Data, Facts and Evidence

What makes a ‘fact’ a fact? What makes evidence, evidence?

The fictional detective Joe Friday is famous for something that he actually did not say – “Just the facts, Ma’am”. Many a CEO used to request the same. But is it possible to lift ‘facts’ out of context and for them still to be meaningful? Take Julius Caesar’s crossing of the Rubicon in 49 BC. Many others crossed the Rubicon both before and after but their crossings are not recorded as ‘facts’. So why Caesar? Caesar’s crossing with his army became a historical ‘fact’ worthy of remembering only because it is considered to have led to the Roman Civil War, which ultimately resulted in Caesar becoming dictator for life and the rise of the imperial era of Rome. In other words, it is the ‘context’ that makes this particular crossing of the Rubicon a ‘fact’.

Data is meaningless, until…

Data, by itself, is without meaning. It is mere blibs – on paper or on screen. It only yields meaning when interrogated. Ask the wrong questions and we get wrong answers. In his presentation to the IPWEA Congress in July, Jeff Roorda observed that when Copernicus proposed that the earth moved around the sun, the data that had been collected about the movement of the stars and the sun did not change. It was just that it was interrogated through a different question.

Not all data is created equal

While natural data may remain constant (although perhaps not well understood), the same is not true of data that we use today in our management systems. That data has been selected, chosen and shaped by the questions that we have asked of it in the past. For example, if the focus of our questions has been on the current value of our asset portfolios, we may have calculated, and recorded as data, the depreciated value but have failed to record the age distribution without which we have no way of knowing what that value means in terms of renewal timing. If we recorded our assets in historical cost terms, we may be able to account for their accuracy by referral to the invoices of the time, but it yields no management information. If we recorded our maintenance expenditures by site but not by what was done on that site, we may know where it has gone, but we won’t know what was done and so what we may have to do later.

Today, our ability to access and analyse data enables us to answer old questions with more precision. This is exciting. The easy thing to do is to collect more of what we have collected in the past and to address the same questions. In other words we can use new data to answer our old questions, questions that were themselves shaped by the data limitations at the time.

So, an even more important question might be – are we prepared to ask new questions that cannot be answered simply by inserting more data in our current current data frameworks?

Are we prepared to rethink our data frameworks? Our thinking models?

With new technology we can now create an abundance of data very cheaply, not only historical but real time data. In fact, we may well argue that anything we can think of we can now collect data on. To take advantage of this, we cannot let ourselves be hamstrung by the assumptions that have ruled in the past and the questions that these assumptions have generated. But having – at great expense – assembled the data we now possess – how do we ask questions that move beyond the models we have already developed?

This is one of the areas that we will be examining in our future podcast – “Talking Infrastructure: creating better questions”

Yesterday I posted IDM in Pictures 3/12. IDM stands for Infrastructure Decision Making. You can think of IDM either as the next stage after strategic asset management or as an intermediary stage between 20th century physical infrastructure and a 21st century that will be increasingly cyber or cyber augmented, but the shape of which we do not yet know. Infrastructure decision making is about asking those questions that will help us make the adjustments we will need to make.

Yesterday I posted IDM in Pictures 3/12. IDM stands for Infrastructure Decision Making. You can think of IDM either as the next stage after strategic asset management or as an intermediary stage between 20th century physical infrastructure and a 21st century that will be increasingly cyber or cyber augmented, but the shape of which we do not yet know. Infrastructure decision making is about asking those questions that will help us make the adjustments we will need to make.

For example, consider the rise of e-sports, a.k.a competitive video gaming. What impact might this have – on physical sports and on our sports infrastructure? Already a $1.5 billion business, it is increasing at 30% p.a. and projected to continue this rate of growth for at least the next five years. How many of our recent stadiums and those now being built have factored in this rate of growth for e-sports – and the possible concommitant impact on physical sports? So far it has mainly affected Asia and North America. However Australia joined the excitement early this year with major tournaments in Melbourne and Sydney. Do our current sports stadiums lend themselves to housing these events? The physical requirements of e-sports in Sydney (pictured) required the design and construction of a purpose-built elevated stage housed in a movie theatre complex. E-sports require high speed internet access and present high intensity light shows, music, dancing along with the video gaming competition. In Asia and North America they can attract crowds of 100,000.

In times of uncertainty we often seek comfort in resorting to what we have always done and are therefore confident that we know how to do. This may give temporary relief from the stress of the unknown but it only pushes the decision making further out whilst making the decisions harder when they come due again, and this is likely to be much sooner than we think. The consequence of doing this in the recent past may be why we are now hearing the term ‘playing catch up’ from our political pundits like Jeff Kennett. I don’t like this term, or the idea it implies. Why catch up when by the time that we do, what we are catching up with will already have passed?

The earlier we pay attention to future issues and start thinking – and talking- about the changes needed – in mindset, technology, principles and practices – the easier our adjustment task will become.

Big data is a route to Abundance, but let us take care, data makes a great servant but a dangerous master.

If we respond to data outputs uncritically we make data our master. Yes, algorithms are becoming ever more complex and difficult to understand – and therein lies the problem. Unless we are able to understand HOW a decision was made, algorithms are just dead dangerous. There are really serious problems of people being denied access to medical or social assistance or being jailed because an algorithm deemed it so. Less serious – but funny! – is the story of two booksellers on Amazon using pricing algorithms that resulted in a 1992 out of print book on the evolution of flies rising to over $28m. A post graduate student interested to buy the book first noticed that where second hand copies were listed at $35, new copies were then over $2,000. When he went back the next day, the price had risen even more, and so it continued. Studying the prices, the student realised that one seller had set his pricing algorithm to be fractionally less than his main competitor in order to attract sales. the other bookseller had set his algorithm to price this book at slightly more than his main competitor. Why? We don’t know but the student suggests (in his blog where he writes it all up) it might have been because the seller didn’t actually have a copy of the book and would have to source it should anyone order. Since the premium of the one seller exceeded the discount of the other, the price kept rising. It took this research student to notice what was happening – not the booksellers, who were, of course, on autopilot. What damage could occur in your work if you are on autopilot?

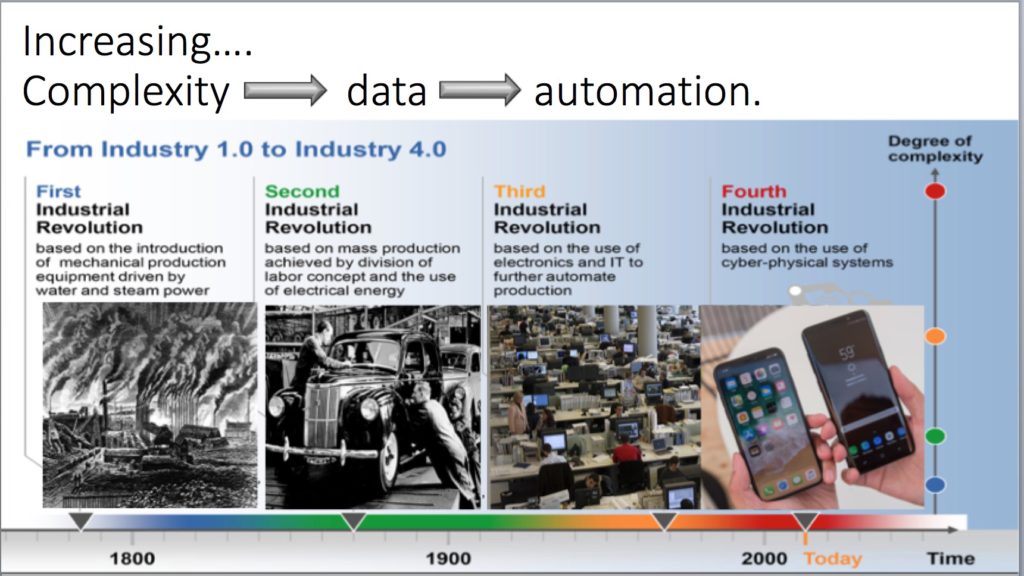

The ability of big data to deal with increasing complexity is nevertheless a great advantage. Consider how we have moved since the first industrial revolution.

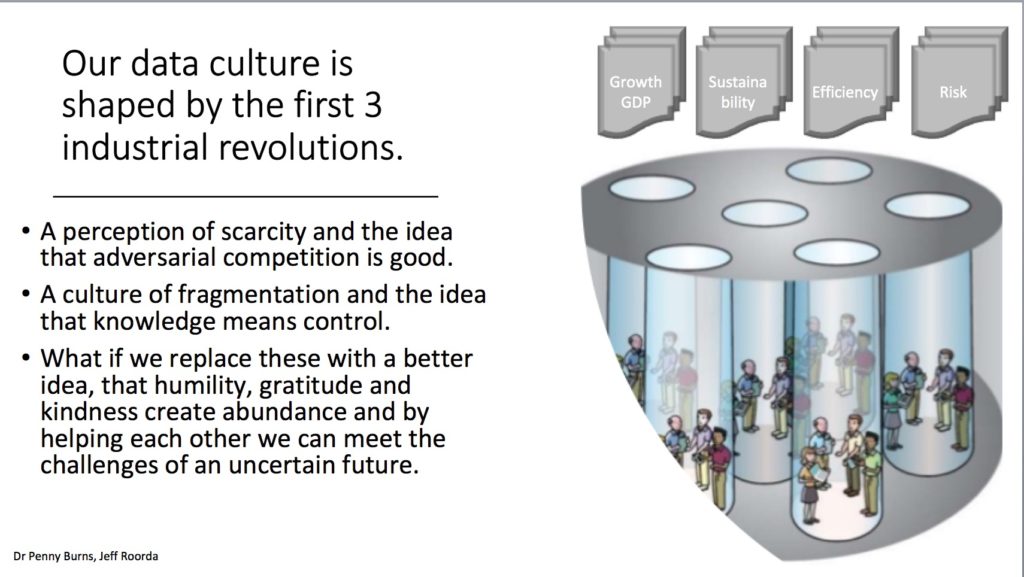

Our data culture is shaped by the first 3 revolutions. This has given rise to two attitudes or mindsets that are no longer acting to our advantage.

- A perception of scarcity and the idea that adversarial competition is good. But we are about to embark on a new world of abundance – as well described in Jeremy Rifkin’s “Zero Marginal Cost Society”. This is requiring businesses to change their business models. We know it as ‘disruption’ but it is more than that, it is opportunity.

- With increasing specialisation we have developed a culture of fragmentation and the idea that knowledge means control. Now that we are able to share knowledge so much more freely, we are able to develop better models, a more fruitful culture.

- This means that we can start to explore replacing these old ideas with a better idea, that humility, gratitude and kindness create abundance and by helping each other we can meet the challenges of an uncertain future. These are not really new ideas. During and just after the second world war, Londoners who had survived the blitz, now faced the problem of recovery. Instinctively they knew that, just as they had survived the war through helping each other, this was also the way that they would meet the uncertainty of the future. But as people became richer, they became more selfish and the initial rate of gain slowed. The way of the future is through collaboration. Harvard studies, as reported by Shawn Achor in “Big Potential”, have clearly demonstrated that teams of collaborating individuals have it all over geniuses. In fact a team of average intelligent people who ‘get on with each other’ well exceed the performance of a team of geniuses.

- This is the real message of ‘big data’ – together we can do more than we can do alone.

The possibilities of big data are impressive but let us not get carried away.

Not only is there the danger of trusting in the results of data manipulation that we do not understand (cf the many studies showing the dangers of ‘private’ algorithms that are not open to analysis), but there is the greater danger that we put our faith in aiming at ‘data’ outcomes (e.g. KPIs) rather than people outcomes.

So let us put our effort into better measurements of what really matters – better (i.e. more relevant) data. This will inevitably mean using non-dollar measures – and judgement.

Discussion today tends to conflate the benefits of greater use of digital data and digitisation itself. Both are valuable, and both impact infrastructure decision making, but they are not the same.

There is currently much discussion of loss of work opportunities through the use of robots. If our decisions are driven purely by data, then robots can do a great job. But if we want our decisions to include values such as kindness, compassion, and fairness, then we need people.

We appreciate the benefits of big data but do we really want to live in a world without kindness, compassion and fairness?

Infrastructure spending is often justified on the grounds that we are ‘building for the future’. If we truly believe this, and if we are concerned to provide a safe and prosperous world for our children to inherit, then we are running out of time. This is the conclusion of “No Time for Games: Climate Change and Children’s Health’ by Doctors for the Environment Australia where they describe the many ways in which periods of excessive heat, disease carrying flood waters, storm events and rising sea levels are seriously impacting the physical and mental well being of our children. This is not a hypothetical. It is happening now. And the recent NEG decision to support coal under the guise of providing ‘reliability’ for renewables is, unfortunately, symptomatic of the hypocrisy of the time.

Infrastructure spending is often justified on the grounds that we are ‘building for the future’. If we truly believe this, and if we are concerned to provide a safe and prosperous world for our children to inherit, then we are running out of time. This is the conclusion of “No Time for Games: Climate Change and Children’s Health’ by Doctors for the Environment Australia where they describe the many ways in which periods of excessive heat, disease carrying flood waters, storm events and rising sea levels are seriously impacting the physical and mental well being of our children. This is not a hypothetical. It is happening now. And the recent NEG decision to support coal under the guise of providing ‘reliability’ for renewables is, unfortunately, symptomatic of the hypocrisy of the time.

We can regret the loss of leadership as David Shearman did in his excellent article in the ABC Adelaide news this morning “Climate change is World War III, and we are leaderless” and urge our elected members to do more, and we should do this.

But maybe we need to DO more? Maybe in our leaderless world we need to take leadership into our own hands? In the past we have tended to leave large scale infrastructure decisions to others. Perhaps this now needs to change? No Time for Games has this to say about Infrastructure:-

Infrastructure and risk reduction

‘Protecting children’s health also requires risk reduction in sectors other than health such as housing, agriculture, urban planning and transportation. Improvement in urban and regional planning design such as relocation away from areas at risk from natural disasters or sea-level rise, or better housing design to reduce heat impacts, are examples of reducing the risk of climate health impacts to children.

‘Protecting children’s health also requires risk reduction in sectors other than health such as housing, agriculture, urban planning and transportation. Improvement in urban and regional planning design such as relocation away from areas at risk from natural disasters or sea-level rise, or better housing design to reduce heat impacts, are examples of reducing the risk of climate health impacts to children.

Reducing socioeconomic disadvantage in children and improving baseline health, food security and education are fundamentally the best form of climate change adaptation due to their role in making children and families more resilient and better prepared for the environmental risks brought by climate change’

We can all have a say in promoting these changes, directly where we are able, and in voting for measures which improve them and against those which don’t.

That the increasing health effects of climate change disproportionally affect children challenges the most fundamental call of humanity, to nurture its young.

Failure to act is a major intergenerational injustice

My thanks to Ian Spangler for drawing my attention to this.

When computerisation first appeared on a large scale, we eagerly adopted it – and used it to carry out the same processes we had used bc (before computerisation). It was many years, in some cases, decades, before we realised that the real value of computerisation was to adopt completely new processes for new outcomes. Today the power of digitisation for connection is still being recognised. We eagerly embrace ‘smart technology’ in our cities – but are slower to recognise that connection can be used to bypass the city. That is we are increasingly able to ‘live, work and play’ in the suburbs, or the country, improving our lifestyle opportunities and reducing environmental costs. But first we have to see it.

INFRASTRUCTURE DECISION MAKING (IDM) IN PICTURES

DON’T MISS ANY OF THIS NEW AND IRREGULAR SERIES, JOIN THE TALKING INFRASTRUCTURE COMMUNITY (it’s free) AND RECEIVE OUR FORTNIGHTLY NEWSLETTER TO KEEP YOU UP TO DATE

There was a time when I would be in and out of an art gallery in 30 minutes, bored. I looked, but did not engage. Then at a Picasso Exhibition, i found paintings that I really liked, but also many that turned me off completely. After viewing all, I went back and studied these two groups and asked Why? Now galleries are no longer boring. I apply the same process to conference talks. I note all the new ideas, the new linkages that really please me and write them down so that I can think more about them later, and I also note those statements that drive me nuts, and I think about these as well. No prizes for guessing what category the ‘heretical questions’ in the last post fell into.

There was a time when I would be in and out of an art gallery in 30 minutes, bored. I looked, but did not engage. Then at a Picasso Exhibition, i found paintings that I really liked, but also many that turned me off completely. After viewing all, I went back and studied these two groups and asked Why? Now galleries are no longer boring. I apply the same process to conference talks. I note all the new ideas, the new linkages that really please me and write them down so that I can think more about them later, and I also note those statements that drive me nuts, and I think about these as well. No prizes for guessing what category the ‘heretical questions’ in the last post fell into.

But the IPWEA Congress this week, ‘Communities For the Future, Infrastructure for the Next Generation’ was far richer in yielding good new ideas, thoughtful linkages, and new ways of expressing accepted ideas so that they come to life and are taken out of the realm of platitudes. These deserve a far wider coverage, and so, with the support of our podcast partner, the IPWEA, we will be bringing you these ideas, and many others, in our forthcoming podcast series. Watch for it!

Or better still, join the Talking Infrastructure Community (click here) (its free!) and you will be the first to know when we launch.

A closing note: At an after lunch session in Parliament House many years ago, the talk was so boring I found it a hard job to keep my eyes open. Yet my colleague was riveted! He was listening intently and taking notes. At the end I sighed and said ‘That was a really boring talk’. ‘Absolutely’, he agreed. Surprised I responded ‘But you were riveted, paying great attention, taking notes, how come?’

His reply? ‘To make so boring a presentation, there must be many things he was doing wrong. I just wanted to figure out what they all were!’ Be engaged!

A heresy is a belief or opinion contrary to the orthodox (usually for religion, but applicable more generally) Here are some heretical questions in the asset management/infrastructure decision making field.

A heresy is a belief or opinion contrary to the orthodox (usually for religion, but applicable more generally) Here are some heretical questions in the asset management/infrastructure decision making field.

Heretical Question 1. Spend better or spend faster? An economist speaking at the IPWEA Congress in Canberra recently, argued that a greater spend on infrastructure was better ‘performance’. But is it? Jeff Kennett, former Victorian Premier, complained that 26% of funding allocated for capital construction had not been spent. He blamed over cautious bureaucrats. Both are focused on the size of the spend – and not what the money is being spent on. Is this really in the community interest? Or is this attitude (not confined to Australia) a contributing factor to the increasing evidence that infrastructure funds are poorly planned and many demonstrably lacking in justification? (cf Joseph Berechman ‘The Infrastructure we Ride On’ 2018)

Heretical Question 2. What is the purpose of infrastructure? And what should it be? Wearing our ‘better angels’ halo we say we are building for the future, but is this really true? If we were, would we not have a well developed vision of the future that we wished to create, and an infrastructure decision process that enabled us to plan to achieve it – and to adapt those plans as changes occur? Where is that vision? Where are those decision processes?

Heretical Question 3. The pipeline. An economist spoke of waves of capital expenditure and was concerned at the lack of a pipeline of projects that would maintain construction activity in the near future. Another speaker commented to the effect that Australia should ‘prioritise infrastructure’. But should it? Why? A pipeline of construction projects will ensure work in the construction industry. But the construction industry represents only about 10% of total employment. Why should we spend massive amounts of capital to ensure the jobs to privilege such a small section of the economy?

Heretical Question 4. Multipliers. You might argue that construction expenditure generates much more by way of multipliers – three times as much according to one speaker. Really? Where is the evidence for this? Many people blithely quote figures such as this, but cannot justify them. Construction expenditure does create jobs. ANY expenditure creates jobs. If the people who receive the income go out and spend it, other people benefit. This much makes sense. But how much of a large construction contract goes to the rich who may save rather than spend, and how much of the rest goes to workers who do not know where their next job is going to come from, and thus will tend to save more than spend? Wouldn’t a permanent maintenance job do more good for the economy than a short term construction contract. Or the same amount of money spent on nurses or teachers?

Heretical Question 5. Supply driven infrastructure. Jeff Kennett argued that we would do well to follow up projects with more projects to take advantage of the, now unemployed, workers completing the first job. In other words build infrastructure to provide jobs. Is this sensible? Tasmania in the late 1980s came to grief over this. With little employment in the North, infrastructure projects were created to provide jobs. The projects not only provided work for the unemployed in the north, but they attracted others from around the state so that when the project finished, there was now a bigger pool of unemployed, demanding a bigger project – and so on. Now most of the Tasmanian population is in the South so the infrastructure was largely underutilised. As a result of this expenditure, the state came close to bankruptcy. So, is this really a sensible idea?

Heretical Question 6. Vision/Plan. We have a tendency to use these words interchangeably, but is this sensible and safe? A plan is a set of actions designed to secure a goal or objective. A vision is an idea of some future state that we would like to achieve. Affordable healthcare could be a vision. A set of projects including asset and non-asset solutions could be in a plan. As technology, demographics, environment, governance and public attitudes change and information is acquired, we would have a succession of plans, all adapting to the current circumstances but addressing the vision. The vision may be a 50 year vision (even a 7th generation vision) but we would surely not wish to commit ourselves to a 50 year set of projects conditioned by only what we know now.

Feel free to add your own heretical questions.

Media articles often leave infrastructure questions dangling. QUESTIONS ARISING is an opportunity for those of you who read widely and keep their eye on what is happening to identify these articles and the questions that need to be answered. These can then be addressed in our forthcoming podcast series, so get involved – add your questions to those listed here, suggest possible lines of development, add new media articles along with the questions they raise. Sources may be the daily journals, the web, podcasts, radio, TV. Plenty of scope!

Media articles often leave infrastructure questions dangling. QUESTIONS ARISING is an opportunity for those of you who read widely and keep their eye on what is happening to identify these articles and the questions that need to be answered. These can then be addressed in our forthcoming podcast series, so get involved – add your questions to those listed here, suggest possible lines of development, add new media articles along with the questions they raise. Sources may be the daily journals, the web, podcasts, radio, TV. Plenty of scope!

Here to introduce our first QUESTIONS ARISING are two items identified by our Business Development Manager, Ian Spangler.

1. The Economist’s Intelligence Unit’s recent report on “Preparing for Disruption: technological readiness ranking, 2018”, places Australia in the top ten for the historical priod (2013-2017) BUT it forecasts that in the next five years, Australia, Singapore and Sweden will take over as the top-scoring locations. The ranking is based on the number of mobile phone connections and internet access.

Questions arising.

- Is this enough to ensure technological readiness?

- What else should we be looking at to test readiness?

- Australians, who are not easily overawed by authority, may well joyfully take up the idea of disruption, but to what end?

- How can we tell whethe our innovation is well directed?

- What else? Add your comments below.

2. The small homes project was recently launched in Melbourne. The RACV reports that “from the 1950s, Australia’s average house size more than doubled to 248 square metres at its peak in 2008-09. Then last year something strange happened: the size of new builds dropped. Over the past 20 years, median house prices across the country have gone up by more than 300 per cent while weekly wages have only increased 121 per cent. Rising cost-of-living pressures are also draining our bank accounts, with the average annual energy bill in Victoria now around $1667. Building and running a big house is not cheap and it is not great for the environment.”

Questions arising

- The ability of the demonstration small home to provide so much convenience in such a small space is its use of 4G and 5G connectivity. How do you see this affecting futur constructions?

- Will we continue to reduce the size of our dwellings? If so, what factors may come into play? If not, why not?

- If our dwelling size does decline markedly, what impact might this have on other infrastructure?

- Other Questions

Three great days in Melbourne in which I met with many asset managers for talks over coffee (or the hard stuff).

Three great days in Melbourne in which I met with many asset managers for talks over coffee (or the hard stuff).

The benefits of a podcast series addressing future change and its impact on infrastructure decisions today was readily recognised and the ability of the podcast to draw from the perspectives not only of those who are responsible for the supply of public infrastructure, (decision makers, analysts, managers and advisors) but also those who rely on infrastructure to achieve community and commercial outcomes was seen as something that people wanted to be involved in. Think those who supply and those who rely!

I was able to meet with Anne Gibbs, the current CEO of the Asset Management Council, who has been extremely helpful in providing follow up material, and with Sally Nugent, the former CEO, as well as a number of active AMC members including Andrew Sarah, Greg Williams and Kieran Skelton. I also had a very positive meeting with Jaimie Hicks, Business Development Manager of the Water Services Association, Australia.

Lara Morton-Cox of the Victorian Treasury drew my attention to innovative work they are doing to encourage future thinking to be built into agency asset management plans. It was also a pleasure to catch up with new friends and people I had not seen for some time – Roger Byrne, Claudia Ahern of Creative Victoria, Christopher Dupe now Manager, Capital Works Programs at Museums Victoria, Brenton Marshall, Shellie Watkins, Thomas Kuen of Melbourne Water, Steve Verity of TechOne, Roger Harrop, Ian Godfrey, Gary Rykers, Dr Nazrul Islam, David Francis, and Greg Williams,

On Friday morning I was able to catch up with Robert Hood, who is now working with Asia Development Bank developing asset management expertise and believes that our infrastructure decision making podcast may have relevance to their work. I also met Robert’s wife, Cherry, from Capital Works Planning at the University of Melbourne who had some interesting ideas and we will talk in October about student involvement in our podcasts.

In the afternoon, a magic time with Ashay Prabhu and his fantastic team of energetic, imaginative and committed young people at Assetic. And finally, a leisurely and interesting conversation over wine with Tom Carpenter, trainer and CEO of the Institute of Quality Asset Management.

I will be back in Melbourne mid October, so if you missed out this time, let’s catch up in October.

Recent Comments