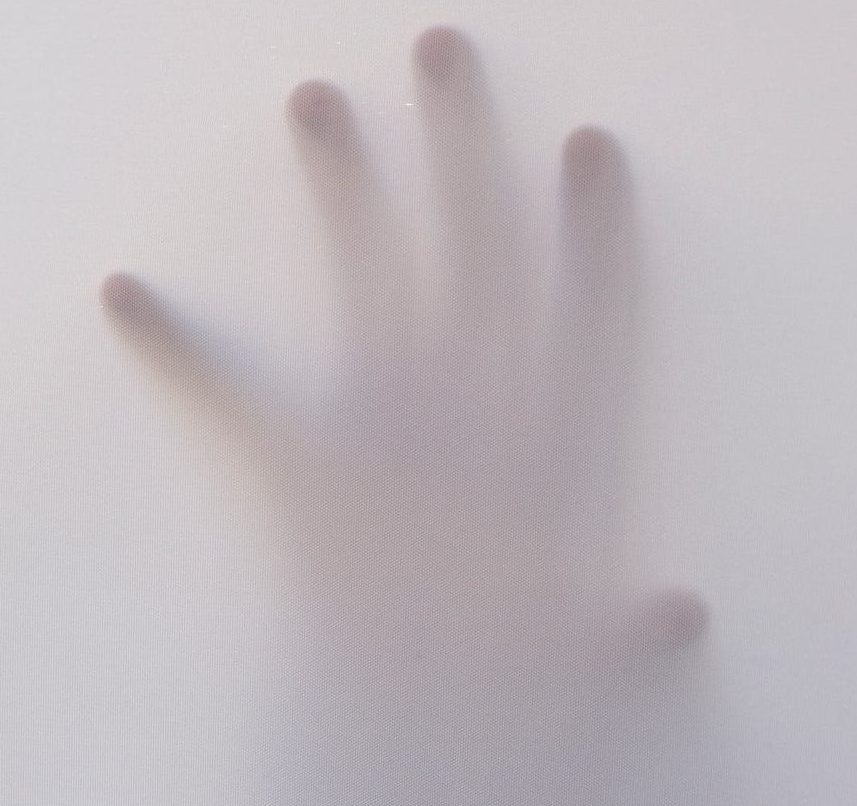

Photo by Сергей Гладкий from Pexels

A single source of truth

As digital transformation expands, there has been pressure in the field of asset management to consolidate, structure, reformat and create new data and align it with the business processes to create a systems approach for informed decision making, with the aim of providing structured data that can become a single source of truth for organisations and enable quality decision making for delivering value to the end user. Many providers of Asset Information Systems and IT promote this as their goal.

Logically, can there be a single source of truth?

While I am definitely in favour of IT solutions (#More code, less cement), I am struck by that phrase “a single source of truth” and ask myself ‘is aiming for it missing the point?’ We have, for a long time, argued that good decision-making requires good evidence. But good decision-making, as we are coming to recognise in these difficult times, is multi-layered and this means that the evidence needed for these decisions must also be multi-layered. No matter how clever our IT, we cannot rely simply on the information we can generate within our organisations, but we need to look without and beyond.

Consider what we have now learned from Covid 19

As the world has watched – and felt – the impact of Covid 19 in recent weeks, we have developed a new respect for Experts and the data, analysis and evidence that they can provide to help us feel our way through this problem. I say ‘feel’ advisedly. Because we are like the blind here, and will need to zig-zag our way forward, trying something and then retreating if the infection rate rises.

First there was a infection pandemic – a health problem. Here in Australia we responded with a national lock down that has been hugely effective in curbing the rate of new infections and thus deaths. But now we have an economic problem as 1.7 million are thrown into unemployment and factories, wholesalers and retailers are standing idle and interstate and international travel and thus tourism halted.

The government has sought to ease the impact on unemployment with its job keeper and job seeker allowances and this has been sound thinking. But later it will need to decide what to do with the debt it has incurred – a public finance problem. No-one knows how long the support will last or when they can go back to work. Many, particularly the most vulnerable casual workers, are not covered. Anxiety rises. Authorities are now anticipating serious mental health problems and a rise in domestic violence.

Sporting events have been cancelled and resumption of them is a major talking point in the media for all of us who would normally attend the football on the Saturday and yell and scream for our teams, (and discuss it endlessly on Thursday, Friday and Sunday) no longer have this opportunity to break tensions, relax and cement social relationships. The arts are particularly affected as few arts workers fall within the protected jobs range. What are we without the arts, without sports?

Yes economics is important. But it is not the only thing that is important.To solve a multi-layered problem it is not possible to have ‘ a single source of truth’

Now let us return to Asset Management.

Is it possible to make decisions based only on clever IT applied to our assets? That may enable us to determine our internal supply costs – but outside in the world how do we know how much will be demanded? What external costs – and benefits – will our actions create? What impact are we having on the mental health of our workers and on the environment? We may be able to make a profit in the short run but what of our resilience in the face of change in the slightly longer term?

Asset decisions are thus also multi-layered, so can Asset Managers really expect that in serving all their stakeholders they can rely on data for ‘a single source of truth’ – no matter how cleverly calculated? Or do we have to come to terms with the fact that all of life is a trade-off? And thus consider how we learn to deal with trade-offs?

If not a single source of truth, then what?

An important question! Talking Infrastructurebelieves that more is required of AM Leads than simply to follow an IT algorithm or a one point source of information. We need to be able to think through the ‘cumulative consequences’ of our decisions, and to that end we are developing “The toolkit for Leads” specifically for those who head up our asset management teams (or aspire to) and see themselves as being a more forward thinking and active part of their organisation’s decision making.

If you would like to know more, sign up now to be a member of Talking Infrastructure (it’s free) and we will advise you as soon as it comes online and keep you up to date with additions.

How can you plan for the unknown – when you literally cannot see your own hand in front of your face? Well, back 12 years ago, when she headed up the Strategic Asset Management Team at RailCorp (now Sydney Trains) I facilitated a scenario planning exercise for Ruth Wallsgrove. The scenario we looked at was an epidemic with an immediate impact on ridership, with everyone – although, of course, we didn’t call it that – ‘social distancing’. Now over to Ruth to look at the implications that has for us today. PB.

The importance of planning

“Emergencies are overrated as a response mechanism. Are preparation, prevention, and planning about to become more popular alternatives? Can we nudge this? “

Planning – that is, thinking ahead and co-ordinating what we are going to do – appears to be central to dealing with Covid-19. We do not know for certain what the conclusions will be, except that South Korea seems to be doing well, and the USA not.

The nature of planning

I teach AM to a lot of people, and quite a lot of them ask how you can plan when you don’t know exactly what’s going to happen. The answer is, of course, that it is even more important to plan when you don’t know exactly what will happen. The point is to give yourself a framework for flexibility. No planning ahead at all gives you nothing to work with.

It would not have been a sensible plan to stockpile ventilators. And there was no possibility to stockpile Covid-19 test kits, because they didn’t exist. Good planning instead would be putting in place the thinking processes that would enable us quickly to ramp up production of known equipment, and to come up with new tests and vaccines.

Scenario Planning

Scenario planning seems to me to be the opposite of Planning with a capital P: the opposite of a high up committee coming up with a visionary Plan for transforming our infrastructure.

The idea of scenario planning is to look at alternative scenarios, and ask what the data tells us. It’s to consider what to do if the future doesn’t go the direction you want it to. What you can influence. How you can stay nimble to respond to what reality tells you.

The Chain of Consequences

In our scenario planning session in 2008 we were asked to consider – Could an epidemic lead to an increasein ridership?

Trains and buses are currently empty not just because people don’t want to be in a small space with many other people, but because many of us are in lockdown. Our workplaces have closed and, if we are lucky, we are working from home. (If we are not… we are out of our paying job, temporarily or permanently).

What if: people go on being nervous about crowded spaces after we go back to whatever the new normal is?

Well, one possibility is that everyone heads to their cars with a vengeance. But what if that led to impossible traffic jams, as most cities already had no spare capacity for personal vehicles?

What if: someone comes up with a neat way to avoid breathing germs on each other? This was one of our scenarios. How could the chain of consequences lead to an increase in ridership? It’s not even hard to do, once you free yourself from thinking you ‘know’ what people will do, or should do, in future.

Along with scenario planning, we also need the skills to go beyond the immediate, and ask what the knock-on impact of one event on another. Such as the basics of AM: if I build this rail line, what will that mean for operating expenditure for the next thirty years? What does it mean I can’t do, because I’ve dedicated resources to this rail line instead of that arts centre? What are possible impacts on our overall capabilities – including the environment? (There is always another Plan, but no Planet B…)

The role of Asset Management practitioners

In late 2018, when a wire down led to a wildfire that burned down a town in California, much attention was paid to control the spread and mitigate the fallout. The AM team were involved, however, not in initiatives to look at the urgent immediate risk, but rather in the important task of what to put in place to reduce such risks in the future. So often, as we know, the urgent drives out the important.

We are not emergency planners; that’s an honourable discipline in its own right. Our job is to consider scenarios and chains of consequences (“and then what?”) and building flexibility into our asset systems and our processes.

Recent Comments