In the comments section, tell us what interests you and we will send you session times and more detail.

1. Inverse Hypotheticals

In an ordinary hypothetical a hypothetical story is created and panelists are asked questions. In an inverse hypothetical, a story is again created BUT it is the panelists who get to ask the questions. The set up is this: A review group has to consider a certain infrastructure proposal or situation. The panel are advisors to this review group and feed them the questions they feel relevant. The facilitator may throw some unexpected new items into the mix as the discussion develops.

2. Development Session: Exploring the role of the Future Asset Management Strategist

If you know the technique of ‘Beyond Bullet Points’, this is a great opportunity to practice. If not, it is a great opportunity to learn. And to produce something valuable in the process.

3. Exploration Session: “The 2020 Infrastructure Challenge”

Those of you who have been involved in asset management for a while will remember The International Asset Management Competitions which took place between 1996 and 2000. They were designed to put asset management, if not on the map, at least high on the priority list of CEOs. And it was very effective in giving asset management greater traction at that time. The 2020 Infrastructure Challenge is looking at how we might do the same for the new infrastructure decision making we will need as we transit for 20th to 21st century infrastructure.

4. Open Discussion Session

Key concerns of asset managers today, Come with your question and/or come to get involved in the ideas of others.

Not in Melbourne?

Workshops are being planned for other cities. At the moment we are looking at Sydney in mid August (while I am over Sydney way to give the opening keynote to the Asset Management for Critical infrastructure Conference, August 20th)

There is something about wet and windy overcast conditions that brings on reflection, which, if we are not careful, can lead us into melancholy. Avoiding this risk requires us to take action – and so I am. Read on to see the reason – and the action.

The way things were

In 1982 I moved from the University where academics were closely focused on their own projects, to the state water authority where – at that time – the focus was improved community outcomes. If I had an idea for improvement, it was not difficult to find half a dozen bright, well intentioned others, to willingly and co-operatively work through it with me. And, equally, there were many others willing to involve me in their ideas for improvement. The Public Service was a great place to be in the early 1980s. It changed, of course, with the introduction of modern commercial management ideas. And, ultimately, not for the better.

The way things are

This started the exodus of those who believed in community service and of the intelligent who could easily secure positions outside the government. Today, with short term public service contracts, there is no devotion to improved community outcomes – how can there be when one’s own short term outcome is so precarious, so insecure? There is also no corporate knowledge and information to draw upon. The community has lost out. The public service has lost out. Who has benefitted from this much vaunted ‘improved management’ shift?

The way things can be

Clearly I am not advocating for greater inefficiency, but I think we could do with improved effectiveness. I miss those days when community focus was the norm amongst the brightest and best. A time when, if I had an idea for allowing unprofitable irrigation farmers to sell those most valuable asset – access to water – to others who could make better use of it; or if I wanted to see whether the hype about the value of the Grand Prix could be proved, I could draw on the expertise of others simply by asking for it. That was how we started a review of irrigation water licences and put together academics and public servants to produce ‘The Adelaide Grand Prix’ – an analysis of the first Grand Prix in Australia in 1985. This was the first serious analysis of the impact of a Special Event, it has been cited in every publication on Special Events since then, and our approach was adopted by the Commonwealth Government in their grant assessments for many years – despite the hyped up arguments of some of the top management consulting companies. It prevented our State Government from following its earlier wish to contend for the Commonwealth Games – and thus avoided the ‘white elephant’ structures associated with these events.

Action now

Is it possible to replicate today those productive, well intentioned, discussions that served the greater good? I think it is. The growing strength on the non-private, non-government ‘Civil Society’ supports this. I also think it is essential that we develop a core of intelligent strategists to help manage the infrastructure shifts that will be necessary as we transit into a digital, increasingly complex, future.

Talking Infrastructure is looking to provide opportunities for those of you, from whatever disciplinary background, who aspire to be these future strategists, to physically get together with like-minded others for the purpose of sharing your ideas for improvement and assisting them in theirs – and in general developing your strategic ability to assist your organisations face the future. Does this interest you?

More information to come.

“Private firms efficiently finance their operations or they fail”

Clifford Winston, Brookings Institution.

There are a lot of implied assumptions here! Where do we start?

A major implication is that private firms must therefore be more efficient than public firms, but this makes a massive assumption – namely that the losses to the community from those private firms that fail is of lower consequence to the community than inefficiencies of public sector organisations that are not allowed to fail.

Where has this ever been rigorously and neutrally examined? And if it had – why would we have persisted so long, throwing good money after bad, at the UK private sector firm, Carillion? Carillion, which employed 43,000 people to provide services in defense, education, health and transport, collapsed in January, becoming the largest construction bankruptcy in British history. It left creditors and the firm’s pensioners facing steep losses and put thousands of jobs at risk

We tend to regard as heroes those entrepreneurs that go bankrupt – perhaps many times – and then come back and make a fortune. That latter fortune, however, is financed (involuntarily) by many small entrepreneurs and their families, some of whom may well have gone out of business because the work they did for our bankrupt hero was never paid for.

There have recently been a number of very large and very public failures in the banking system that have created enormous public havoc. These banks cannot ‘go bankrupt’ but can – and are – bailed out by the public, which is the equivalent. Without this ‘safety net’ and the incentive to make a profit ‘no matter what’, would a public banking system, such as we once had, have fallen prey to the sub-prime mortgage debacle?

Have the so-called ‘efficiencies’ created by a private banking system been systematically weighed against the costs? I suspect that this is an area where we are acting in ‘blind faith’. It has to be blind because there is so much to the contrary that we can see if we but look.

Another aspect of this faith is the presumption that anything that we may say in favour of private sector or ‘market‘efficiency’, still holds true when the private sector is propped up by government contracts (e.g.public toll road contracts).

I am not arguing that there are not problems in the public sector. There are. But would it not be an idea to address these problems directly rather than advocate private provision where there are also problems – but they are less amenable to correction?

When are we going to get that definitive examination of Carillion and hold them responsible?

Can’t stand economists? I often don’t care much either – and I am one! But this week I am proud to be among the number of ‘new economists’, economists for whom human beings are actually people, and the whole reason why we engage in economic activity, and not mere dispensible cyphers in the production cycle.

Kate Raworth, author of “Doughnut Economics – Seven ways to think like a 21st century economist” and the team at Rethinking Economics got together to issue a challenge to find an 8th way. Contributors could use any medium but they had to tell their story in 3 minutes or less. There were three sections, one for schools, one for universities, and one for ‘everyone else’. I like the emphasis on the young – where better to get new ideas?

Last Friday I posted the first place University Winner, “Legal Rights for Nature” voiced over a video of beautiful New Zealand. That encouraged me to see what the other winners came up with. You might like to see them too. So go here for the Schools winners (great ideas from passionate young people, a joy to hear and watch – they all use video, they are young!), the University winners and Everyone else.

If you are asking yourself why, as a non-economist, this should be of interest to you, I will draw your attention to a brilliant article in the New Economics Network of Australia (NENA) Journal by Steve Liaros “Economic Disruptions will reshape our cities” His thesis is simple: “Economics is about how we organise ourselves to satisfy our needs and wants. This ultimately translates into the arrangement of human settlements; the spatial relationship between living spaces, work spaces and their connection to food, water, energy and other resources needed for surviving and thriving. The economic disruptions mentioned above will transform our cities and the patterns of human settlements.”

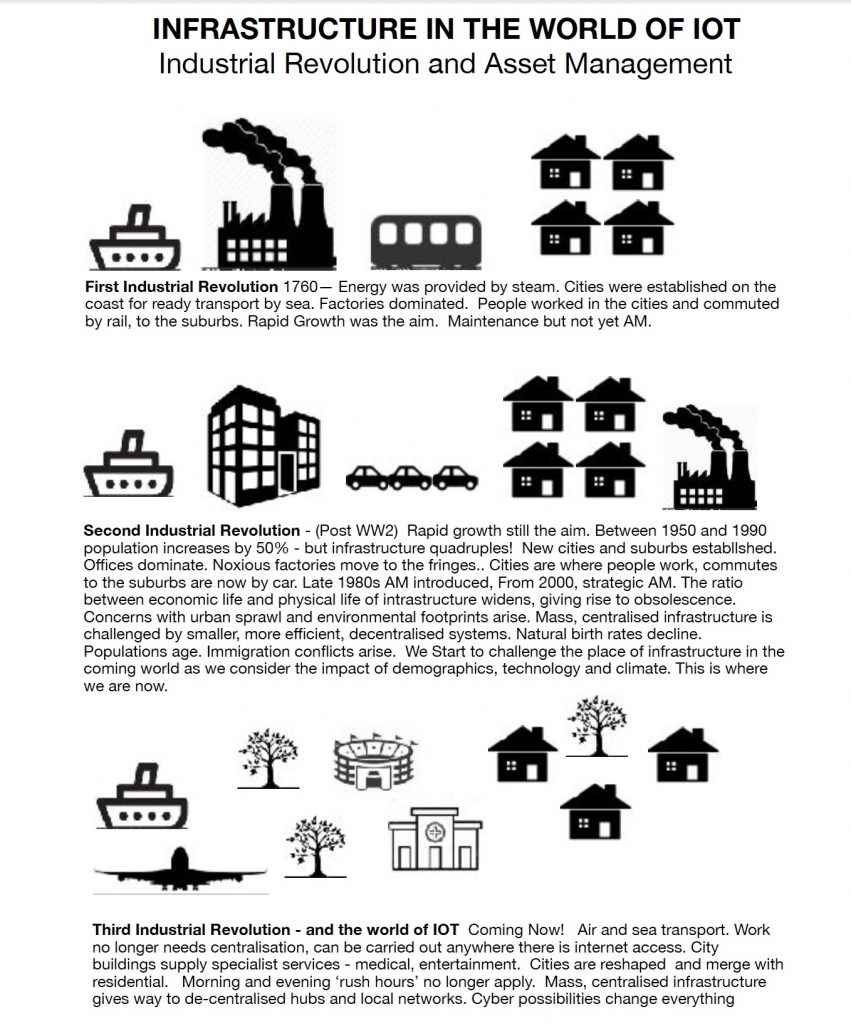

What delighted me about Steve’s article is that it is a beautifully argued elaboration of the story of the next stage of AM, that Jeff Roorda and I outlined in our article ‘The Third Asset Management Revolution’ back in April 2018. The original graphic for that story is reproduced here.

So there you are – economists and asset managers on the same page! Who would believe it?

SEVEN SPECIFICS OF BEING A STRATEGIST

SEVEN SPECIFICS OF BEING A STRATEGIST

We were talking about asset management – of course! – but more specifically about ‘thinking like a strategist’ when my friend and colleague, Ruth Wallsgrove, asked:

‘What would a strategist do that a professional engineer, accountant, or administrator would not?’

Now the truth is that any professional can think like a strategist, and often does. The trick to doing it better is to do it consistently, consciously, and in collaboration with others, in other words – corporately! So What does it mean to ‘think like a strategist’? Here are what I consider the 7 specifics.

- The Goal – Strategists adopt a big goal, the aims and objectives of the organisation they serve. They recognise that once the prime objective of their organisation is recognised, there may be many different ways to achieve it, in addition to those already identified – and they look!

- The Time Frame – Not ‘now’, and not ‘then’, but rather ‘from now to then’. A focus on what needs to be done to plot the path from the current situation to the desirable future. Such a path needs to be flexible and allow for adjustment as changes occur. (i.e. there is always a Plan B. C…)

- The Scope – the whole organisation and its wider social and environmental context

- The Reason – never ‘because XYZ is doing it’ or ‘because we have always done it this way’ (or even because it is new, innovative and exciting) but because, on balance and considering the options, it is the best way- for now -of achieving the goal. Always reviewing.

- The Attitude – Pragmatic (think Machiavelli), do what works, but analyse why it works. Curious. Sceptical. Analytical. Challenging.

- The Awareness – Strategists are not Superman and do not attempt to be. They know they need, and they fully appreciate, the contribution of others: professionals, tradespeople, users. The stance is one of willing collaboration.

- The Communication – understanding what drives the actions of others is key to the way in which ideas can and should be presented to be effective. People don’t fear change, they fear change being imposed on them. The art of good communication is winning hearts and minds. Strategists listen for more than words, they attune to the emotions of others (feelings of fear, trepidation, courage, hope)

The key difference between the Strategist and Other Professionals can be seen in the goals that they adopt.

Take Backlog for instance. A maintenance engineer will see the need purely in terms of the asset, its reliability and ease of operation. He will generally not see that the resources needed to achieve this reliability and ease of operation that could be used elsewhere in the organisation, and possibly achieve even greater good.

Take KPIs. An accountant may see, and even promote, rules such as debt ratios or productive staff: overheads ratios because these are manageable by her division. She may not even see the damage that is being caused to overall corporate goals by such rules.

Or take “finished staff work”. Any administrator that insists on finished staff work as the sine qua non of excellent administration has to accept old ideas thus ruling out new ones. Easier on him, but not necessarily to the benefit of the organisation.

Each of these is an instance of ‘solo thinking’

Solo thinking is ‘what’s best for me, my performance, my KPI’ – rather than ‘corporate thinking’ or what’s best for the organisation or community.

Organisations bring this upon themselves to a large degree by failing to articulate their goals, and especially their values. They also bring it on themselves by not encouraging and rewarding the strategic behaviour that would serve them better.

Thinking like a strategist, is ‘thinking holistically’ (I realise this word scares the living daylights out of many people, but it really is necessary!)

Recent Comments