Jeff Roorda continues the story he began with Motorways and Steam Engines (Mar 27)

In part 1 we introduced the difference between physical life and economic life.

In part 1 we introduced the difference between physical life and economic life.

Part 2 talks about certainty bias, that is, we pretend to be certain about the future even though this is an irrational and emotional response. The feature photo shows the I-35W Mississippi River bridge collapse (officially known as Bridge 9340). An eight-lane, steel truss arch bridge that carried Interstate 35W across the Saint Anthony Falls of the Mississippi River in Minneapolis, Minnesota, USA collapsed in 2007, killing 13 people and injuring 145. The bridge had been reported structurally deficient on 3 occasions before the failure and ultimately failed because it was structurally deficient. The design in the 1960’s had not anticipated the progressively higher loads compounded by the heavy resurfacing equipment on the bridge at the time of failure. There was no scenario I could find that explained clearly enough for any reasonable non-technical person to understand, the likelihood and consequence of failure and the uncertainty of the safety of the bridge. After the failure, the courts found joint liability between the initial 1960’s designers and subsequent parties involved in managing the assets. The allocation of blame and acceptance of wrongdoing was highly uncertain, but lawsuits were settled in excess of US $61M. The strength and life of the bridge was uncertain and this was reported in technical reports but every person that drove over the bridge and every decision maker with the power to close the bridge had the illusion of certainty that the bridge was safe and would not fail.

As asset managers, our estimates of asset life have critical consequences but are uncertain. We estimate and report how long an asset will last before it fails, is renewed, upgraded or abandoned. This then determines public safety, depreciation, life cycle cost and our future allocation of resources. Whether we decide to use physical or economic life, we still are making a prediction of the future, something we should be uncomfortable about when we really think about it. None of us knows what will happen tomorrow, much less in 10 or more years. We prefer the illusion of certainty, or expressed another way, we have uncertainty avoidance. Uncertainty avoidance comes from our intolerance for uncertainty and ambiguity. Robert Burton, the former chief of neurology at the University of California at San Francisco-Mt. Zion hospital wrote a book in 2008, “On Being Certain”, in which he explored the neuroscience behind the feeling of certainty, or why we are so convinced we’re right even when we’re wrong. There is a growing body of research confirming this phenomenon. So then, what do we do about asset life? We prefer the comfortable feeling of certainty because of the discomfort of ambiguity and uncertainty.

‘Experts’ have been taken to task for being ‘close focussed’, thinking only of their own area and not connecting with the wider world. If infrastructure decisions are to improve our world, they need to take in the wider context. How difficult this will be is, I think, indicated in the following statement of purpose for the World Economic Forum that begins this week in Davos.

‘Experts’ have been taken to task for being ‘close focussed’, thinking only of their own area and not connecting with the wider world. If infrastructure decisions are to improve our world, they need to take in the wider context. How difficult this will be is, I think, indicated in the following statement of purpose for the World Economic Forum that begins this week in Davos.

Creating a Shared Future in a Fractured World

“The global context has changed dramatically: geostrategic fissures have re-emerged on multiple fronts with wide-ranging political, economic and social consequences. Realpolitik is no longer just a relic of the Cold War. Economic prosperity and social cohesion are not one and the same. The global commons cannot protect or heal itself.

Politically, new and divisive narratives are transforming governance. Economically, policies are being formulated to preserve the benefits of global integration while limiting shared obligations such as sustainable development, inclusive growth and managing the Fourth Industrial Revolution. Socially, citizens yearn for responsive leadership; yet, a collective purpose remains elusive despite ever-expanding social networks. All the while, the social contract between states and their citizens continues to erode.

The 48th World Economic Forum Annual Meeting therefore aims to rededicate leaders from all walks of life to developing a shared narrative to improve the state of the world. The programme, initiatives and projects of the meeting are focused on Creating a Shared Future in a Fractured World. By coming together at the start of the year, we can shape the future by joining this unparalleled global effort in co-design, co-creation and collaboration. The programme’s depth and breadth make it a true summit of summits.”

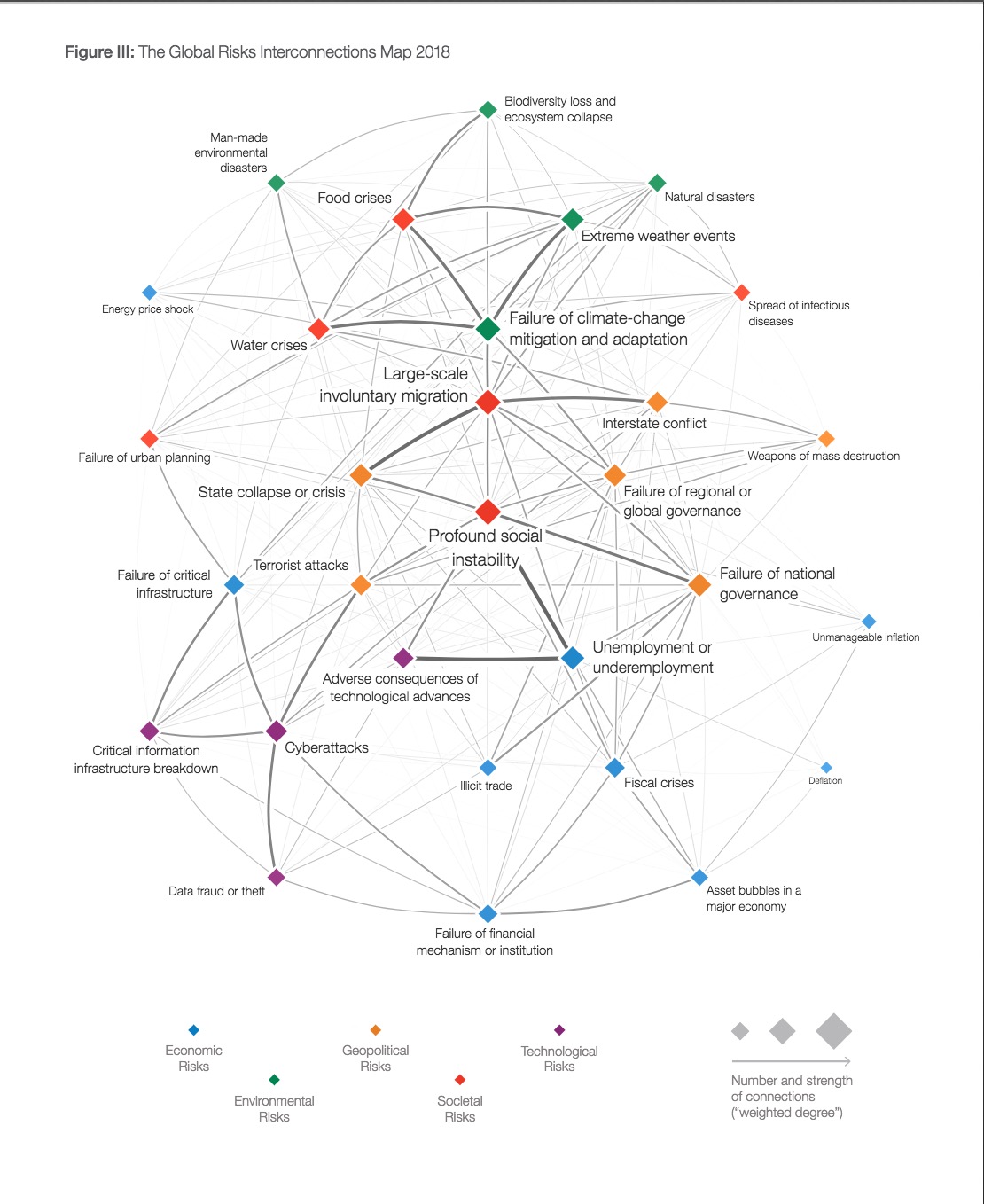

Next week Australia will join world leaders, big business and international institutions at the World Economic Forum in Davos. Ahead of this meeting WEF has released its Insight Report “The Global Risks Report 2018”. It is worth reading – and fascinating! This is the world for which we need to make future infrastructure decisions. Here is a glimpse.

Next week Australia will join world leaders, big business and international institutions at the World Economic Forum in Davos. Ahead of this meeting WEF has released its Insight Report “The Global Risks Report 2018”. It is worth reading – and fascinating! This is the world for which we need to make future infrastructure decisions. Here is a glimpse.

Also of interest for future planning is the section of the report that contains a chart showing how the risk profiles have changed year on year.

Thoughts?

Recent Comments