I was listening to an interview with a theatre director who observed that in innovative theatre it is necessary to create an environment where, as he put it, it is ʻsafe to failʼ. Not everything you try will work, he went on to say, so you rely on the generosity of your fellow actors to go along with you and give it a try.

It reminded me of the time I was directing a small Jewish play – with all non-Jewish actors – and my lead actor, at the very last rehearsal, chose to try out a lovely, but unexpected, Jewish accent. It completely flummoxed the entire cast. But they recovered for the opening night which went well. They had the requisite generosity of spirit.

My question is: Do we? If somebody tries something new, do we immediately reject it? Do we work with them to round off the awkward edges or do we carp and criticise? If it fails do we nevertheless recognise the beneficial intent and work with them to find solutions? If I had not had the support of the great engineers I worked with I doubt I would have been able to create a way of addressing the problem of planning and asset renewal that we now see as infrastructure asset management.

Not everyone can, or wants to be, an innovator. But we can all focus on the purpose and work with those who are able to solve some of the pressing problems of today. Innovation is ‘doing different’ – but not for difference sake! Anybody suggesting an innovation needs to be able to explain what problem they are addressing. Then others who can see the wisdom of addressing that problem can join.

The position of Asset Management Team Leaders is critical here. Team Leaders need to ensure that failure is not fatal, but rather a learning device. In particular, we need to prepare the level above us to recognise and support innovation by making sure that our boss understands and supports.

I am sure we have all had experience of what not to do, but focusing there won’t help. Rather, what experience have you had that can help others develop and support an innovative spirit?

This week my oldest and dearest friend, Bob Ritchie, the Secretary of the PAC, died after a valiant fight against Leukemia. I was able to see him just a few days before he passed on Tuesday last week. His influence on AM was immeasurable, but largely untold.

It was Bob who recognised, 40 years ago, the potential of the work I had done for predicting the likely cost and timing of water and sewer infrastructure renewal to be applied to all major state infrastructure and who convinced the Parliamentary Committee to engage me to do a research project where they had never done one before. He worked with me on all eight reports to Parliament and saw, where I did not, the opportunity of a vaguely defined job vacancy in public works to be converted to, as he put it, ‘anything I wanted’, which I interpreted as the opportunity to spread the AM message Australia-, and indeed, world-, wide.

A few years later he was my major support in developing the International AM Competitions and then again when I started Talking Infrastructure. He was always there, encouraging, supportive. So much he contributed! Yet hardly anyone in the AM community would know his name. True, he featured in ‘The Story of Asset Management‘ as he should, and I am glad I had the opportunity to say Thank You before he died.

Vale Bob Ritchie. 01.02.1942 – 11.03.2025

In the perennial tussle between the thinkers and the doers, I must confess that I have always been impatient with those who want to ‘get out and do’ before they have ‘sat back and thought’. They have been just as impatient with me!

I now realise that we are both motivated by the same goal – we want to avoid wasting our time.

Since I have confidence in my ability to design a suitable operational system to meet any objective, once I clearly know what that objective is, I avoid wasting time tackling the wrong objectives by sitting back and thinking about it.

The practical doers of this world do not want to waste their time thinking about objectives that may be “all very fine but not operational”. So they first insist that I show them that it can be done; then, and only then, will they be prepared to consider whether it should be done.

Recognising our common pressures, I will try to get less frustrated next time I encounter this reaction – and patiently explain ‘how’, even though I really want to get straight onto the ‘why’.

Today we seemingly all accept that we are short of time and thus feel constrained to give short shift to thought and planning. But how much of this lack of time is self-induced? How often do we need to re-do what we did in haste? Or spend time working around the problems that the haste engendered?.

Whichever camp you fall into – the thinkers or the do-ers – how do you cope with the frustration of dealing with ‘the other’ ?

In 2004 (Feb 14, The Buzz) ABC’s Radio National broadcast an interesting interview with an American post graduate student whose research work caused major security concerns, so much so that Richard Clarke, former White House cyberterrorism chief, declared that it should be burnt!

What did the student do to create such antagonism at security levels?

Critical Infrastructure Database

His thesis was on critical infrastructure in the United States, with a focus on information infrastructure. As part of his work in analysing the infrastructure and its vulnerabilities as preparation for determining a set of tools to deal with the vulnerabilities, the student put together an integrated database. The dataset consisted of a large collection of geo-spatial data on where the fibre optic lines were in the country, both long-haul lines that connect cities up, the metropolitan area networks within cities, switching centres and data warehouses that house and direct traffic on the network. The data carried on theses lines included a wide variety of critical sectors in the US economy and global economy including financial transactions, military command and control, emergency response, telephone calls, government communications. “Pretty much everything runs over fibre except for satellite transmissions” he said.

He worked quietly away at his research for a number of years – and by the way all of the data in his database was gathered from the public domain! – until the Washington Post wrote an article about his work, and then things started to get a little heated. Top security people then spoke with his university and wanted to know what security precautions were being taken with the database. The University asked government agencies what security precautions would be taken within their domain and then tried to replicate as best as they could within the university.

Safeguarding the Database.

This is what they did: The graduate explained “The computers that the data is housed on are not connected to any network and are in a secure room behind cipher locks. We have a vault that we take the removeable hard drives to and put them in there for storage.. and things along those lines.”

Integration

What I found interesting about this story is that as long as the data was available in a distributed form, on individual websites all over the country, there was no great hue and cry. Admittedly the student started his research in 1996, which pre-dated Sep 11.

However, the general lesson remains – integrated databases are more valuable because they allow us to do things that distributed databases don’t. In the student’s case it made it possible to analyse national vulnerabilities.

But the very act of integration introduced the biggest vulnerability of all!

Just over 10 years ago Dr Linda Newton (Canada) joined Ruth Wallsgrove, Chris Lloyd, Charles Nelson (England) and myself (Australia) in London in considering the different ways in which AM might develop. The work was then written up in Strategic Asset Management. We were only looking at developed countries then so I thought it worthwhile in asking Linda, who has now had seven years experience in applying the UN Asset Management work in developing countries what has particularly stood out for her.

Musings from Seven Years of Promoting AM in Developing Countries

By Linda Newton, PhD

I have been working with the United Nations Department of Economic and Social Affairs (UNDESA) for just over seven years now. During this time, we’ve worked with local governments in least developed countries (LDCs) to build their asset management awareness and capacity by delivering workshops based our published handbook Managing Infrastructure Asset for Sustainable Development.

If asked to provide two key takeaways from the workshops, it would be this:

- ‘Strategic’ is simply a point in the future.

- Asset management is best understood when its personalised.

How often do we see the words ‘strategic’, ‘tactical’ and ‘operational’ associated with a specific time frame? For example, many strategic plans cover 3-5 years. Now think about an individual. What does strategic mean to them? It all depends on their personal point of view. For instance, for some individuals, ‘strategic’ could be measured months, ‘tactical’ in weeks, and ‘operational’ in days, or even hours. Which brings me to the second takeaway.

I used to start the workshop by jumping right into asset management definitions and principles. For many, it was a lot of theory with no practical grounding. And then I had an idea – let’s start with personal assets. Almost everyone has, or has had, a bicycle. What comes next – a motorbike and later, perhaps a car? Different assets, delivering the same service (transportation) but at different levels and different costs. What if I used this to explain asset management? And so, ‘What I Can Learn from my Motorbike’ became the focus of the introduction to AM.

These takeaways are not unique to LDCs. Understanding an individual’s perspective and using personal examples helps position strategic asset management in terms that are understood. So, I invite you to take a look at your own organisation. Are people struggling to understand AM? If so, make it personal!

In the art world, knowing the provenance, or the ownership history, of a piece of art, is critical to establishing its veracity and value. The same should be true of any ‘fact’ that you wish to use to support an argument in asset management. We speak of ‘evidence-based’ decision making, but how valid or reliable is our ‘evidence’? In other words, how do facts become facts? As you think about this, consider the following:

I had been asked to review a paper about disability access and the author was keen to get my comment. As I read it, I noted his use of substantial and very favourable benefit-cost figures. Knowing how difficult it is even to conceptualise some of the benefits, let alone measure them, and finding no explanation of the figures in his paper, I ask him for the source.

“Oh, never mind that”, he airily replied, “what do you think of the paper overall?

I told him that I wouldn’t be able venture an opinion until I understood the data and, after a fair amount of applied pressure on my part, he eventually said:

“Look, I made them up! But it doesn’t matter because I am giving this paper at an international conference and someone will quote me, and then someone will quote that person – and pretty soon, it will be fact!” Unfortunately, this is a true story and he may not the only one acting in this manner.

Much of the time, however, mis-representation is not as blatant as this. It can be simply a matter of not paying enough attention to labelling the axes. Often we slap up a graph without identifying the axes and expect the audience to fill in the gaps from the context of the conversation. This is a lazy habit that is responsible for many subsequent misunderstandings. For example, what we think is a trend line showing full life cycle costs, might simply be a trend of operating costs. With very different implications!

What other examples do you have where presentations or papers, have or can be, misinterpreted with ill effects on Asset Management?

Ten years ago, after 20 years, I brought SAM to a close. I asked past contributors what the key issues then were, and what we – as asset managers – should do. What did they say – and what would you say today?

Here is that issue, SAM 400. What are your favourites? Top of the list for me was Melinda Hodkiewizc, Professor of Engineering at the University of Western Australia, who bluntly stated it was time to ante up and provide evidence to support our claims for asset management. I could not agree more, but have we done it?

Several referred to the need to make things simpler – both in terms of action and communication and Peter Way, then Chairman of the IPWEA, while recognising the difficulty, spoke of the critical need for asset managers to speak out whenever they see their political masters moving in a questionable direction. If only! After all, if we who know don’t do it, who can?

Many recognised the importance of the quality of our people in AM and the need for us to continue to think and to develop our abiliies, not mindlessly react. The ever practical Ashay Prabhu, implored us to ‘stop measuring the gap and start plugging it’.

While most focused on developed countries, Jo Parker, the only engineer I know who has had to build a bridge under duress with limited resources – whilst wearing a burka! – argued that “To spread AM to developing countries, first understand their world!” Is it ignorance or arrogance that drives so many ‘advisors’ from developed countries to assume what works for us will work everywhere?

What were the key issues then? Alan Butler, then Director of the Australian Center of Value Management, now retired, identified the following:

- depletion of core skills and the resultant dumbing down of the asset portfolio “clients” who need to be responsible for effective briefing and critical review of solutions being delivered on their behalf – the asset client must remain an informed client;

- the politicising of the public service where whole agencies are wrapped up in the short term priorities of the incumbent colour of government at the expense of strategic, portfolio-wide context – impartial advice, without fear or favour must exist;

- changing the procurement models that place specialist consultants in a position of technical influence where smaller solutions or non-build solutions are not in their commercial interest to present to the engaging “client” – no matter whether the arrangement is called an Alliance, Strategic partnership, Design & Construct, the “non-asset” or smaller solution must always be sought and tabled for real consideration;

- not understanding what “value for money” means for each client – these words are written everywhere including White Papers, policy, business cases and project briefs with very little understanding or ability to explain, measure or demonstrate what levels are sought and achieved – We have the tools and institutions to address this.

I think that this was a pretty good list for the time. What are the most critical issues we should now address? Thoughts?

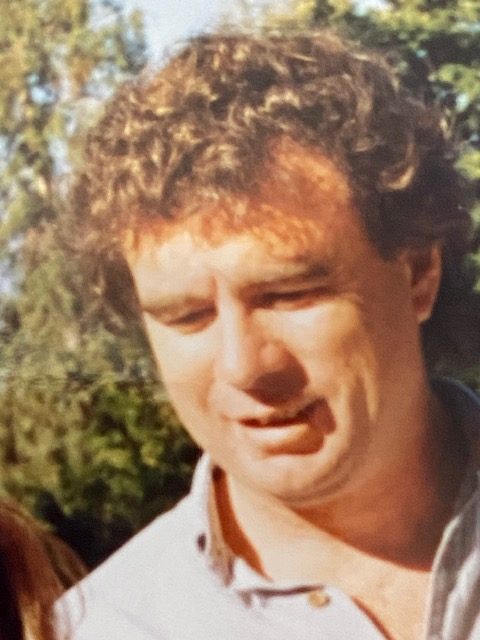

Me at my favourite coffee shop

Most mornings I have coffee in my favourite coffee shop and have a chat with George, the barrista. I like George and I want his coffee shop to remain viable – difficult in these times of rising prices – so, in addition to the pleasure of the coffee itself, I get satisfaction from knowing that I am contributing in a small way to his continuing income. I could have spent my $6 in another coffee shop or not on coffee at all and then those dollars would contribute to someone else’s income and job sustainability so I know that my expenditure is not increasing the number of jobs in total, I am simply impacting (admittedly in a very small way) where the jobs are being created or preserved.

But let us consider this same type of transaction – purchasing something for money – on a far larger scale. The government decides to build more infrastructure, say for a billion dollars, and it justifies that expenditure on the grounds that it is ‘creating thousands of jobs’. Let us set aside for a moment that the number of jobs is usually greatly exaggerated, never validated, and many of them may last only a few weeks or months. The real question is: are these jobs ‘additional jobs’, which is the way we are expected to view it and generally do, or have we simply changed the type and location of the jobs?

The government could have spent that one billion on community services (doctors, nurses, teachers, police etc or, indeed – if infrastructure is so important – on the maintenance of existing infrastructure ), or it could have left it in your pay packet instead of raising taxes to fund its infrastructure spend, but it chose to spend it on bricks and mortar. We like the idea of ‘more’ jobs being provided. We are less thrilled about the idea of jobs being lost. Fortunately for our peace of mind we do not see the jobs that are lost and although we do experience the lack of services that results we do not necessarily associate the two. So let us look at a typical project.

In December 1985 when the Adelaide Casino was established by the state owned Lotteries Commission, there was much hype about how many jobs would be ‘created’ by the Casino. And indeed, for the first six months, there was great excitement about this novelty. People flocked to it, abandoning their usual venues. It was the first Casino in the state and many went there to drink or eat, and some to gamble and the Casino employed many. After a while, however, the novelty wore off, fewer people went and the number of service people employed by the Casino declined. Customers sought to return to their previous venues but some of these, having to cope with reduced incomes in the interim but still pay high city rental prices had gone broke and moved out. Trouble was, in calculating the increase in jobs, no attention had been paid to where the new Casino customers were coming from or how long they would remain customers. The lovely little coffee shop I frequented in the city, which provided chess sets and boards for its customers, was sadly one of those that went out of business.

The moral of this story is when thousands of new job are vaunted, stop, look closer.

In case you haven’t caught up with it yet, ALGA’s ‘2024 National State of the Assets Report: future proofing our communities’ was released a week ago. You can download a copy of the Summary and Technical reports here:

Sometimes reviewing a report is a chore. This was a pleasure. It ticked all the boxes: it was very readable; honed in on the important issues and provided useful, verified data. It would be impossible for anyone to read this report and not gain a great appreciation for the pressures being faced by all councils, but especially smaller and regional councils, as they face the combined effect of asset ageing, climate change, increasing consumer expectations and more stringent regulations – and very little access to funding.

My overwhelming reaction, and it may be yours too, was to realise that better asset management is unlikely, by itself, to be sufficient. And this may be the most important take away. Asset Management is often presented as a panacea, it is not – but it is where we must start, for if we cannot manage effectively what we already have, how can we ask for more?

The good news is that this ALGA report indicates improvements are being made. How we express data has a major effect on how it is received. I particularly appreciated having infrastructure costs expressed per ratepayer. There was a time when we felt that large aggegate numbers had more impact and everybody tried to make their future costs as big as possible ‘to be impressive’, but expressing costs on a small personal scale, i.e. per ratepayer, enables greater understanding. We are more able to feel it. I also like the way that averages were dealt with. When I started work on life cycle renewal costs, realising that averages concealed more than they revealed, I put a lot of effort into calculating full age distributions. But ALGA has realised we don’t need to do all that work if we supplement the average with an indication of the extent of the most urgent of renewals. Very sensible. Indeed the entire report is very sensible. There is a lot of data, but it is carefully designed not to overwhelm.

It is a useful base for arguing for change. Change in the way we fund councils, change in the way we record and use depreciation figures are the first two that come to mind. What else would you like to see changed?

“What’s the first step to a good Strategic Asset Management Plan (SAMP)? A bad SAMP…”

My ex-colleague Ark Wingrove’s saying has resonated with clients since he first coined it. You do not have to wait for perfection; the important thing is to start, knowing you can improve as you go.

It works not just because it’s true. Just having someone tell you you won’t get everything in Asset Management perfect first time liberates us to try. Otherwise – and this surely tells us something about the asset culture we pick up, and need to change – we get frozen in the headlights of needing to be right.

It’s a profound truth of AM that you will never know enough about the future; and yet you still have to have a strategy, you still have to plan, you still have to make decisions that matter. And so inevitably we will get some important things wrong.

The approach that the AM documents and processes we produce are all iterative is, of course, built into the diagrams, the 6 Box Model and the flow of ISO 55000, continuous improvement and the ’learning loop’ of Plan-Do-Check-Adapt. The idea that, above all, we can’t leap straight from muddle to highly sophisticated Asset Management Planning has long been recognised in Australasia. We have to build, step by step, our planning evolving with our increasing understanding.

But it just struck me that it’s not simply how we improve things as we know more. The real blocks are thinking we know more than we do at the start, and the fear that we will be exposed for not knowing enough – the toxic aspects of being an expert.

Years ago Penny Burns came in to take my Sydney team through scenario planning. The real achievement of this was to move everyone away from their confidence. From believing they could ever be certain about the future.

In an exercise around understanding our levels of uncertainty in risk training this week, someone asked – tongue in cheek – how we could ‘win’.*

The urge to be right is natural, I guess, but it also goes with all sorts of baggage. That we won’t even start unless we can be certain. That it is better not to try than to run the risk of being wrong.

As though, for example, a strategy for Asset Management is a test we have to pass.

The principle of evolving, getting better as we go but never reaching 100% certainty. What examples of positively ‘embracing uncertainty’ have you seen in practice?

*Calibration training based partly on the work of Douglas Hubbard, see his The Failure of Risk Management. If you have never come across this, aiming to show off that you’re right that will ensure you don’t get it right. (And even telling people this doesn’t help them, at least the first time around.)

Recent Comments