In the last post I suggested that it might be time we changed our thinking on major issues like nuclear disarmament. But perhaps it is also time we changed our ideas on how we try to convince anyone to change anything!

I am indebted to Kerry McGovern for the following idea. She spoke of a friend who had argued that when introducing a new and controversial idea, 3% of the population are already of this opinion and do not need you to tell them, 7% are almost there and can be easily convinced, and about 30% recognise that they don’t know enough but are prepared to find out, the next 30% are too busy doing other things, and the last 30% are going to oppose you no matter what. Her advice is forget that bottom 60% and concentrate first on networking with the 3%, bringing in the 7% and then, as a group addressing the next 30%. I don’t know the source of the figures but the general idea is attractive. Moreover, working on these figures, once we have captured the 37%, assuming that the middle ‘busy’ 30% are neutral, we now have a majority on our side!

So often, we focus on the bottom 60% and see the issue as an ‘us and them’ antagonistic confrontation. But what if we were to look instead at the top 40% and see the issue as one of collaboration? Would not that be generally happier and more productive?

Last year I took part in a ‘Ban the Bomb’ march. Many organisations were involved, including WILPF (The Women’s International League for Peace and Freedom), and the photo above is thanks to the keen eye of WILPF’s International Treasurer, Kerry McGovern, who noticed it in an Instagram feed of hundreds of photos to celebrate the fact that the UN had reached the milestone of the 50th ratification of the UN Global Nuclear Weapons Ban Treaty.

Here’s the situation

With the Honduras, 50 countries have now ratified the UN Global Nuclear Weapons Ban Treaty and there was much celebration. There are 84 signatories, so 34 are still to ratify. None of the 84 have nuclear weapons. Meanwhile countries that do, like the USA, Russia, the UK, France and China, India, Pakistan and North Korea (and likely Israel) have not signed. Australia also has not signed. It does not have nuclear weapons but it does possess the uranium which makes them possible. So effectively those that have signed, even if they haven’t yet ratified, are those who have everything to gain and nothing to lose.

We are now just a few months away from the end of the ten year agreement between the USA and Russia to limit nuclear research and testing.

No wonder the world is getting nervous!

But is treating nuclear disarmament as a moral issue the most effective way forward?

It certainly is a moral issue, and ‘Ban the Bomb’ marches such as the one that I took part in last year, keep the issue in the public mind, but is this the most effective way to bring about change?

When we look at the issue clear eyed we can see that it is those who have nuclear weapons who are the most at risk, both physically and morally. They are the ones who have the difficult decisions to make, not the 84 signatories from the non-nuclear countries. And after the experience of Ukraine, a country that did have nuclear weapons but ceded them to Russia in the breakup of the USSR and then suffered the consequences, it is not surprising that those who currently possess nuclear arms are in no hurry to dispossess themselves.

So is it not time to invert our thinking?

Instead of collecting masses of signatories from non-nuclear nations, which only serves to make us feel we are doing something, when we really aren’t, perhaps we would be more effective if world organisations thought about how they could make things safer for nuclear weapons countries to dispossess, particularly for Russia and the USA.

I realise that thinking of nuclear armed nations as needing protection, rather than us being protected from them, is not the normal way of looking at the problem. But this ‘inverted’ thinking might serve us well in all of our encounters with others. It puts us all on the same side, rather than in ‘us v. them’ opposition. This idea can be used everywhere.

LATE BREAKING NEWS (FRIDAY 30 OCTOBER)

The Russian Mission in Vienna has just issued a 4 tweet communiqué which you can find at https://twitter.com/mission_rf/status/1321815042384449538?s=09 . Its complaint is valid and the results are just what you would expect when you set up an antagonistic, ‘Us v. Them’ framework. See what you think!

The 4 tweets read

- On January 22, 2021 Treaty on the Prohibition of Nuclear Weapons will enter into force. It was negotiated without Russia or other nuclear-weapon states. (We regret) this development for the following reasons:

- We don’t see any legal gaps in disarmament process for #TPNW to fill in. It was negotiated w/out taking into account fundamental principles of #NPT. Those principles should be applied consecutively and w/out distortion

- #Disarmament should be addressed only through consensus of all parties, including nuclear-weapon-states as per #NPT. #TPNW conceptual framework is unacceptable. It ignored strategic context & addressed #disarmament separately from existing international security environment.

- (We stand) for stands for nuclear weapons-free world & respects those sharing this view. But this process can’t be forced. We reaffirm our individual & collective #NPT commitments, but #TPNW is a mistake. It creates a rift btw states & harms #NPT. We won’t support, sign or ratify it.

Goodbye

Infrastructure

Guy!

In the 1960s you were young and growing rapidly. We supported you as we do all youngsters. It was the right thing to do. But now you are grown and need to take your place in the support and protection of others. We have already passed the point where we should have weaned you and helped you grow to full independence. That is our fault. We weren’t seeing the bigger picture. But if we continue to baby you, to protect you, to put your needs ahead of others, we will end with a flabby, overgrown infrastructure, absorbed in itself, incapable of recognising its true purpose – which is to support the wellbeing of the community.

This possibility is being brought into clearer view by Covid 19. The global pandemic is having a negative impact on infrastructure demand which, while we may expect some recovery, won’t recover completely. It follows that increasing the supply whilst demand is falling will not produce the economic recovery effects we seek. We need to think again.

So, Infrastructure, the time has come for you to take your rightful place in the world, to underpin the four community wellbeings – social, cultural, environmental and economic. It is time to consider how best you can serve these wellbeings. You need to be clear about your purpose. Simply ‘being’ is self indulgent and will no longer cut it. Like all adults today you need to change and develop, learn new skills, and to do things not done before. Growing bigger is no longer the objective, it is now time to grow wiser, to demand less and provide more. For this you need a new image.

In your youth, you were brash and grey and analog – all concrete and steel. But now we say goodbye to this old image. In your maturity, you need to be self effacing, indispensable, but in the background and not the foreground. In this world, you are no longer grey, but white – the invisible whiteness of digital technology, of human intelligence, of caring, and yes, of love. No longer the focus of attention, it is now your role to help others grow and shine.

You are now the pot, the support, the soil.

It is community wellbeing that must grow.

Your job is to nurture!

Welcome to Adulthood!

Welcome to adulthood!

Differences are good; understanding them helps us develop. So here, in a few words, I look at why – and how – the UK and Australian approaches to Asset Management differ, by considering how they started – with water.

NOTE: If you have early experience of these approaches please add your ideas in the comments section .

The UK

In the UK, asset management started with the privatisation of the water industry in 1989. The rationale for privatisation was to increase the quality of the service and the route to this was seen to be by directed capital expenditure. Ofwat, the regulator, set water prices high to enable the necessary investment and capital spending was the focus of Ofwat regulation. Water companies’ asset management plans set out the rationale for their capital spending, new and renewal, to meet the needs of the regulator. Thus their focus on spending capital to improve service.

Australia

In Australia, asset management also started with the water industry, but the impetus was very different. A long term modelling exercise for the water industry in 1983 made it clear that the cost of maintaining current water services would have to rise steeply, as assets aged and needed renewal. The same modelling was then extended to all other infrastructure holdings in the State making it clear that the combined renewal demands of all agencies would, within 15 years, completely overwhelm the state’s funding ability. So, in 1987 the SA Parliament set up an Asset Management sub-committee and the Government created an Asset Management taskforce to consider ways of reducing the renewal costs to a manageable level by a combination of changes to planning, management, maintenance and financial policies and practices.

And so…

Thus, whereas the focus of asset management in the UK with the water industry (and later other industries),was how to fund capital renewal, the focus of asset management in South Australia, and then across Australia generally, was in how to avoid having to fund so much capital renewal.

The difference between the two approaches became clear in 1995 when the South Australian Government, in an endeavour to create international export markets for its water industry skills and services, offered a 15-year management contract to an international company that could expand the state’s water industry exports and at the same time reduce management costs. The Government made it clear that it was well satisfied with its current level of service and just wished to reduce cost, not increase standards. However when the UK water industry companies (and the French) were asked to demonstrate their asset management abilities, none could offer any evidence of actions taken to manage and reduce costs and, indeed, seemed somewhat perplexed by the question and focused only on what they had done by way of capital expenditure to raise services. During pre contract negotiations they consistently re-iterated their claims for capital enhancement and resisted discussion of cost reduction.

These two different approaches to asset management have continued. They both have strengths – and weaknesses. The Australian approach needs more attention to evaluating and prioritising capital projects (the main focus of Talking Infrastructure). The UK approach needs more attention to management cost reduction through better planning, maintenance and financial practices.

Your views?

“The farther back you can look, the farther forward you are likely to see” Winston Churchill

Until around 1996 the terms ‘Asset Management’ and ‘Strategic Asset Management’ were practically synonymous. But with the increasing popularity of the term ‘Asset Management’ to describe a wide variety of activities, as described in Pt 1, there was a need for a term that could differentiate decision making from the doing so, in January 1999, when the Asset Management Quarterly became fortnightly and thus needed a name change, I chose “Strategic Asset Management”, popularly known as SAM.

This was to stress that Asset Management wasn’t maintenance and reliability, or capital acquisition, or Treasury asset sales or many of the other associated activities, but rather what later became known (in ISO 55,000) as ‘the alignment of asset activities with the goals and objecitves of the organisation’

The first issue of SAM, January 1999, explained the name change, and in doing so, focused on what differentiates asset management from what went before.

“The real key to being strategic is where you focus your attention. If you focus on what you are doing you are carrying out an operational task; if you focus on how you are doing it, seeking to ‘tweak it’ or do it better, then you are engaged in a tactical activity. Both of these are necessary and important. However, they are not strategic. The strategic task is the one that focuses on the outcome, or the purpose….What constitutes a ‘better’ outcome, however, is not for the maintenance manager to decide. A ‘better’ outcome is one that moves the agency in the direction of its strategic vision.

By way of illustration, take the construction of a new hospital. If the questions you are asking yourself are ‘what is the purpose of this new hospital; what needs are we providing for, should we be providing them or should they be provided by others, or should they not be provided at all; is a new hospital required or are there better means?’, then you are focussing on the outcomes – ie being strategic.

Asking yourself ‘should this construction be carried out as a ‘design-construct’, ‘build-own-operate’ or some other form of contract’ is asking tactical questions. If you ask ‘how do I ensure this construction comes in within time and budget and is of the right quality’ then you are engaged in an operational task.

Thus ‘Strategic’ is not the same as ‘Important’. ALL aspects of asset management are important.”

In January 2014, the first international standard in asset management, ISO 55,000 was launched, and with this, we came to the end of the beginning of Asset Management. No longer a novelty, a new-comer; Asset management arrived.

For What Happened Next see: AM – The third wave

In Australia, interest in asset management arose as the result of a series of eight parliamentary reports in South Australia in 1986/1987 modelling the likely cost and timing of renewing all the State’s major infrastructure assets.

The projected costs were so large that they would have absorbed the State’s total capital budget within the next 10 years if urgent action was not taken. To address this problem, the recommendations in the reports covered possible planning and accounting reforms as well as engineering and maintenance changes.

Following the Public Accounts Committee’s Reports, a major SA Government Task Force was established that reviewed, then agreed and reinforced all the ideas presented in the reports. This led to the formation of a Cabinet sub-committee to consider the issues raised, This provided high level impetus for the development of asset management.

Further support was provided by the Auditors-General who were appalled to find that no public sector department. not even the statutory authorities, had decent asset registers and they made this a requirement.

But the most significant change was that led by the Australian Accounting Standards Board. At this time the board covered accounting standards in both the private and the public sectors. The private sector used commercial standards with accrual accounting but the public sector used cash accounting. The board wanted to standardise on accrual accounting for both but was concerned about how this would be received. When it learnt that the Parliamentary Public Accounts Committee in South Australia was promoting the idea of accrual accounting to better understand and deal with infrastructure asset management, it was encouraged to push ahead. Within two years of the release of the final PAC report, the board had released Exposure Draft 50, the model of accrual accounting for local government.

The introduction of accrual accounting meant that local, state and federal government departments were required to move from their previous practice of simply recording annual cash in and cash out, to establishing balance sheets and recording, for the first time, the depreciated value of their infrastructure and other assets,

You might think that an accounting change would be of no interest to maintenance engineers. Fortunately @Roger Byrne was not your ordinary maintenance manager. He had already been in the habit of including economic and planning issues in briefing notes for his clients and he quickly seized on the opportunity this change presented for maintenance engineers.

It was these briefing notes that later provided the content for the first local government asset management manual which subsequently became the IIMM we all use today. So through top down interest and bottom up capacity building, Australia took an early lead in the development of asset management.

The Parliamentary Reports created a lot of interest Australia wide. No other state was prepared, or even able, to duplicate the research for their own constituency but all infrastructure agencies recognised that the conclusions reached applied as much to them as it did to their South Australian counterparts. The CSIRO’s Engineering and Construction division took an active interest, as did State Treasuries and the Auditors-General.

With these organisations, I continued to develop the ideas that had arisen and, after advising governments, commissions of audit, and infrastructure agencies themselves, I created ‘The Asset Management Quarterly’ publication in 1994 to share with others what I was learning. Then, in 1996, noting that lots of interesting things were being done in the name of asset management – but nothing was being documented, I launched the International Asset Management Competitions where the awards went to the best documentation of good asset management practice. They ran between 1996 and 2000 and in 1998 AMQ International launched the world’s first asset management website with information on asset management freely available to all.

The term ‘asset management’ started to become very popular and everyone wanted to get in on the act. One day, flying from Sydney to Canberra my seat companion described herself as an asset manager – on questioning it turned out that she was actually a real estate developer! Once off the plane and into a taxi, on the taxi radio I heard an advertisement for ‘asset management services’ – which turned out to be office cleaning! Yes, asset management had become the buzzword ‘de jour’.

To be continued….

A REQUEST

I am currently working on a book about our beginnings and would love to speak with anyone about their recollections pre 2014.

Please leave your name below and I will contact you.

Mama

It was 2016 and I was engaged to train Auditors-General in the Pacific area in how to approach infrastructure performance audits. Their audit offices, like their countries, were not well resourced and they could ill afford to waste time and resources. It was important that they focused on the key issues and got their messages across to decision makers. With my colleague, Kerry McGovern, I spent a week in Port Moresby. At the closing party I was honoured with the title ‘Mama’. I thought this was simply a recognition of my age, but no, “mama” meant a wise woman who leads a village. I was enchanted! Who would not want to be wise and lead a village? And is this not what councils do?

So when approached last week to help the UN who are preparing a manual to assist local governments in under-developed countries struggling to adopt AM, I was happy to oblige. I spoke with Kerry and we prepared out ‘top dozen’, as follows.

What needs to be added?

- Build with your own labour and your own local materials. This will ensure you have the skills and ability to maintain what you build.

- Learn to say ‘No’ when donors offer to build something for you with their labour, or to use imported materials when local alternatives are available. Always seek out alternative practices that use local. Welcome financial assistance if, and only if, it strengthens the ability of your own people in the construction, operation and maintenance of the new assets. That is necessary to ensure that the assets will remain functional.

- Prioritise. Do not accept ‘nice to have’ assets, such as sports stadia or entertainment centres, even as donations, if you have more critical requirements in power, water, roads or communications.

- There is no such thing as a ‘free asset’. Every asset costs you. Not only does it require continuous operational costs such as lighting/heating/cleaning, but it will distract the attention of high level decision makers away from other issues.

- ‘Best practice’ and ‘high tech’ can be deceptive. The real ‘best practice’ is the one that you have the skills and abilities to apply over the longer haul. The same for ‘high tech’. The more complicated the technology the more chances are that something will go wrong and that you will be unable to fix it without outside help. And that help may not be available when needed.

- Give your Auditors-General responsibility for auditing the performance of all public infrastructure for both effectiveness and efficiency – and fund and train them in the ability to do so.

- Be clear on what is to be achieved. Assist the Auditors-General by ensuring that all infrastructure proposals – whether with local or donated funds – state clearly the expected outcomes, in addition to cost and time.

- Identify who is going to operate the asset, who is going to maintain the asset – both scheduled maintenance, and unscheduled maintenance and the costs of enabling the operation and maintenance over the entire life of the asset. Then, with that estimate to hand (and preferably arrived at with input from the people who are going to do it) identify the source of funds to pay for all this.

- If using loan funds to pay for the asset, add interest and redemption payments to the operating and maintenance costs. Ensure you factor in the administrative costs of meeting lender requirements, including the cost of training staff to meet them.

- You may need to train workers to operate and manage the asset. Negotiate with the education department to find out what is involved in ensuring a supply of skilled people, able to operate and maintain the asset and administer loans / grants for the asset.

- Consider how the country is going to set up the support systems to enable the asset to function as intended. For example, if a road, what vehicles will be using the road? where will people obtain these vehicles? how will they be maintained and operated? Who will pay for that? What income streams will cover the costs of the asset PLUS using the asset in your country.

- Plan for the safe treatment of waste generated by the asset (in both construction and use – eg. disposal of old cars, mitigation of petrol fumes, unused bitumen, water run off, etc.)

Your suggestions? (add in the comments box below)

Homo Sapiens is a pattern seeking species

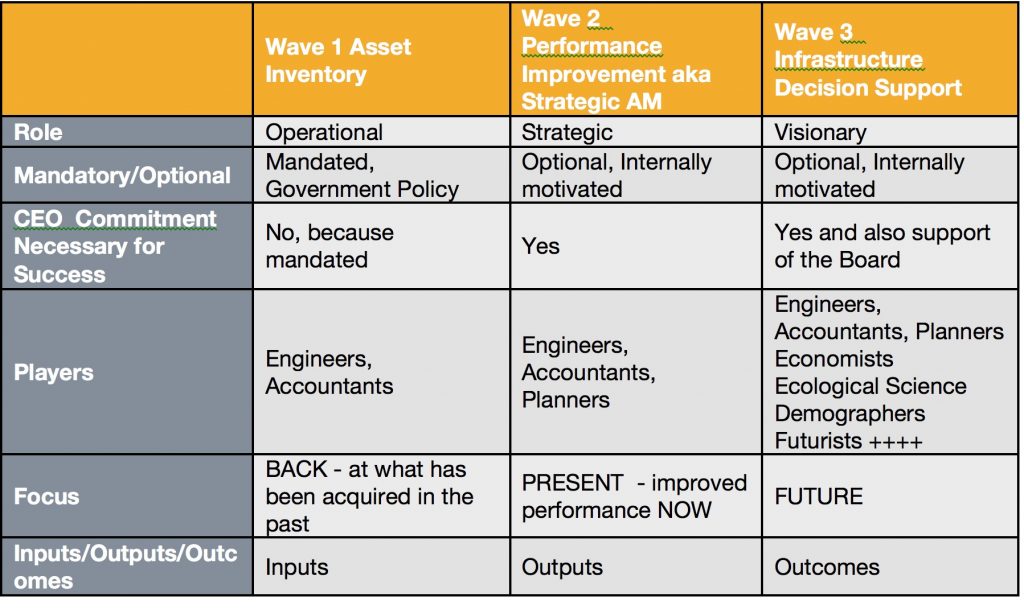

it is how we advance. We seek patterns to find meaning. Me, I look for patterns in AM development. I seek the characteristics of the different stages (that I now think of as waves rather than as revolutions, as explained in the last post) and how each builds on the one before and takes us further. This helps me to see not only where we have been but also where we can go. Each wave has its own focus, viewpoint, key players and sources of support as well as constraints. Below is a table illustrating some of the characteristics of the first three waves that I see. What do you think?

Where we have been and where we are

Waves 1 and 2 you will readily recognise, for they reflect where we have been and where we are. Wave 3 is where we need to go next. This is the visioning stage where asset management teams, use their appreciation of ‘line of sight’ or the necessity for asset actions to support organisational objectives to guide decisions on both new and existing infrastructure. This is where AM teams need to anticipate, communicate, and prepare for the inevitable shifts in attitudes, governance and demand, that are now occurring and will continue to occur as demographics, climate and technology change. Turning around large infrastructure portfolios is not an overnight task. It takes intelligent planning and communication. This is Wave 3.

Where we are going

Communication, anticipation, action. In Wave 3 AM teams help their corporate managements to explicitly recognise that the asset portfolios and management practices they have now are a reflection of the past, and that the future will be very different from the past and will involve new thinking. This may seem obvious, but it is not necessarily happening at the moment. Sometimes it seems that it is easier to assume that nothing will change very quickly so we can continue doing what we have always done. And sometimes the lure of the new and shiny leads to adoption of the new without sufficient examination.

The Wave 3 challenge is not to jump straight into the new and exciting, but rather to determine how best to reduce the twin dangers of changing too early, and of moving too late.

The biggest change will require us to ask what changing circumstances and future communities will DEMAND of us, what the new needs will be, and not to look at new technology as merely an opportunity to change the way we SUPPLY the current needs of our customers and community.

From Supply to Demand. In the past most of the information we have needed for our decision making in asset management has been internally generated and recorded in our Asset Information Systems. This has been solely supply side information. We still need our supply side information. But this will not suffice. Knowing what we CAN do is not enough. We need also to look at what we MUST do. For this, we will increasingly require the ability to understand and anticipate future demand change. This is why our our asset management teams will need to expand to include the talents of many other professionals, as I have suggested in the table above.

Is your Asset Management Team prepared?

Is your Asset Management team prepared to tackle the third wave? If you are not sure, then a good place to start would be with “Building an Asset Management Team” by Ruth Wallsgrove and Lou Cripps. This will help you recognise not only requirements but also the many new possibilities. Here is a short excerpt “What kind of people does an AM team require?”

Note: When you buy “Building an Asset Management Team” you not only get the very latest thinking in AM teamwork, but you pave the way for future developments, for Ruth and Lou are donating all their proceeds (ALL, not just profits) to Talking Infrastructure.

So go ahead, click this link to get your copy. You can get a Kindle version for less than $10. In this case value greatly exceeds cost. It’s priced low to maximise the number of teams that can gain access. Spread the word!

I was wrong. Movement from maintenance to asset management, to strategic asset management is NOT a revolution. Why not?

In 2018, for the IPWEA’s online journal, Jeff Roorda and I sketched out what we saw as the general pattern of these individual journeys and what this suggested about where we would go next. At the time there was a lot of discussion about the third (and for some) the fourth industrial revolution. We needed a sexy title for our paper so we called it ‘The third AM Revolution’.

We saw AM moving from the pre-AM stage of maintenance only to the first stage of data collection, or ‘asset inventory’, to the second stage of performance and alignment, or what we call ’Strategic asset management’ – the stage we believe most of Australia is now in – to a new third stage, our ‘third revolution’ that we are calling ‘infrastructure decision support’.

We now see that ‘revolution’ was the wrong word.

Revolutions have connotations of what was previously important getting the chop – quite literally in the French Revolution! Although each of the three stages we identified are still important because they represent different mindsets and approaches, different groups of players and different techniques, they do not discard what went before. Instead they increase our understanding of their value and make them stronger.

Let’s see how that works.

0. Before AM there was maintenance. Maintenance specialists firmly believed in the value of their work, and they were right. Unfortunately they were unable to convince others, especially finance. When AM came along it provided a framework to demonstrate that not only was maintenance able to fix what was currently broken – it could also help prevent more breaking down in the future. That is why so many maintenance engineers were keen to see AM adopted by their organisations.

1. The first stage of AM, naturally, was to establish an asset inventory. We needed to know what we had to manage.

2. With enough basic data we were enabled to take the next step use the data collected for performance improvement. When we did this, we became much more aware of data quality and coverage. That first stage of data collection did not get the chop, now we wanted more. Instead of data being required simply for a mandated balance sheet (e.g. a storage location) it was increasingly seen as necessary, indeed essential for progress, and so demand for more data, and for data of a higher quality with greater coverage has continued.

3. The coming third stage is what will bring all of these stages – maintenance, data collection and performance improvement or strategic asset management – together, for it is at this third stage that asset managers finally reach the stage that they have desired for a long time. Asset management is able to get (and worth a) place at the board table!

So not a revolution. But what?

We could simply call them ‘three stages’ and be done with it. This, however, would not show the connection between them, how each builds on what went previously, so we are calling them waves, for like waves they build on each other and get stronger.

Why is this important?

Because now that it is so easy to access detailed information about the second wave of strategic asset management or performance improvement (IIMM, PAS55, ISO 55,000) there is a temptation is to dive in at this level. But without attention to the first wave of data collection and without strengthening the pre-AM stage of maintenance, such attempts lead to failure. Under-developed countries wanting, and needing, to do fast catch up with the developed world are at particular risk.

They are being pressured ‘to do asset management’ in order to get the strategic asset management, second wave, benefits but the importance of funding and training at the earlier stages, particularly maintenance is not being recognised and dealt with. Every stage – maintenance/pre-AM, data collection/asset inventory, and strategic asset management/performance improvement or alignment – requires a different focus, different tools, different groups of players.

I will talk about Wave 3 – where we go next – in a later post.

Q: Does this development pattern make sense to you?

Can you recognise it in your own organisation or others? Is it obvious, or do you see an alternative pattern to your own asset management journey?

Coming Next: The Three Waves

Why understanding them can help you move closer to your ultimate goal.

Ten years ago, on LinkedIn’s Asset Management History Forum, I asked “Why bother with history?” It was the most animated discussion on the forum. Now, with ten more years of history behind us, have we learnt more or do you agree with Jan Korek’s view that history is irrelevant?

This was Jan Korek’s opening statement:

“I have never subscribed to the suggestion that you need to know where you’ve been, to know where you’re going! History, to me, is little more than a badly-drawn representation of the past, based on an exaggerated impression of successes….. and an amnesia of the failures.

Having been deeply fascinated by Asset Management for a score or more years, and am still working at the blunt edge of the process, I have had to change, adapt, forget much and learn more along the way. So what do practitioners, or the process, gain from a knowledge of when (or why) some obscure government department became notionally interested in the stewardship of infrastructure assets? I would suggest very little.

Anyone who has been in Asset Management for a period of time will have grown their own unique history based on any number of influences. So what is to be achieved in distilling each individual story into an homogenised, badly-drawn fiction? Experience shows that we even fail to avoid the mistakes of the past, even when we know the history involved. The news, each day, is full of such examples.

What seems more important is the future, “Where are we now”, and “Where to from here”? Or to put it another way, you need to know where you are now, to know where your going.”

A compelling set of arguments.

Opening for the other side was John Hardwick.

Wow!

What a start to the year you go away for a couple of days and a great discussion begins. I can only say that everything i have implemented has come from others.

I have implemented knowing what worked and what didn’t. I have used this to significantly change the way my organisation does Asset Management. I am only new in comparison to many of you but it is your collective knowledge i have used.

Also I have used your history and stories that have helped many other companies not make the same mistakes. I am a strong believer that we learn from our mistakes and not to make them again.

If this is the case it is critical for new organisations implementing Asset Management to have access to some of the good the bad and the failures.

I have given more then 20 organisations access to my staff and myself over the last twelve months to learn from what we have done and the mistakes we made. The best part is I learnt so much in return it has been amazing.

History allows us to tell stories that help others conceptualise their path to hopefully a more successful future.

Also a compelling set of arguments.

Recent Comments