I have long been interested in one particular aspect of the history of asset management. Why was it that agencies would so often progress to the stage of being the envy of all others in terms of their asset management – only to collapse and have to rediscover everything they previously knew? I suspected that there must be something inherently unstable about asset management – and there is! Here I explain what the problem is and how you can make sure it doesn’t happen to you.

You are going to come across a lot of definitions of asset management. Maybe you already have. All have validity. But the one that I favour at the moment has a focus not on what asset management does – but rather on what we get out of doing it!

I look at asset management as ‘a series of process and information improvements that enable organisations to see not only the likely consequences of the decisions taken today – but also of the actions not taken.’ You can argue with this definition, but bear with me, because you will see how it can help.

When armed with a knowledge of likely consequences you can make better decisions. You may not have enough money to do everything, but if you understand the consequences you can be reasonably confident that the things you are doing are at least of greater value to your organisation or community than the things you are not. Even more importantly, you can demonstrate this to others.

Asset management protects you. If you are a councillor, it protects you from pressure by lobbyists and those who would have you spend council resources in ways which you know are sub-optimal. If you are an administrator, it enables you weigh up different uses of your limited resources. If you are a manager responsible for assets, it enables you to know what to do that will best meet the service needs of the community.The key word is ‘consequences’.

When you can tell what is likely to happen next as a result of the actions you take today – and of your inactions – you are able to make better decisions and make them with confidence. And when you are able to demonstrate this to others and gain their confidence, life becomes much more enjoyable.

Driving in the Dark

Driving in the Dark

Without asset management, you are operating in the dark. It’s like driving at night with your headlights showing you just a few metres of the coming road. You are only able to see a little way ahead, and all of your decision making, whether on short or long term goals, is constrained by having such a limited view. So you have to move cautiously, never quite sure what those shadows mean, or what is coming next. And you can easily miss your turning and have to make time wasting course corrections. Or at worse, run into something with expensive, maybe fatal, results.

Introducing asset management is now like switching on your high beam.

Introducing asset management is now like switching on your high beam.

Suddenly, with a better view of the likely consequences of your actions, you can now see a long distance in front. You can move forward more confidently, make better decisions, and avoid potential problems, because you understand the likely consequences of actions and inaction.This is very exciting and it is not difficult to see why asset management creates evangelists. Many of you will have experienced this in the early stages of asset management, when, perhaps for the first time, you now have an overall view of your asset base, a better understanding of what you have, what condition it is in, and what its value is. This gives you a completely different view of what you can do – and it is pretty heady stuff.

But a word of caution!

What I have learnt is that when you reach this stage, you must not stop. The High Beam stage is unstable. When you are on the road, any approaching vehicle can force you to switch them off. Similarly when you are starting asset management, and you adopt generic assumptions about asset lives and desired service levels to get yourselves started, you get a ‘great leap forward’. This is the ‘switching on the high beams’ stage. It enables you to make progress quickly.

As in all things, easy come – easy go!

When things get tough – the asset management equivalent of the oncoming traffic – you can no longer rely on those generic assumptions and service levels. In times of trouble, such as missed grants, unexpected and unfunded asset renewals, in fact any difficulty, your staff and your ratepayers need to have full confidence in the reliability of your system and this means that you need to move on from the generic data and develop information that is credibly yours. In other words, you need to customise, to make the service levels and associated asset lives your own.

To do this you need to work with your community to develop service levels that are widely understood and accepted and can withstand criticisms.

Your asset data needs to reflect these service levels and to demonstrate the reliability that comes from documented, efficient, update mechanisms. Your asset lives need to reflect your own local conditions and known maintenance histories. And you need robust processes to ensure that all new asset acquisition reflects your strategic directions.

This takes effort, commitment – and time.

However, once you have done this, you are largely failure proof. By the time you have developed a good understanding throughout your staff from field staff to CEO, board or councillors, by the time you have good, up-to-date data, and by the time you have the confidence that this brings, then your asset management is secure.

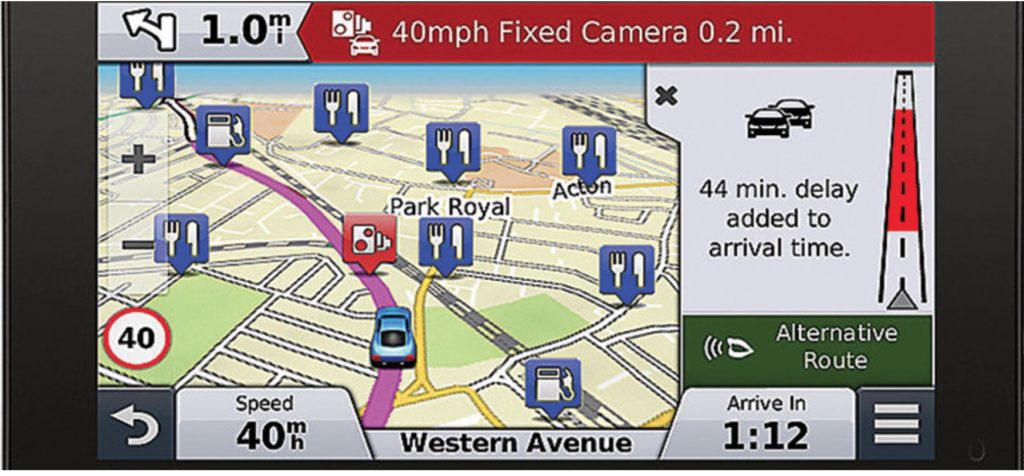

You have successfully navigated the instability phase and come out safely on the other side. This stage of asset management is like adopting a Satellite Navigation System. Now you can analyse all the options and choosing the optimum course is easy.

Moreover, when you get here you won’t want to stop. Now, asset management improvement for the benefit of your community will simply be the way you do business and you will enjoy always seeking to do better. The Road Ahead is now clearer and you travel it with confidence.

Questions?

- Where are you on the road to sound, reliable asset management?

- Are you still at the stage where you are using general purpose asset lives, gleaned from somewhere else? Or have you customised?

- Have you established accountable service levels? And are these service levels clearly and transparently connected to your asset life data? Do they inform your understanding of effective age and time to renewal?

- Have you reviewed, updated and streamlined your asset management practices?

Think this is too much work?

Then be sure to read next week’s post where we look at the danger not only for your assets, but for your staff ,of not getting to this stage of asset management.

Great analogy Penny.

I call this methodology “scenario analysis”. Today you hypothesize what would happen tomorrow if…….and then determine the outcomes/consequences of that action or inaction (what if I didn’t….).

Its a great technique and can be applied to any possible future event. Where it gets really interesting is if we can apply that scenario to a model of the system we are questioning. The model’s input parameters are the question/scenario and it outputs the outcome.

Naturally the model needs a range of inputs (such as useful lives, degradation curves etc for AM scenarios). As you state in the article, initially you have only rough estimates of the inputs and you refine these estimates over time as you provide feedback to the model ie where the model fails, you improve the estimates.

Also, the fit of the model to reality will determine the accuracy of the model’s predictions.

A key word you used in your article is “reliability” which I infer as the fit of the model to reality. With sufficient data and better models, you can predict not only the outcome but the confidence level of that outcome. You could also end up with a set of probable outcomes (dependent of the question).

This moves you then to asset modelling and how best to implement it in your organisation…..which is another story…..

Love to see scenario analysis being applied! The role of scenario analysis (as originally developed by the Shell Company to such great effect) is to consider a range of possible future scenarios and to think through what the company would do in the event that any one of them eventuates. There is a tendency now to develop scenarios and then try to pick the ‘most likely’. However when Shell applied it, the ‘least likely’ scenario was the one that actually came up. This scenario was ‘what if all the OPEC countries band together and set the price?’ At the time the price was regularly set by the oil companies themselves and this scenario was considered so unlikely that none of the other oil companies even considered it. But Shell, who at the time was the least significant of all the companies, did consider it, and when it happened they were ready to take advantage of the planning that they had engaged in. It took them from the least significant to the most significant. The other companies who considered only the most likely were left flat footed.

Love the definition of asset management! x

Thanks Ruth. But this definition has a sting in its tail for traditional asset managers, because it changes the focus from supply to demand, opening up new questions, questions that cannot be solved by reference to standard asset data collections. We have to go further and involve others that we have not collaborated with in the past.

Hi All,

I do a lot of teaching of Asset Management and its principles as well as assistance to communities regarding primarily water related asset management and I have often used a similar analogy where you are driving on a road without a map of where you are going. You are driving and you are going to get somewhere, but it won’t necessarily be where you wanted to go or in the most efficient manner. I then discuss the need for level of service goals because it starts to build your road map for where you want to go. Then you bring in the criticality and life cycle stuff to tell you how to get there efficiently. You need the underlying asset inventory to do any of this and you need the money to be able to put the gas in the car and get there.

I like your headlight analogy because I think it is even a more clear way of describing the situation. I couldn’t agree more that there are folks who get started in AM and then it starts to fall apart soon after the initial excitement and first few wins occur.

Thanks for sharing your thoughts about this and your new definition. I often struggle with how to best describe asset management because I don’t think very many of the standard definitions really do it justice. It is so much more than just “meeting customer service at the lowest life cycle cost.”

I enjoyed the post.

Thanks, Heather. Glad you liked the new AM definition because it is related to the way I now look at infrastructure itself. When I originally defined infrastructure back in 1985 it was from a supply perspective because that is what I was interested in at the time. But I now think that we would do better to look at infrastructure from the perspective of what it DOES, its functions. This is what is going to open up new options as we move into our digitised future.

I have had asset management (AM) training and consulting experience and it strikes me that asset management is more than a maintenance system or the software / inquiry / monitoring-evaluation / database / analysis system that implements AM. AM is an essential holistic culture that needs to be CEO/Board driven and imbued in an organization (from Board level down to worker level) as an essential planning, risk and financial management and organization sustainability, policy and practice. Like HR or safety culture. What software or systems for form of enquiry, analysis methods or prediction philosophies are used are important but are secondary to having an imbued AM culture and should not be subject to the vagaries of the egoistic preferences of a new hotshot in the organization or the latest AM consultant who wants to trash talk your current system, and sell you their system. We deplore the lack of long-term planning in the short opportunistic election cycles for Government and equally need to implement AM cultures (and manageable strategically evolving commitment to supporting AM systems as ideas and technologies evolve) that transcend short term Board, CEO, AM managers etc whims and comings and goings.

AM is like the proverbial prized axe (that has had 3 heads and 5 handles) that we claim to be the best damn axe we ever had. The components may change or be renewed but the AXE is the thing – regarded as an essential and prized tool, always kept sharp and operational, wielded often and deftly.

Thanks Geoff. No argument from me on any of the points you make. Question I think we need to ask ourselves is HOW? How do we, as individual asset managers work towards embedding an AM culture in our organisations, in getting and keeping the support of our CEOs and the commitment of our colleagues? Clearly we cannot sit back and just hope and wish these things into existence (or worse, use their absence as an excuse). I think that the steps the NSW Council took towards developing good clear practices and promoting them is a step in the right direction. What other steps could be taken by those who care enough?