On Tuesday last, under pressure from Senator Nick Xenophon, the Australian Government committed to overhaul rules about how it spends its annual $60 billion procurement bill to maximise local content.The new rules will take effect from March next year. Under the changes, bidders for government projects worth more than $4 million will need to show:

On Tuesday last, under pressure from Senator Nick Xenophon, the Australian Government committed to overhaul rules about how it spends its annual $60 billion procurement bill to maximise local content.The new rules will take effect from March next year. Under the changes, bidders for government projects worth more than $4 million will need to show:

- How much locally-produced material they will source

- How they are contributing to local employment

- How they are growing local skills

- The whole-of-life cost of the project, not just the build cost

- That the materials they use comply with Australian product standards

The fact that these changes were needed, and that they were resisted for so long, throws doubt on the long held popular notion that infrastructure ‘creates jobs’ and, by implication, Australian jobs. Now there is more chance that they will. The use of local labour and materials and increase in local skills will also improve our ability and reduce costs needed to maintain the new infrastructure.

But, perhaps the most interesting of the new requirements is the requirement for ‘whole-of-life’ cost of the project which will require assessment of the anticipated life of the project, and, hopefully, public discussion of what determines the useful life in a world of rapidly changing opportunities, demands and technologies.

I would like to see an additional requirement – designers and planners should be expected to show how they are actively minimising whole-of-life, or lifecycle, costs.

Questions today:

What do you like – or dislike – about Xenophon’s proposals?

What other additions might improve our approach to infrastructure?

There used to be two economic policy tools – monetary policy and fiscal policy. With monetary policy, we would raise or lower the interest rate to decrease or increase the amount borrowed and spent. It was argued that reducing the interest rate would decrease the readiness of consumers to save and so would lead to more consumer spending and simultaneously increase the willingness of firms to borrow and invest more. But interest rates have hovered close to zero (and in the case of Japan, below zero) for close to a decade and the expected increase in spending – either consumption or investment has not arisen. Despite calls that suggest governments should take advantage of low interest rates to spend on infrastructure, it is noticeable that investors (playing with their own money) are not doing so. The point is that it is only when the economy is healthy that tinkering with the interest rates is likely to work. For a long period after the end of the second world war, that was the case. We simply assumed it would always be the case, but we were wrong.

There used to be two economic policy tools – monetary policy and fiscal policy. With monetary policy, we would raise or lower the interest rate to decrease or increase the amount borrowed and spent. It was argued that reducing the interest rate would decrease the readiness of consumers to save and so would lead to more consumer spending and simultaneously increase the willingness of firms to borrow and invest more. But interest rates have hovered close to zero (and in the case of Japan, below zero) for close to a decade and the expected increase in spending – either consumption or investment has not arisen. Despite calls that suggest governments should take advantage of low interest rates to spend on infrastructure, it is noticeable that investors (playing with their own money) are not doing so. The point is that it is only when the economy is healthy that tinkering with the interest rates is likely to work. For a long period after the end of the second world war, that was the case. We simply assumed it would always be the case, but we were wrong.

So, now we are down to one policy tool – fiscal policy. In the recent past governments have been trying to build up their surpluses while simultaneously encouraging the population to do the reverse! Communities have been urged to spend, while governments have struggled to save. But government savings (mostly through reductions in the public service or by outsourcing) has resulted in loss of jobs and, as this has mounted, loss of confidence. So consumers are not spending, they are saving for that inevitable ‘rainy day’. Again, when our economy was healthy, governments used capital spending as a tap that could be readily turned on or off. Recurrent spending was not seen to be so amenable to manipulation. This has morphed into today’s focus on infrastructure with a simultaneous reluctance to spend on the upkeep and operations that are necessary to provide service from that infrastructure. But infrastructure spending during the global financial crisis of 2008, which was seen as so successful at the time, led to severe reductions in spending subsequently in order to pay the interest bills incurred. So a short term gain at a slightly longer term cost.

Are we now down to zero economic policy tools? Are we clinging to the belief that infrastructure spending will save us simply because we know of nothing else? And is infrastructure spending better than nothing?

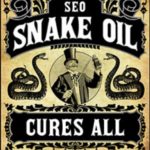

Thirty years ago the word infrastructure was hardly in the public eye. Today it is a panacea for all modern ills. It can make our countries stronger and richer, it can provide jobs for all, it can save the planet, it can prevent an economic downturn, it can rescue the poor from poverty, it can increase trade, reduce costs of production, and make our cities more productive. In recent times, not only is infrastructure considered to be able to do all of these things, it is seen as the only thing that can. Very much like the promises of the old snake oil merchants!

Thirty years ago the word infrastructure was hardly in the public eye. Today it is a panacea for all modern ills. It can make our countries stronger and richer, it can provide jobs for all, it can save the planet, it can prevent an economic downturn, it can rescue the poor from poverty, it can increase trade, reduce costs of production, and make our cities more productive. In recent times, not only is infrastructure considered to be able to do all of these things, it is seen as the only thing that can. Very much like the promises of the old snake oil merchants!

This is encouraging the public to demand more and more infrastructure (and perhaps all of them with a different infrastructure project in mind) and for governments to spend on infrastructure quite indiscrimantly, without thinking of future consequences. After all, if all infrastructure is ‘good’, it really doesn’t matter what you do. And so we get major 4 and 6 lane highways going nowhere!

So our question today is to ask all our readers:

What should governments be thinking about when they think infrastructure?

As ‘professionals’, economists, engineers, administrators and others have been educated to put emotion aside and concentrate on facts and logic. Moreover, we each have our own set of facts, and our own take on logic. Like a fish, who cannot imagine water, we have been surrounded by this approach all our lives and find it difficult to imagine another. Surely to be ‘professional’ we have to be ‘logical’ and eschew emotion and feelings?

As ‘professionals’, economists, engineers, administrators and others have been educated to put emotion aside and concentrate on facts and logic. Moreover, we each have our own set of facts, and our own take on logic. Like a fish, who cannot imagine water, we have been surrounded by this approach all our lives and find it difficult to imagine another. Surely to be ‘professional’ we have to be ‘logical’ and eschew emotion and feelings?

Or do we?

In a future world guided by algorithms written by professionals, do we want the ‘human’ element omitted? It is now seen that lack of empathy for the plight of others on the part of the professional, the ‘educated’ class, was a major factor in Brexit and in the rise of Trump.

Nor is Australia immune from decisions without empathy. If you are sick at heart at the way the Australian Government has been treating those who have committed no crime other than wanting to live in safety, please demonstrate your empathy and caring by responding to the following call from the Asylum Seeker Resource Centre.

Let’s lead with fairness and decency.

In the past week, the Government has shamelessly trashed Malcolm Fraser’s extraordinary refugee legacy when Peter Dutton called the contribution of over 200,000 people a ‘mistake’. George Christensen has gone as far as to call Lebanese Australians ‘the sins of the past’. This effectively invalidates the very people who have helped make this country great.

This, on top of the Government’s unprecedented attempt to ban refugees from entering Australia forever, if they come by sea and a shaky refugee ‘deal’ with the US that has no time frames, no process and no plan in place.

The ASRC are calling this out for what it is – an attack on our values and strength as a multicultural nation. We are better than this.

Help the ASRC to keep fighting. Donate to our appeal

Make your voice heard

Over the past few weeks thousands of people have contacted their MPs and Senators calling on them to stand for decency and vote against the Government’s proposed lifetime refugee visa ban. We need you to make your voices heard and let the Senate know that you want them to vote agaisnt this ridiculous law.

Understanding how we make choices is at the core of a new site that MIT has created, ‘The Moral Machine’. Gregory Punshon referred to this site in his recent post in which he wrote about a decision made by Mercedes-Benz that, in the event of a collision between one of their self-driving cars and a bystander, the car would be programmed to protect the life of the passenger. Gregory noted that prioritising passenger lives is attributed to there being more control over the passengers’ situation. This choice is one of the many trolley problems that arise for us when machines are given ‘intelligence’.

Understanding how we make choices is at the core of a new site that MIT has created, ‘The Moral Machine’. Gregory Punshon referred to this site in his recent post in which he wrote about a decision made by Mercedes-Benz that, in the event of a collision between one of their self-driving cars and a bystander, the car would be programmed to protect the life of the passenger. Gregory noted that prioritising passenger lives is attributed to there being more control over the passengers’ situation. This choice is one of the many trolley problems that arise for us when machines are given ‘intelligence’.

The Moral Machine’s interest in decision making is concerned with machine intelligence.

‘From self-driving cars on public roads to self-piloting reusable rockets landing on self-sailing ships, machine intelligence is supporting or entirely taking over ever more complex human activities at an ever increasing pace. The greater autonomy given machine intelligence in these roles can result in situations where they have to make autonomous choices involving human life and limb.

This calls for not just a clearer understanding of how humans make such choices, but also a clearer understanding of how humans perceive machine intelligence making such choices.’

I think it calls for more than that. Who, in the choices to be made in this coming digital infrastructure world, is weighing in on the side of community wellbeing? Who is speaking for ‘the common man’? Silicon Valley speaks for the technicians who are inventing new devices. Wall Street speaks for the businesses like Mercedes-Benz who stand to make a profit from them. But who speaks for us?

In a wiser world, this would be the politicians that the people elect to represent them, but they do not seem to be doing this. Where do we now look?

This is not only a problem for the management of machines. Paul Keating’s idea for a “Reserve Bank” for physical infrastructure (see the last post) raises exactly the same questions.

What is the difference between handing over infrastructure decisions to an unaccountable body of private sector financiers and public servants and handing them over to machines? How should decisions involving the disposition of community taxes and the future directions of community wellbeing, be made?

How are we going to make choices?

And Who should get to make them?

A few days ago, the former Prime MInister, Paul Keating, came out with a proposal for a ‘Reserve Bank for Infrastructure’.

A few days ago, the former Prime MInister, Paul Keating, came out with a proposal for a ‘Reserve Bank for Infrastructure’.

“What Australia desperately needs is a Reserve Bank of infrastructure, that is a public body that nominates the big projects and then gets them going, that’s what I’d be doing.”

On line comment was generally favourable. The idea of taking infrastructure decisions out of the hands of politicians (but putting it where exactly?) was also well received. We don’t trust our politicians. But is there any other group that we do trust? Bankers? Professionals? Overseas Investors? Big Business? (Who would fill the ‘private’ slots in the proposed public-private RB?)

Only one commentator thought to ask exactly what infrastructure Keating had in mind, and what growth might result from it. Which is to my mind the real issue with infrastructure decision making – we don’t know how to do it. If we had clear criteria on what constituted a ‘good infrastructure investment’ then we could leave it up to a professional group to determine. We could even leave it up to a computer algorithm!

Two questions:

How might such a ‘Reserve Bank’ work – and in whose interests?

If such a RB were to be established, what rules would you like to set for it?

In the early days of asset management, enthusiasts, seeking to expand the boundaries of their craft, would argue that we should consider people as assets. At the time it was meant positively. For example, if you invest capital in an employee’s training, then you need to maintain that capital by providing opportunities for practice and maybe refresher courses, or the new skills and learning will gradually fade and disappear – or depreciate.

In the early days of asset management, enthusiasts, seeking to expand the boundaries of their craft, would argue that we should consider people as assets. At the time it was meant positively. For example, if you invest capital in an employee’s training, then you need to maintain that capital by providing opportunities for practice and maybe refresher courses, or the new skills and learning will gradually fade and disappear – or depreciate.

Others, however, argued that thinking of people as assets was unwise. Assets are a means to an end but people, in any civilised context, are the end in themselves. People are citizens. Public infrastructure, in particular, is to serve the citizenry.

We lose sight of the ultimate end game – the wellbeing, strength and resilience of our communities – when we focus on people as merely cogs in a production machine.

Moreover, if we are to cope with future change – political, demographic, climate and technological change – we need people who can respond imaginatively, can be flexible, and can innovate, not for personal gain alone but for the sake of the community as a whole, to be part of civic improvement. So important for infrastructure decisions.

Which brings me back to Virgin (see previous post). But not only Virgin. To all companies that treat their people as cogs in a machine, and to all governments that do the same. Companies can change, governments can change, but it is unlikely that change will come from within.

Where then does change come from? I am reminded of a comment by Michael Breen in an online forum on change that I ran many years ago. It was shortly after the death of Princess Diana and, in answer to the question of where change comes from, Michael referred to the strange thing that happened at Princess Diana’s funeral. After the eulogy by her brother, the very upright audience clapped. (This was completely not ‘the done thing’ at a solemn state funeral!) Michael observed that the clapping at the church ceremony started outside in the park. The insiders were too culturally bound to change things – even spontaneously. The outsiders were less bound, and therefore more able to be spontaneous, so much so that the inside people were able to ‘join in’. So the ‘opinion makers’ were able to change their behaviour with permission from commoners outside the elect group.

Question: As ‘commoners outside the elect group’, what can we do to get the positive change that we need to ensure that the infrastructure decisions we make will serve our future well?

Sunday night the first automatic check in machine I try at the Virgin terminal in Brisbane is set to ‘Check-in baggage only’, and the next and the next. In fact they all are. The one attendant on duty is dealing with another passenger but I have 15 minutes to spare before check-in closes so I wait patiently. When I have her attention she says, cheerfully, ’the baggage tag printing isn’t working, hasn’t been working all afternoon. Ignore the instruction, just use the machine and get your tag at the baggage drop’. By now it is 40 minutes to check-in and, as it turns out, these machines require 45 minutes clear for passengers with baggage. I therefore go to the counter. Now I am beginning to suspect my seat has already been given away to a waitlisted passenger because the check-in assistants go into a huddle, make telephone calls, hold me up for many minutes and then announce that the check-in is closed! My only recourse is the Services Desk. Here the clerk, in a tone implying she is doing me a favour, says that, as this is the last plane for the night, she can book me on the first flight the following morning at a cost of $120. I explain that my delay was caused by their malfunctioning machines but it makes no difference, she simply repeats (many times) that she ‘understands how I feel’ (She doesn’t!) At this stage my only alternative is to book with another airline and pay the full fare, so I accept. I am now out two taxi fares, one overnight accommodation – and $120!

Sunday night the first automatic check in machine I try at the Virgin terminal in Brisbane is set to ‘Check-in baggage only’, and the next and the next. In fact they all are. The one attendant on duty is dealing with another passenger but I have 15 minutes to spare before check-in closes so I wait patiently. When I have her attention she says, cheerfully, ’the baggage tag printing isn’t working, hasn’t been working all afternoon. Ignore the instruction, just use the machine and get your tag at the baggage drop’. By now it is 40 minutes to check-in and, as it turns out, these machines require 45 minutes clear for passengers with baggage. I therefore go to the counter. Now I am beginning to suspect my seat has already been given away to a waitlisted passenger because the check-in assistants go into a huddle, make telephone calls, hold me up for many minutes and then announce that the check-in is closed! My only recourse is the Services Desk. Here the clerk, in a tone implying she is doing me a favour, says that, as this is the last plane for the night, she can book me on the first flight the following morning at a cost of $120. I explain that my delay was caused by their malfunctioning machines but it makes no difference, she simply repeats (many times) that she ‘understands how I feel’ (She doesn’t!) At this stage my only alternative is to book with another airline and pay the full fare, so I accept. I am now out two taxi fares, one overnight accommodation – and $120!

While waiting for the cab, I reflect on the way that Virgin started business. It put its focus on its people and they were not only given the chance to take initiative but actively encouraged to do so. It was said that recruitment of young people (and they were mostly young) was on the basis of their ‘improv’ ability – their ability to react quickly (and generally with humour) to circumstances and customers’ needs. Those early years were fun. The liveliness of the crew was in stark contrast to the more sober performances of the more established airlines.

So what is happening now? The machines had been malfunctioning ‘all afternoon’, but no one had taken the initiative to put up a sign explaining the cause and letting passengers know what to do. The programmed and robotic parroting of standard spiels and ‘I understand how you feel’ was so mechanical, the clerk might as well have been a machine herself. This is a far cry from the early days. What has gone wrong?

Question today: Is technology increasing or reducing customer service? And how is it impacting the ‘human element’ in our interactive systems? Short practical examples preferred.

Over the last several weeks we have looked at problems for infrastructure decision makers when directions change – but before construction has started. However, since large scale projects can take a long time to construct many changes are likely to take place (and today much more so than in previous decades). If we were to stop and start again each time a new development comes on line, nothing would ever get done and budgets would explode. So do we accept that once a project starts construction, we ‘leave well enough alone’? Consider the following:

Over the last several weeks we have looked at problems for infrastructure decision makers when directions change – but before construction has started. However, since large scale projects can take a long time to construct many changes are likely to take place (and today much more so than in previous decades). If we were to stop and start again each time a new development comes on line, nothing would ever get done and budgets would explode. So do we accept that once a project starts construction, we ‘leave well enough alone’? Consider the following:

in 1950, Port Adelaide was rated as Australia’s third busiest port with berthing capacity for 41 ships and 6 kilometres of wharfs. The Greater Port Adelaide Plan was published that year with plans for the expansion of the port. A great deal of development then took place: reconstruction of wharfs, bulk handling facilities for coal and other bulk materials installed. Huge grain silos were constructed in 1963 and many storage sheds.

Then along came containerisation and made it all largely redundant as not only were the storage facilities not needed, the new container ships had a deeper drafts which required moving this shipping to the Outer Harbour because the Inner Harbour where the reconstruction had taken place, did not have the depth required. Compounding the misery for the port was another change that saw an increase in transportation by land rather than sea.

Looking back we always say ‘the signs were there’ – and no doubt they were, but how are we to tell ‘the signal from the noise’ to use Nate Silver’s phrase. Yes, the first container ship was launched in 1956 and it is hard to believe that this had not been a subject of much discussion in the navigation industry for years before its launch, possibly back to the time of the publication of the Greater Port Adelaide Plan but information was then not as easily accessible as it is today and it is also likely that the full potential of container shipping only gradually became apparent after that first voyage, i.e. while the reconstruction, much of which was to prove redundant, was going on.

So, our question for today is: Given the long lead times for planning and developing major infrastructure – and the likelihood of increasingly rapid change – what can we do to protect ourselves from such seismic changes, or even smaller, but nevertheless expensive, ones?

A second question is: How can we build in processes that make adaptation to new information easier?

Over the last few posts I have been looking at the problems for decision making. We may never be a hundred percent sure of success from our projects, but sometimes we can be a hundred percent certain of failure!

Over the last few posts I have been looking at the problems for decision making. We may never be a hundred percent sure of success from our projects, but sometimes we can be a hundred percent certain of failure!

This is the story of a new hospital, designed as a private-public-partnership. It featured a very complicated financial vehicle that got extensive coverage in the financial press, so much so that I decided to visit with the designer and find out more. Over a period of 5 hours, he generously went through the details of the contract design with the relevant paperwork stacked in three piles at our feet, each almost a metre high! At the end, convinced that if it had taken 5 hours to explain it to me, a fellow economist, the chances of non-economists understanding the finer details were pretty slim, I asked him two questions.

The first was: “This is a very complicated contractual arrangement, what is the likelihood that you will have the opportunity to use this tool for another PPP?”

The designer replied that this was unique. I was concerned that so much valuable time had been committed to the design of this contractual vehicle and it would have no further use outside this project. But more so I wondered about the stability of such a contract. However it was the answer to my second question that told me that the project would not succeed.

I asked him “If you were an investor, would you undertake this project under these contractual conditions”. He laughed heartily and said a very definite “No Way!”

The contract failed and caused the government much grief. The moral, as I see it, is that unless a contract is designed to be a win-win situation – expect failure!

Our question for exploration today is: What would you look for to determine the success/failure of a project?

Recent Comments