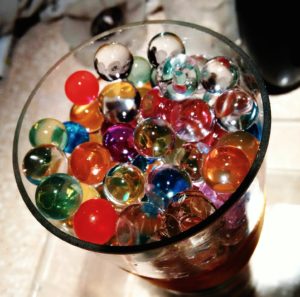

“General equilibrium”, an economics colleague explained, “is like a bowl of marbles, move one and we have to reckon with a change in every other one. Depending on the location of the original marble, the change will be large or small, but there will be always be a change.”

“General equilibrium”, an economics colleague explained, “is like a bowl of marbles, move one and we have to reckon with a change in every other one. Depending on the location of the original marble, the change will be large or small, but there will be always be a change.”

Thinking now of energy, a breakthrough in battery storage development would be the equivalent of moving a marble at the very bottom of the bowl. Anyone following the technical developments in batteries, and the vast resources now being devoted to this exercise, would expect to see this happening within the next five years (and probably sooner rather than later). In other words a breakthrough in the length of life and the economics of solar energy (and wind energy) storage is an almost certainty. But what then?

As important as technological innovations are, they are not the end of the story. In fact they are just the beginning. When battery storage possibilities improve, here are some of the impacts we can expect to see – a change in social attitudes towards energy usage; changes in manufacturing to take advantage of this; a great increase in the demand for solar panels; an increase in the willingness of some to go completely off grid; but also an interest of many more in adapting the present distribution network to serve localised production and sharing of power. Localised power production and distribution will enable greater security from events such as the recent power outage in South Australia and future impacts from climate change, as well as attacks on our critical infrastructure.

However, the change in demand for distribution networks will present a business model challenge for network owners which is why ‘economic innovation’ is now needed. No change will take place unless a profit can be made from it. Profit is not a dirty word. It is essential to good resource allocation.

So my question today is: what do we know of research into new business models that can promote and support the adaptation to distributed production and distribution that solar and wind power combined with good battery storage can make possible?

By now, every Australian would know that the entire state of South Australia experienced a power system failure as severe storms with high winds uprooted 22 high voltage power pylons cutting off a major part of system generation at Port Augusta. For about 10 hours on Wednesday, we all effectively went ‘off grid’. Rolling blackouts or brownouts are not uncommon but this was the first time that an entire state has been without power.

By now, every Australian would know that the entire state of South Australia experienced a power system failure as severe storms with high winds uprooted 22 high voltage power pylons cutting off a major part of system generation at Port Augusta. For about 10 hours on Wednesday, we all effectively went ‘off grid’. Rolling blackouts or brownouts are not uncommon but this was the first time that an entire state has been without power.

At 3.30pm light and power was cut to my office. The desk top computer stopped – the laptop, however, continued working for another 5 hours. The land line phone connection ceased – but the mobile did just fine. Televisions stopped but information got out to everyone via Facebook on mobile connections. Power was mostly resumed at 1.10 am Thursday but, for ten hours, the battery was king!

Those in government responsible for the future of our infrastructure might well have asked themselves whether climate change might not engender future storms like this and, reflecting on the fact that the statewide blackout was caused by the necessity to protect the integrated system, perhaps they might also have asked themselves whether the efficiency benefits of integration might not come at a cost? They might then have considered whether a more disintegrated system of power generation and distribution, such as is now available with the growth of renewables such as wind and solar might not have mitigated the impact? After all, when the system goes down, those who are not reliant on it benefit. So it is curious that the Prime Minister and assortment of others antagonistic to wind and solar should blame renewables for the failure!

Or perhaps not so curious if the aim is to protect incumbent power and distribution networks? The electricity industry is well aware of the threat of wind and solar to its generation and distribution networks when long lasting batteries are developed, which is now, perhaps, not more than five years away.

Our Question today: Given that battery development will represent a major disruption to power production and distribution what should be the intelligent, forward looking, attitudes of our government – to block, or to adapt?

Recently at a workshop of asset managers I suggested that the role of Strategic Asset Managers in today’s environment will be to anticipate the changes that are affecting their organisations policies and be ready to address them. I asked them to come along prepared to discuss the key trends affecting their organisation and what they were planning to do about it.

Recently at a workshop of asset managers I suggested that the role of Strategic Asset Managers in today’s environment will be to anticipate the changes that are affecting their organisations policies and be ready to address them. I asked them to come along prepared to discuss the key trends affecting their organisation and what they were planning to do about it.

The key trend identified was diminishing or uncertain funding. No surprises there.

What I found interesting, however, was the way that almost all of them were coping with this situation. It was to place a greater focus on the ‘customer experience’ and to broaden the scope of their activities. A university asset manager said that they were seeking to provide staff, students and researchers with ‘desirable experiences’. The airport manager was looking to extend the airport facilities to attract not only passengers and those who came to greet or see them off, but people who would come to the airport for the events or activities it provided, rather than for the intention of flying. The asset manager from the electricity authority said that they now saw themselves, not in the electricity business but in the energy business. He too, saw the need to focus on customer experience. In fact, he recognised that in this new environment that ‘asset management’ and ‘marketing’ had to come a lot closer, for they had a common goal.

Infrastructure management and marketing! An interesting combination.

So my question for today is: Is this the way you see infrastructure moving?

I am often told that I should be targetting ‘Talking Infrastructure’ at the politicians because they are the real decision makers. But are they?

I am often told that I should be targetting ‘Talking Infrastructure’ at the politicians because they are the real decision makers. But are they?

Politicians are like a jury. The lawyers make their best case and the jury chooses between them. The result depends on the skill of the lawyers who have to examine the facts before them, assess their validity, make a case and then present it as persuasively as they can. Now the lawyers may not have all the facts, or the jury may be influenced by matters other than the facts – the look of the defendant, perhaps. It may be that the guilty go free, or the innocent are convicted. No reasonable person could think that this is ‘fair’ or ‘right’, but it is the way we discover the truth under the legal system we have. Importantly the jury is chosen deliberately for its representativeness, not analytical skills. To get better results from our jury system we therefore work on improving the system – and the quality of the lawyers who analyse and present the information.

Politicians are like a jury. Infrastructure analysts examine the issues, collect data, analyse it, make a case and present it. They are like the lawyers. The politicians then have to take a stand. The analysts MAKE the case. The politicians TAKE a stand. That is why I refer to the analysts as ‘infrastructure decision MAKERS’ and the politicians as ‘infrastructure decision TAKERS’. Semantics perhaps, but a useful distinction.

It is also why I am targetting this Talking Infrastructure Blog at the analysts and not at the politicians. It is the analysts who can make a difference.

Whether a proposal ‘gets up’ depends on

- the merits of the proposal itself,

- the skill with which it is presented, and

- the match between it and the needs of the politicians

All of these (yes, even the last) are within the capacity of the analyst – the infrastructure decision maker – to improve. End of manifesto!

Question for today: Do you believe we need to better understand the needs of politicians. Why or why not?

In his post on August 12, Mark Neasbey of the ACVM spoke about the infrastructure decisions we make when we don’t think we are making any. Dangerous! If you haven’t read it yet, it’s worth it! Click here. And here is another example of unconscious decision making.

In his post on August 12, Mark Neasbey of the ACVM spoke about the infrastructure decisions we make when we don’t think we are making any. Dangerous! If you haven’t read it yet, it’s worth it! Click here. And here is another example of unconscious decision making.

At his last school, surplus capacity was up around 45-50% and the school principal approved the use of one of the vacant classrooms as a drop in centre for parents and carers.

Now he was also on the council for another school, one his own children attended. This school was in a growth area and had no surplus capacity, but when he spoke of his drop-in centre, the other council members thought it a good idea and since school extensions were being designed at the time, the second school agitated to have a drop in centre designed into the new building.

The designer liked the idea and in the next school design he was involved in, he automatically included a drop in centre.

Now what had begun as a good use of surplus capacity, a “one off”, had become a new standard. Who approved the ‘new standard’? In all likelihood, no-one. When was a conscious decision on the new standard taken? In all likelihood, never. Was the corporate level (in this case the Education Department) even aware of the change? In all likelihood, not at all!

This is infrastructure or service level creep. Everyone defends it. Why wouldn’t they? A better service at no cost is what we should all aim at. But what is ‘no cost’ when we already have surplus infrastructure, becomes very costly indeed when the extra space is being deliberately built in.

This is not to argue against drop-in centres, per se. They can be a great addition to a school and to the community. But rather to suggest that the decisions be taken advisedly. To do this we must first be aware of it!

Question: What examples of infrastructure creep (or service level creep) can you think of?

obsolete power plant

If you want to know why something is said or done, ’follow the dollar’ – in other words, find out who stands to benefit. Earlier this week an article in the Brisbane Times argued that future generations would ‘rue the day’ that the Government failed to take advantage of current low interest rates to invest more in infrastructure. The arguments were being put forward by a multinational company that constructs infrastructure! It is clearly in their interests, but is it in ours? The writer of the report wrote “Borrowing money to build the infrastructure for a future economy is not only the right thing to do, it is absolutely essential to our future economic prosperity.” But is it?

With low interest rates why isn’t the private sector investing if it is such a good idea? May be they cannot see the demand necessary to justify the extra capacity they would be creating? Also they are aware that the economy is in a state of flux and are probably, and sensibly, seeking more clarity on the future before they consider committing shareholder funds. Do we really want our governments to be any the less wise with our funds?

Economists, looking only at the cost of borrowing, often argue that we should borrow to spend at times when interest rates are low. In a recent ABC news item, Glenn Withers, economist at the ANU, argued that current low interest rates meant this was a good time to invest in infrastructure but Gary Bowditch, Head of the Better Infrastructure Initiative at Sydney University said the price of money and historically low interest rates were “completely meaningless in the current context, first we needed to be choosing the right projects”.

Question: Who do you agree with, and why?

The role of infrastructure is to create benefit. No one wants to see waste. And yet we have many failed, wasteful, projects. Some may fail for unforeseen, and unforeseeable, reasons. But many of them fail because their underlying assumptions were not tested. Nor is this only a problem for public infrastructure, private infrastructure is just as vulnerable.

The role of infrastructure is to create benefit. No one wants to see waste. And yet we have many failed, wasteful, projects. Some may fail for unforeseen, and unforeseeable, reasons. But many of them fail because their underlying assumptions were not tested. Nor is this only a problem for public infrastructure, private infrastructure is just as vulnerable.

Consider the Melbourne Docklands project where many of the apartments that the private sector built (and was encouraged to build) relied on the general assumption that people would be willing to sell up large properties on the outskirts of the city to take up apartment dwelling to benefit from closeness to city attractions – and pay large sums for the privilege. This assumption has proved not to be true in sufficient numbers to justify the construction and many apartments are still unsold or unlet.

In addition, many of the apartments that have been sold have been taken up as investment properties by wealthy Chinese seeking an alternative location for their money. No-one lives in these apartments. So the projections of demand for newly established retail outlets in the complex have not been met. Could this have been foreseen? Maybe the overseas investment was not obvious then. But certainly it would need to be taken into account from now on. However, retail demand depended on close to full occupancy.

Maybe this will self correct in 5 years or more. However, if take up was expected to take time then an interim strategy was needed. Now, what had the potential to be a very attractive redevelopment serving the wider community may now suffer if landlords attempt to recover their investment by letting their apartments to temporary dwellers who have no commitment to the area.

A serious consideration is whether the policy planners gave sufficient – or indeed any – thought to the problems that might be experienced on the outskirts of the city if their assumptions of mass departures to the city proved correct.

What questions do these stories raise in your minds? If you were on a decision committee for a large redevelopment project, what questions would you ask?

Jeff Roorda suggested this provocation. I wrote it, so don’t blame him! If you would like to submit a provocation for posting – keep it under 400 words and no more than 2 arguments. (i.e. leave something for someone else to say!) To set up a new provocation, email your suggestions to me at penny@talkinginfrastructure.com

Jeff Roorda suggested this provocation. I wrote it, so don’t blame him! If you would like to submit a provocation for posting – keep it under 400 words and no more than 2 arguments. (i.e. leave something for someone else to say!) To set up a new provocation, email your suggestions to me at penny@talkinginfrastructure.com

Or leave a comment on this one!

For years we have acted as if we could tax our way out of an infrastructure deficit if only they (the Government of your choice) would have the wisdom and courage to do it. That is why so much effort has been put into calculating ‘backlogs’. But is it true that we can fix the problem with more money?

The pro side: Yes, if we are prepared to pay for it by forgoing personal consumption (ie pay more tax or more rates) or by reducing other government expenditures. However, without some reduction in the total renewal bill what we have to go without might be rather painful. But would this clear the backlog?

The con side: No, for just as work expands to fill the time available (Parkinson’s Law), the infrastructure deficit or backlog expands to meet the money being spent on it! The clue is in the definition “The term Infrastructure Backlog refers to the total amount or value of renewal works that need to be undertaken to bring a Council’s (or other entity’s) asset stock up to an acceptable standard” source LGMA Knowledge Base. Consider the key word ‘acceptable’. Think back to when you were young, your funds were low and an ‘old bomb’ was quite acceptable (and certainly better than the bus!). But what did you do when you started to earn a decent income? Now it wasn’t ‘acceptable’ any more, so you upgraded. And that is what we all do. ‘Acceptable’ is a relative term. The more we spend on infrastructure, the higher our expectations and the higher the minimum ‘acceptable’ level. Whenever I hear that our roads or other assets are in poor condition, I think ‘relative to what?’ Spending more money to reduce the deficit is thus like a dog chasing its tail. And will be equally unsuccessful.

Your views?

With monetary policy now so ineffective (bank rates are as low as they have ever been, in some countries negative, and yet they are not stimulating investment and spending) countries are increasingly looking to fiscal policy – that is direct spending by Governments. The expenditure of choice is infrastructure, and government infrastructure proposals are usually well received by the electorate because they are seen as creating jobs.

With monetary policy now so ineffective (bank rates are as low as they have ever been, in some countries negative, and yet they are not stimulating investment and spending) countries are increasingly looking to fiscal policy – that is direct spending by Governments. The expenditure of choice is infrastructure, and government infrastructure proposals are usually well received by the electorate because they are seen as creating jobs.

But proposals are normally vague on exactly what type of infrastructure spending is in mind, and the employment benefits of spending are often hyped up, so here are a few facts to bear in mind.

FACT: Out of every dollar spent in Australia, some proportion will go overseas in the form of imports. Some years ago, a government industrial economics report estimated that:

Maintenance generates 25% more employment than house construction and from 50% to 100% more employment than engineering construction. This is because:

- Maintenance is highly labour intensive, therefore there is little leakage of funds overseas to pay for imported elements

- House construction spending has a higher proportion of imports

- Engineering construction (i.e. infrastructure), with its specialised equipment and materials has an even higher proportion of imports.

FACT: It is not infrastructure spending specifically that creates jobs but ANY government spending. Some types of spending, as indicated above, will create more jobs than others (and engineering construction such as infrastructure is on the low end of job creation).

FACT: Just as putting money into the economy will stimulate job growth, it is also true that taking money out of the economy, e.g. by taxing us to pay for the infrastructure, or reducing other government spending for the same purpose, will reduce job growth.

FACT: Low income earners spend more of any dollars they earn than high income earners. So if we find the money for infrastructure by increasing taxes or reducing other spending on low income earners (which is what is happening at the moment) and we then spend that money on high income earners in infrastructure industries, this will itself reduce jobs rather than creating them.

So is infrastructure spending the jobs panacea so many believe it to be?

I have been told that, today, asset managers and other middle to senior management decision-makers, are becoming a victim of the drive for ‘efficiency’: resources are being reduced, workloads increased. So much so, that they have ‘no time to think’. If this is true there are some very serious consequences.

I have been told that, today, asset managers and other middle to senior management decision-makers, are becoming a victim of the drive for ‘efficiency’: resources are being reduced, workloads increased. So much so, that they have ‘no time to think’. If this is true there are some very serious consequences.

I recall a client of mine who wanted my help in developing strategic policy and planning for her more than two billion dollars of education assets: schools and colleges. Her day was back-to-back meetings, so much so that we had to get together for policy discussions over coffee at 7 am or else after her day eased off at 7 pm. I asked her, with such a hectic schedule, when did she ever get time to think. She smiled wryly, shrugged and said “When I get home!” I was concerned for this bright young woman but also for her staff who really needed the strategic direction that she should have had the time to give them. Then my concern moved to the students, who were being shortchanged by not having infrastructure decisions thoughtfully coping with changing needs, and to their parents and their future employers. The whole community misses out when infrastructure decision-makers do not have time to think.

And the individual misses out too. With increasing automation, jobs that do not require thinking are going to be taken over by robots. Do we really want infrastructure decisions made by computer algorithms, by robots?

Questions today

Is it true that many decision-makers believe they have ‘no time to think’?

Is this something we need to address, and if so, how could we do it?

Recent Comments