Thanks again to Bill Wallsgrove

Human beings may not naturally be good at thinking about the future.

One thought is that, just like with charity appeals for current disasters, we should focus on an individual. Think ourselves into the shoes of some one as they experience the future.

It could be ourselves, a grandchild (if we have one), a ‘descendant’ – or anyone we can picture.

A startling powerful example of this appears in the first chapter of Kim Stanley Robinson’s The Ministry for the Future, published in 2020. The author specialises in thoughtful, ‘realistic’ depictions of the future, for example in colonising Mars.

The Ministry for the Future starts by describing the experience of one Western man in a climate catastrophe, when twenty million people in northern India die in a heat wave. Many millions in a faraway country in the future: a newspaper headline. And ‘Frank May’, who works in a clinic near Lucknow, who nearly poaches to death in a lake full of people, where the water is above the temperature of blood.

I could not get the image of him out of my head for a lot longer than a headline.

I realised when watching the final episode of Planet Earth 3 last month that the image of Frank May was so vivid that it felt it was happening right now. It was not hypothetical, despite being fiction.

We may overdo the image of threats to a panda or polar bear or orangutan, to be invited to imagine a world without them. Just like we stop reacting to doe-eyed young children in charity ads. But I suspect we simply need this emotional connection.

Maybe like the Japanese traditionally put on the garment of a descendant, to feel how they will perceive the results of what we are doing now. We too could do this, to really feel it when we make a decision now about their infrastructure in fifty years’ time.

A technique to consider next time we are involved in long term asset decisions?

My colleague Todd Shepherd and I had a brainwave* last year to restructure how we teach Asset Management – not as a line that starts with investigating capital needs, the conventional beginning of the asset life cycle, but from where we are now. That is, right in the middle of maintenance. We are always deep in maintenance needs.

It makes more sense of the history of AM, straight off. It was not people writing business cases, or design engineers, who realised the urgent need for something different. It was maintenance, post World War 2, and then Penny Burns and the problem of unfunded replacements and renewals in the 1980s.

If Asset Management has waves, we might suggest what Wave Minus 1 was. Wave Minus 1 was hero engineers, from the Industrial Revolution on, building heroic infrastructure – Bazalgette and London sewers, Brooklyn Bridge. Sewers and bridges are both good things. But they are not quite such good things if they leak or fall down because they are not maintained or renewed.

With infrastructure, it is not enough to start; you have to see it through.

Penny used life cycle models to understand the extent of renewals, and increasingly I don’t feel anyone is really doing Asset Management if they do not use such models. Of course it is called life cycle for a reason. There isn’t an end, only another cycle.

But now I fear that starting at the beginning of one lifecycle in our teaching still makes it sound as though it is the creation of infrastructure that’s the important thing. We have not really got the cycle bit across enough, at least to the average engineer we teach. What comes after construction is still a vague future state, that is someone else’s problem.

And, not at all coincidentally, that’s also the point of the circular economy concept. There is no meaningful product end, and we are right in the middle of the mess we already built.

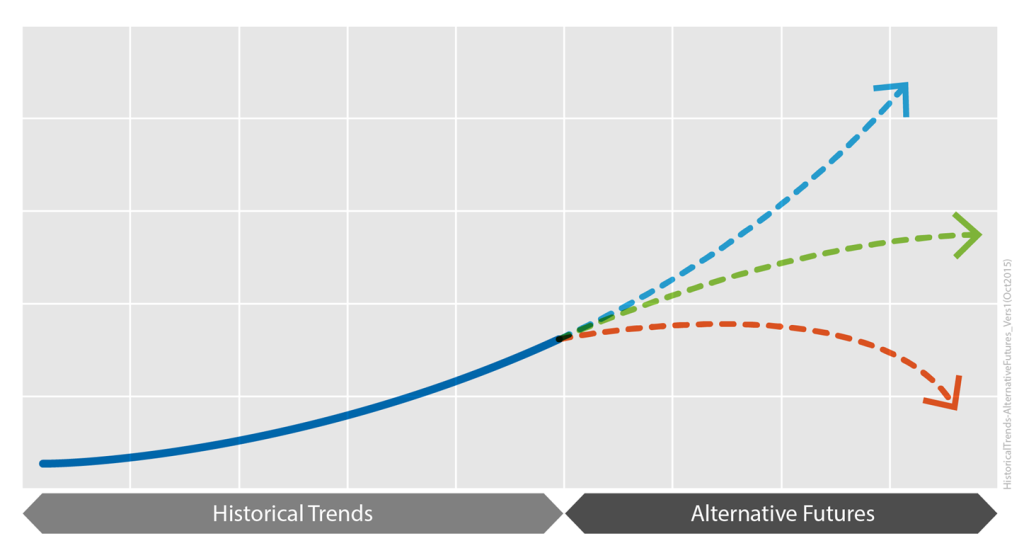

It is not a straight line into the future, where we set assets in motion and let them go. Longer term thinking, long-termism, has to think in cycles.

*Almost certainly it was Todd’s brainwave, which I managed to catch up with.

Thanks to my brother Bill Wallsgrove

Board member Lou Cripps and his team at RTD are great Asset Management practitioners – and that is largely because of their attitude to time.

For example, the team prepares carefully for meetings with key stakeholders, not just the CEO but engineers, IT, maintenance, HR. They think carefully about what they want to effect through the meeting – their objectives – and then project forward what the possible response/s of the others will be, based on their previous interactions. They can then work on what will most connect and make a win:win outcome likely.

Lou’s team also makes full use of red-teaming and pre-mortems, to imagine what could go wrong with an initiative so they can prepare not to go there. Risk assessments and risk plans, essentially, but exploiting the human ability to project forward and then ‘look back’ in our minds. (“Imagine it’s six months’ time and we are doing a post-mortem on what went wrong.”)

Lou refers often to ‘future me’ and ‘future us’: that is, stepping in the shoes of himself in a year or ten years’ time. This is not just to feel how fed up he might be then about what he failed to do now, but also to consider what future him would care about more widely. It is empathy with a future self. And it does not even need to be yourself. What about someone in the community in a hundred years?

This is good Asset Management for infrastructure, in particular, as infrastructure decisions we make now should always be assumed to have lasting implications. The assets we build now may still be in use in a hundred years. And the things we don’t build because we’re building something else. The lost opportunities, and future debts. What we fail to maintain, so will have to be built again…

Lou’s team last year relentlessly analysed the data to work out the likely costs – the total costs, now and into the future – for a proposed project to buy more electric buses. They worked out that this particular set-up would cost their transit agency approximately $2 a mile extra on every electric route for the next 50 years. It wouldn’t even save on carbon, because the electricity supply proposed was fossil fuel burning generation. (It was not a good proposal, and the Board duly turned it down thanks to their analysis.)

To build and not think ahead is a dereliction of duty. Principle number one for an Asset Manager: always ask, “And then what?”

Making full use of the past, in order to think ourselves into the future.

How do you this in your team?

In 2024, Asset Management turns forty.

One key question for me this year as an Asset Management practitioner is time itself, and how we act with the future in mind.

The innovation of Asset Management is very largely about time. Penny Burns created AM to look forward in time and consciously choose whether we needed to renew like-for-like, or should manage our assets differently in future.

Forty years ago, we were not thinking about climate catastrophe, and we were only just at the start of the IT revolution. (I had only just seen my first PC, and the world wide web, smart phones and terabytes of data storage for $50 were barely pipedreams.)

But the question of longer-term thinking has in some ways gone backwards in our societies since then, not forwards.

The vast majority of infrastructure organisations still only have very short term asset plans, and almost no asset strategy. More have, must have, 3- or 5-year plans now, thanks to AM as much as anything. But the 15 to 20 years plus strategic view that Penny proposed is still a challenge.

And shockingly few agencies even use life cycle modelling to project the very basic realities about the timings for replacements, let alone a mindset of always asking ‘And then what?’ of our day to day and year to year asset decisions.

I fear as a community we are still underskilled, underprepared for the future: for embracing uncertainty and identifying with the future.

And so, as we celebrate, look back and learn from the last 40 years, Talking Infrastructure plans to act like the future matters.

Starting with a time series of blogs to ring in the New Year. Your contributions most welcome!

In April 2024, it will be 40 years since Penny Burns started the whole thing. Talking Infrastructure plans to party like it’s 2024, all year.

2024 also marks milestones for the Global Forum for Maintenance and Asset Management (update of the AM Landscape), ISO (10 years since ISO 55000), and the Institute of Asset Management (30 years since it was founded): there will be a lot happening.

The need for more considered decision making for our future infrastructure has only grown and become more urgent. Asset Managers everywhere know this. Our 40 year celebration will be an opportunity to take this message not only to managers of infrastructure but also to those who decide, design, construct, fund and vote for our infrastructure.

Like infrastructure itself, our purpose is to support the wider community. There is a lot of satisfaction to be had in this and we invite you to join us, and enjoy it too. What area of Asset Management and decision making particularly interests you?

We are looking to develop a circle of advisors, who, through their interests and work, can have the fun of keeping Talking infrastructure up to date with current issues, and setting its future directions.

Your ideas for celebrating our 40th are also needed and much welcomed. This will include events across Australia in April, and presence at AM conferences and articles wherever and whenever we can.

What did we learn in the last forty years? Where do we need to go in the next 40 years?

© https://www.dreamstime.com/ image120059878

I love a friendly alien. Some of us – possibly the less military minded – have long preferred stories of good contact experiences, from ET and Close Encounters of the Third Kind to Arrivals. Indeed, the grandmammy of them all, The Day the Earth Stood Still, which is about the shortcomings of militarism.

There’s a new generation of sci-fi with what can only be described as positively cuddly species from other planets. The close encounter in A Half-Built Garden, by Ruthanna Emrys, echoes The Day the Earth Stood Still in that the aliens have come to save humanity from itself. But the ‘dandelion networks’ are already saving the planet through direct democracy based around watersheds, to them the natural way to organise.

And it could not be more cuddly: the first human to meet the aliens is woken by water pollution alarms in the Chesapeake in the middle of the night, and hurries out to check what is happening taking her baby with her. Turns out the aliens don’t trust anyone who would not bring their babies to a key negotiation.

The principle the dandelion networks use in decision-making about infrastructure and other technology is: will what we are building be at least as benign as a cherry tree? With evident, multiple benefits and few costs, and a net positive impact on the environment?*

If not, don’t build it.

Is there anything we are building today that would pass the cherry tree challenge?

*Ruthanna borrowed the metaphor from Cradle to Cradle: Remaking the Way We Make Things by William McDonagh and Michael Braungart, 2009.

Note: Print copies of The Story of Asset Management are available, go here and choose the direct Amazon link for your location. (and my thanks to Matthew Hughes who drew my attention to the fact that this was not at all obvious.)

A writer for the Guardian described ‘The Story of Asset Management’ as the ‘inside story of a major change’. She said: “While discussions about government reforms make take centre stage, the behind-the-scenes processes of problem-solving and innovation remain less documented” and this is very true.

I am grateful to her for this insight, for it tells me that this story of how AM grew, can also be used as a rough guide to growing any idea. I can’t say that I knew this at the beginning, but looking back, I think that there are three keys to growing an idea. 1. You have to be fully committed to your idea which doesn’t mean knowing exactly how to do it, but rather having, and believing in, a direction you want to move in. 2. You can’t expect others to do the work, you have to be prepared to do much of it yourself. 3. But while you are doing this, you must actively share the excitement, fun – and the credit – as widely as you possibly can.

As you read the many anecdotes in this story I would be interested to hear from you whether you believe this to be true. I hope you enjoy the story, simply as a story, our story. But I would be very pleased if you were able to use it fo further an idea of your own, either in asset management or elsewhere.

Penny

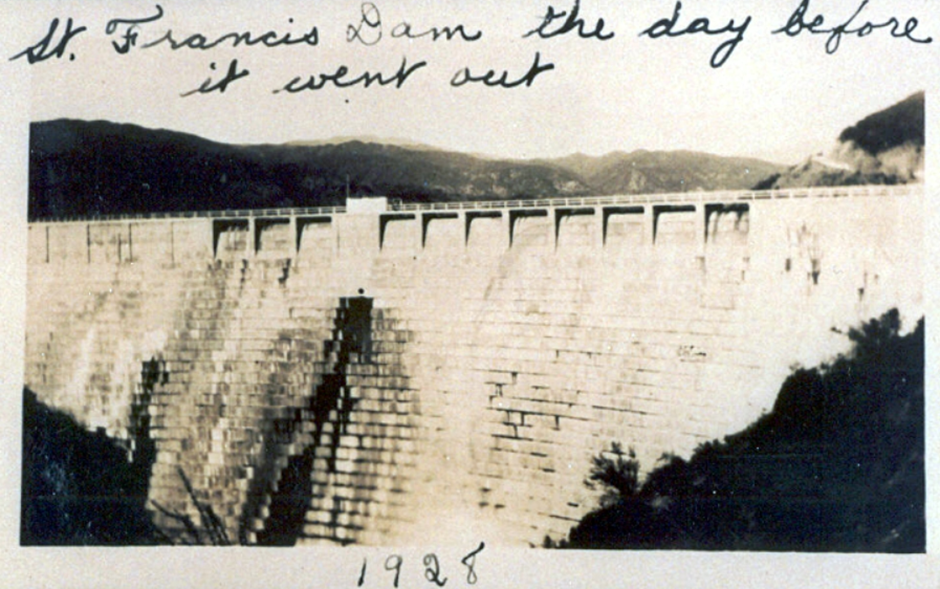

Last known photo of St Francis Dam before it collapsed, © scvhistory.com

You know when you hear something you never noticed before, and then hear about it again the very next day? (It’s known as the Mandela Effect.)

I mean, I saw Chinatown many years ago and so understood that there was a rotten heart to Los Angeles’ water supply, but I never thought about where the water comes from – or understood how it trashed a valley and its communities in the 1920s.

Originally called Payahǖǖnadǖ, meaning ‘place of flowing water’, Owens Valley is a now dry valley north of LA.

I work with enough hydro dams to be curious about dam failures – there have been a few catastrophic failures in the 20th century – so wanted to watch a PBS documentary about the total failure of St Francis Dam in the valley. It failed because of hubris. It did not make it past its first day in operation. But the documentary was about much more than the immediate collapse and the hundreds of people who died that day.

Los Angeles basically stole the water, buying up water rights surreptitiously and sometimes illegally. For some reason I can’t comprehend, it even memorialises the engineer responsible for the dam failure (and the overall aqueduct, which does still exist): Mulholland, of the Drive.

And the day after I watched the documentary, I read a review of a book titled Dust, by Jay Owens, using the Owens Valley as a 20th century example of humanity creating arid dust bowls where there were once thriving ecologies.

Metropolitan LA is a funny old place. I have spent plenty of time there as my brother moved to Azusa in the late 1970s, and retired to Orange County to the south. It was hailed as the city of the future once, but water is the big question mark, still. You would have to conclude that the LA basin is well beyond its carrying capacity, and perhaps always was.

Owens Valley, and St Francis Dam, seem suitable reminders of the challenge of sustainability. enshrined in the original BSI PAS 55 definition of Asset Management. The valley and its people – original and immigrant – paid the price for the development of a vast city region.

Not the first and surely not the last example, but a sobering reminder that water engineering is both hard, and not always on the side of the angels.

Thanks to Chad Dulac of Chelan County PUD, WA, for this steam-punk platypus

I just dutifully waded through a dismal history of the last five decades of British economic policy. Plenty of government mistakes, and nothing that really got past missing an empire. (The Tyranny of Nostalgia, by Russell Jones.)

Despite a less than adequate grasp myself of the mechanics of money supply and exchange rates, I wanted to learn lessons for we should be doing in future. And try to keep up more with Penny Burns, of course.

The book itself focused most on economic stability, and how that encourages good things to happen. Or at least doesn’t scare the horses. And something beyond short-termism and political self-interest.

But, at the very end, the author did have to conclude that successive British governments have done less and less on what truly underlies the ‘economy’: on developing skills, encouraging new ideas, and supporting infrastructure. On how to enable people to do interesting things, really.

And here is where talking about infrastructure comes in.

The physical infrastructure of water and waste water, power, transport and telecommunications isn’t something in its own right, assets for their own sake. It’s about enabling us to do what we need and want to do. Along with agriculture, education and health, it has to start with supporting Maslow’s hierarchy of needs. No-one too hungry or cold or isolated or poorly educated to reach for self-realisation.

In a country increasingly of “private wealth and public squalor” – used originally to refer to the United States – I come back to the sheer waste of potential in Britain, along with the heartache of poverty and lack of opportunities. It’s not like we don’t have plenty of really interesting challenges to apply our collective energy to.

Obviously no-one in the current British government has any kind of vision for community beyond their rich mates.

But what is our vision?

Recent Comments