18 months ago I had the pleasure of co-designing and presenting a capacity building workshop for Auditors-General in the Pacific Islands. The subject of the workshop was auditing for the better management of public assets. We looked at the 4 stages – planning, construction,operations & maintenance and, finally, renewal or disposal – and discussion revealed that the auditors chose to spend the bulk of their time in analysing performance at the operations & maintenance stage. This made sense. It is by far and away the area where most expenses occur. However, it is not the stage where most expenses are committed. That occurs much earlier, at the planning stage. This is the stage where the nature, location and size of the project are determined and these are the primary determinants of how much will be spent later at the operations and maintenance stage.

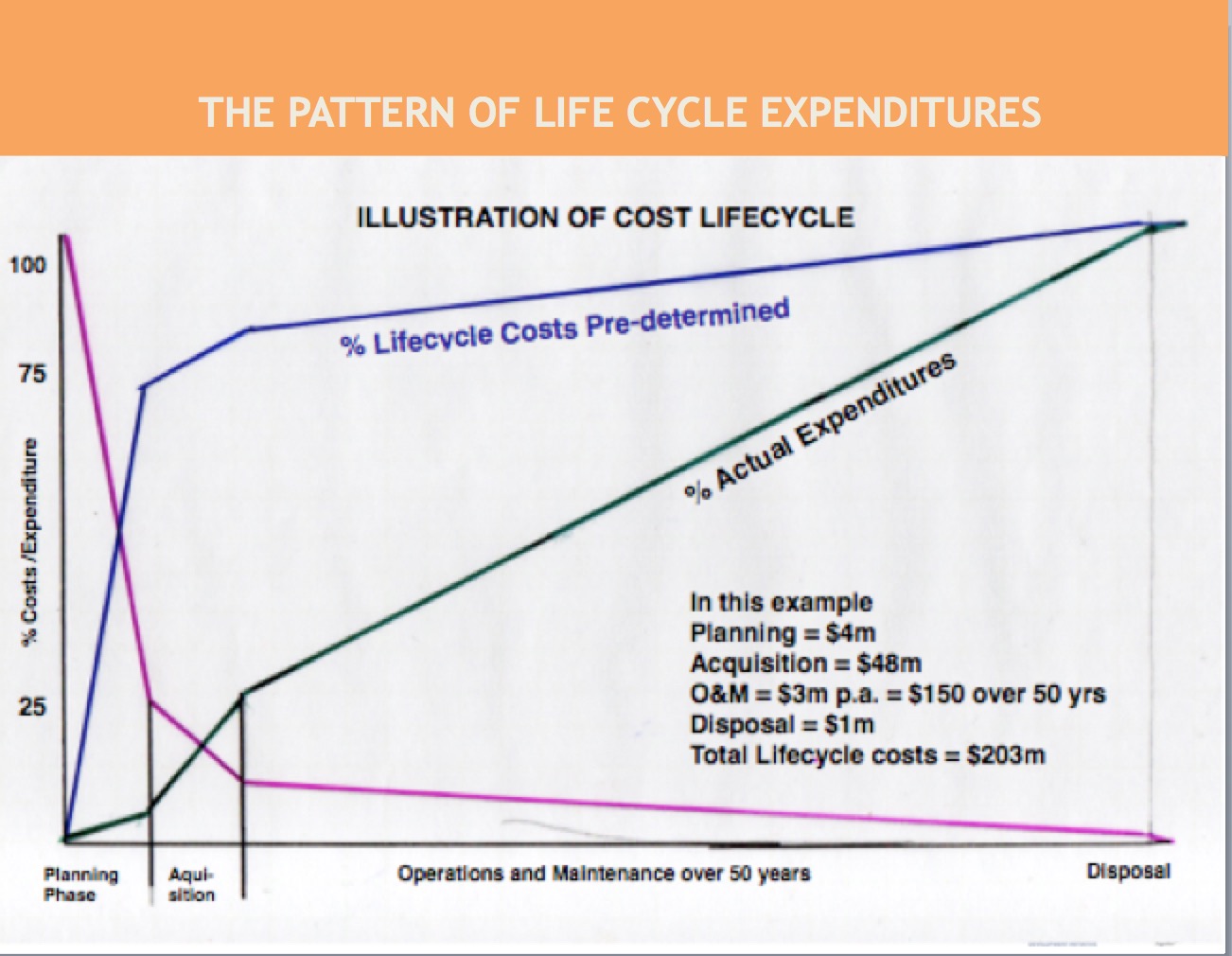

I drew up a hypothetical schema to make the point. It showed that, by the end of the first or planning stage, only $4m of the total life cycle costs ($203m) had been spent BUT, the decisions made during this phase had already committed about 75% (and sometimes more) of the total costs. In the diagram the green line represents costs actually expended, the blue line costs pre-determined and the purple line represents the scope remaining to make a difference to total costs. This shows that by the time the plant is commissioned and operational, there is really relatively little that can then be done to improve on the overall life cycle costs.

The figures I used in this example are fictitious.

They are consistent with the theory and principles of life cycle costing as shown in the major textbooks on the subject.

I would have liked to use real figures but I couldn’t find any. So I contacted people who might be expected to know – key academic figures in asset management, experienced consultants, long time practitioners. But no, no-one could help.

So my question today is:

Why do we have so little actual data about this very key and critical stage of decision making? And how can we improve our knowledge – and thus our performance?

In the last post “The Infrastructure Quiz” I asked what the ‘purpose’ of infrastructure is. What did you choose? If you ask this question of most people, the answer is obvious – it just isn’t the same answer for everyone!

Have a look at the following possibilities:

- For asset managers, the answer is obvious – it is to provide needed services that underpin the economy and society well being.

- For economists in the Treasuries, the answer is equally obvious – it is to kickstart the economy. (For many years we had a stop-go policy for infrastructure. Whenever the economy got overheated, governments would cut back on infrastructure spending, and whenever it slowed down, they would spend more. There was a period in the early 2000s when this was recognised for the damage it caused. But now it seems to be back again.)

- Politicians and Think tanks are the ones likely to claim that infrastructure – ‘increases productivity’ and ‘raises the standard of living’ (but they seldom spell out exactly how, for it is all regarded as self-evident.)

- For the general public (most of whom could not give any examples of infrastructure beyond roads, if that) the answer is that the purpose of infrastructure spending is to ‘create jobs’.

- Military and strategic planners often see the construction and location of infrastructure as a strategic control problem. Many politicians do the same.

- The construction industry and its lobbyists strongly believe that we not only need infrastructure to keep the industry afloat but that we need to forecast what infrastructure and where in order to enable them to plan.

So, many purposes – all ‘self evident’!

In the last post Jim Kennedy, Asset Management Council, looked at what it took to construct a ‘defensible budget’. He argued that stakeholders (customers, community, government, employees) are everything but he wondered whether organisations really understood what they were promising. In other words were they really clear about the consequences of their decisions and promises made?

In the last post Jim Kennedy, Asset Management Council, looked at what it took to construct a ‘defensible budget’. He argued that stakeholders (customers, community, government, employees) are everything but he wondered whether organisations really understood what they were promising. In other words were they really clear about the consequences of their decisions and promises made?

Capability to deliver

For example, had they turned these promises into the capability to deliver (technology, plans, people, facilities, information systems, logistics, support systems).

This has two aspects: there is an ‘enabling or inherent capability’ and an ‘organisational design, or organisational capability’. In other words, the equipment may be able to deliver, but has the organisation the right people in place?

Studies have shown that where someone was sent in to fix a problem who did not know what needed to be done, was not familiar with the asset or problem, or was not fully competent to do it, the level of competence was only 50% . This led to the job needing to be done 5 (!) times more often than if a competent knowledgeable person had done the job initially with 100% competence.

But what is the organisational implication of this? To ensure that you have the right level of competence ready when needed, you have to have highly competent (and thus well rewarded) people under-occupied so as to be available when needed. As we cut back on training because it is expensive, and aim to have everyone fully engaged all the time in order to ‘achieve efficiencies’ – what is the real cost? If we cannot demonstrate the benefits of organisational capability in a ‘defensible budget’, costs will increase and quality decline.

Comment?

We often take pride in our ability to ‘make do’ when the situation is not as we would have liked. This particularly applies to those occasions when we do not get the budget we requested. We grizzle – but we ‘make do’. But what message does this send? Jim Kennedy, speaking at an Asset Management Council Chapter Meeting in Adelaide warned of the dangers of this ‘make do – can do’ culture. When we ‘make do’ (usually by cutting corners, or deferring activity that results in larger costs later) we are telling the finance section that our budget request was overblown. When Finance subsequently provides less than requested (working on the basis that the initial request was ‘gold plated’) and the recipients subsequently ‘make do’, that does more than confirm the initial Finance suspicion, it creates a lack of trust on both sides. Budget proposals are now ‘boosted’ to allow for the inevitable cuts. Finance reduces the budget request and as it goes on, budgets lose their informational, decision-making, value.

We often take pride in our ability to ‘make do’ when the situation is not as we would have liked. This particularly applies to those occasions when we do not get the budget we requested. We grizzle – but we ‘make do’. But what message does this send? Jim Kennedy, speaking at an Asset Management Council Chapter Meeting in Adelaide warned of the dangers of this ‘make do – can do’ culture. When we ‘make do’ (usually by cutting corners, or deferring activity that results in larger costs later) we are telling the finance section that our budget request was overblown. When Finance subsequently provides less than requested (working on the basis that the initial request was ‘gold plated’) and the recipients subsequently ‘make do’, that does more than confirm the initial Finance suspicion, it creates a lack of trust on both sides. Budget proposals are now ‘boosted’ to allow for the inevitable cuts. Finance reduces the budget request and as it goes on, budgets lose their informational, decision-making, value.

Jim proposes that the value proposition for Asset Managers should be “How to protect your leader against political opposition” and his answer to this question is a ‘defensible budget’.

So what is a ‘defensible budget’? Jim describes it as follows:

- Fact and Risk Based

- Fully traceable to the asset’s output requirements.

He reckons these two are really sufficient but could be bolstered by showing that the budget is

- demonstrably good practice and in accord with national standards; *compliant with statutory and regulatory imperatives;

- implemented by competent (certified) staff;

- supported by verified technology (information decision systems);

- transparently and verifiably costed (which builds up trust between the technicians and finance; and

- deliverable in the agreed time frame (don’t promise what you cannot deliver).

Good stuff! – but, and here’s the rub – developing good practice, ensuring competent (certified) staff, establishing sound information decision systems, demonstrating transparency and ensuring deliverability does not happen overnight. It takes years of consistent management attention and good leadership.

Question this week: Do you know where your organisation stands on each of these facilitators of sound and defensible budgets? Is there a program to improve it? Comment?

Editor: You can find earlier posts on budgets, by using the search function, and all posts by Mark by selecting his name.

Further to my earlier posts about asset budgets, I couldn’t help but want to have another go at this by asking a slightly different set of questions. These relate to the principle of transparency.

Further to my earlier posts about asset budgets, I couldn’t help but want to have another go at this by asking a slightly different set of questions. These relate to the principle of transparency.

By transparency I mean:

Is there a clear and documented basis for the estimates upon which the asset budget has been based?

- Are the estimates based on ‘simple’ or ‘averaged’ projections of expenditure rather than ‘modelled’ projections that emulate realistic timings and patterns of expenditure for the nature of the works involved and how they will be procured?

- Is it based on estimates for all assets over the full period that the budget is meant to address? By all I really mean a schedule that lists all of the assets, including those for which a $NIL expenditure is forecast for the relevant period. (I ask this as a check that all assets have been given consideration.)

- Are the underlying assumptions documented and made clear to those being asked to approve the budget – especially the reliability / sensitivity of rates used and associated finance costs?

- Are the priorities inherent and sequencing / pace of the proposed works also made clear and demonstrably aligned with corporate business and services priorities for the forecast period? How does this align with projected cashflow requirements and funding availability? (A projection showing a skewed acceleration of expenditure towards the final quarter must raise concerns – not only about reliability of delivery, but also in relation to business and services priorities being effectively supported, and in relation to getting value for money from what is going to be spent.)

- Are the risks that are inherent to the portfolio and the proposed program delivery made clear and ‘current’ for the immediate and forecast context of the program and its delivery?

If these aspects are not transparent to the decision-makers then there is greater risk that the program will not be delivered and the budget will be nowhere near accurate

A hole in your budget needn’t be the end of the road!

In the previous post we looked at a city council’s response to a sudden $60m hole in its budget – and the consequent media storm. Could this have been treated differently?

Put yourself in the City Council’s situation. Faced with a sudden $60m hole in your budget through external circumstances, what are your options?

- You can cut back on services (but these are services that the community want and that you have already prioritised into your budget)

- You can borrow (and borrowing might be a short term option to maintain service continuation but only if there were expectations that the external cut would be reversed in the near future or that other revenue increases could be anticipated)

- OR, and this is the option that the City adopted, you could withdraw the funds from your fully owned subsidiary – in this case BC Hydro – in exchange for a city asset portfolio (city street lighting).

BC Hydro now needs to make a return on the assets it has bought and so it engages in a forward contract to maintain, operate and supply street lighting services to the council.

Bear in mind, that any profit made by BC Hydro reverts to its shareholder – the City Council. If the costs of the contract are greater than the costs that would have been incurred by the City if it had retained ownership of the assets, then this will be reflected in a larger profit made by BC Hydro. Conversely if the contract costs are less than the City would have otherwise paid, it saves on ratepayer funds but (unless BC Hydro can run the streetlighting more cost effectively) it will receive a lower return on its BC Hydro shareholder funds.

OK, so these are the financial facts. The transaction enables the City to continue providing all the services that its ratepayers want and expect in the face of a sudden hole in its budget caused by the withdrawal of provincial funding. Out of one pocket into another but the same city coat! This being the case, why did the question of how much that was paid for the contract become the major story?

I would suggest that there are a number of lessons to be learnt here:

- The City could have sold this as a smart solution to the problem of continuing needed community service in the face of sudden withdrawal of funding by the Provincial Government. It could have promoted the idea of BC Hydro being in a better position to cost effectively manage street lighting given its expertise in lighting and power generally. It could have used this problem to market the value of its ownership of BC Hydro. In other words, on a PR basis, it could have got out in front of the story. But it didn’t. Instead it hid the contract details for 5 years before eventually acceding to Freedom of Information requests. Whatever the facts of the case, this action itself makes the council guilty in the eyes of the public.

- The public generally have very little understanding of the ratio of ongoing operations and maintenance costs to the initial capital costs. If we don’t tell them – in ways that they can understand – their natural reaction is to see the annual payments in the light of (exhorbitant) interest payments.

- The time to generate this greater understanding is BEFORE you need to use it to substantiate council decisions

- In all likelihood, the councillors (and perhaps senior staff members) did not understand the full import of operations and maintenance costs either. Their reaction in hiding the costs from public view suggests that they did not believe they were defencible.

Lesson 1 may not apply to you now, but Lessons 2-4 will always apply.

Comment: What are you doing to ensure this level of understanding of O&M is generated in your council and staff (or in your senior management and board)

Should I jump?

In 1993 a very successful American bond trader gathered together a few of his disciples and a handful of super-economists and set up a new hedge fund company that promised to be different from anything that had gone before. The new company apparently genuinely believed that their ingenious computer models would allow them to bet on the future with near mathematical certainty. Because their team had some high powered players – including two who were to be future Nobel Prize winners – investors believed them. The company portfolio grew quickly to $100 billion when a default in Russia set in train a sequence of events that the models had not anticipated. This placed the whole financial system at risk and the Federal Reserve quickly called in Wall Street’s leading bankers to underwrite a bailout. Roger Lowenstein in “When Genius Failed” (Fourth Estate. 2002) tells the whole fascinating story.

How could anybody – let alone the super intellects in that hedge fund company – possibly believe that a computer model, no matter how finely tuned, could predict ‘with near mathematical certainty’ future stock markets (which, after all, reflect the volatility that Keynes referred to as ‘animal spirits’). How could investors clever enough to have amassed the funds to invest, believe them!

Pondering these questions, I thought of the managers I have met who so passionately believe in their models that they brook no doubt, no exploration of better ways, no questioning – and I thought of the problems that this causes. Possibly it starts because to get financial backing in the first place, either from your organisation or from the market, you need to assume and project confidence.

However, confidence is one thing, blind confidence completely another.

So my question for you today is: How do we transit from the confidence we need to be persuasive before the project is adopted, to the level of confidence we need, after the project is adopted, that allows some room for doubt enabling resilience when the world changes (as it certainly will)?

Our post today responds to a comment by Ben Lawson that the “Fit for the Future” program is leading councils to equate depreciation and renewal spending regardless of the age or need of their assets.

Our post today responds to a comment by Ben Lawson that the “Fit for the Future” program is leading councils to equate depreciation and renewal spending regardless of the age or need of their assets.

This issue came to the attention of one of our State Auditors-General who dismissed it, saying ‘I agree that a ratio of renewal: depreciation is too simplistic and that there are real risks to be managed, but ‘it is only an indicator’ ‘ He also suggested that since ‘bureaucrats avoid things that are too complex’, it was necessary for indicators to be as simple as possible.

It is not difficult to see how dangerous this approach is when you consider that an aircraft instrument panel is simply a set of indicators. But without many hours of flying instruction (and thus an understanding of what lies behind each of the indicators) would you expect to be able to correctly interpret the information provided by these indicators – and keep the plane from crashing?

Perhaps we can make it easier for you as the pilot if we simplify the indicators! What if were to just keep the altimeter, for example, or the speedometer? Perhaps just the fuel gauge? Maybe we could do without the compass, or the airspeed indicator, or the directional gyro? And is the turn indicator really necessary? What about the vertical speed indicator?

Well, you don’t have to be a trained pilot to figure out that actually you DO need all the instruments on the panel – ALL the indicators, and enough understanding to be able to correctly interpret them in any particular circumstance. Moreover, this is just for a simple two seater Cessna, not even a Boeing 707, and just for just one aircraft – not a fleet of aircraft.

Now consider that even a fleet of aircraft would present far less decision points than the far greater variety of assets and asset questions facing the average council. Can the task of managing an ever changing and wide range of public sector assets with all their attendant services and disparate user groups, possibly be managed by a few simple indicators?

Worse, can they be managed by a few rules that are applied blindly without understanding?

Ignoring a problem doesn’t solve it!

You might think the answer to be self evident: surely we would all wish to see the best outcomes! However, when it comes to government spending on infrastructure and public assets, this may not be the case. For state government public authorities, capital expenditures are often seen as a means of increasing the state’s GDP (gross domestic product), or a means of keeping up ‘a pipeline of investment projects’. When this is the case, departments that do not spend all their capital budgets are not regarded as ‘economical’, instead they are considered grossly inefficient.

When I was a policy manager in one of the state public works departments, budget meetings were only concerned with how fast money was being spent, not how effectively. Taking the time to find more efficient ways to produce any given outcome, and so to spend capital money more efficiently, was actively discouraged: it slowed things down and the department did not spend ʻenoughʼ.

Much of the problem is that there is no easy way for politicians to demonstrate performance – only dollars of spending. I doubt that this happens for any organisation with a quantifiable ʻbottom lineʼ (utilities, mining, manufacturing, etc) – but maybe they have other problems?

Even for local governments, which are generally very short of capital money overall, and where one would think the ideal solution would be to get the ʻmost bang for the buckʼ, taking the time to look for ways to achieve ‘more for less’, is rarely well regarded as the economies achieved are often difficult to demonstrate, while the extra time taken will often feature in negative media reporting. In addition, local governments frequently depend on capital grants from state and federal resources with short decision and expenditure deadlines imposed in order to secure a fillip to the economy (i.e. to spend money fast).

This problem has bedevilled me for over 30 years. Is there a solution?

Many of us watched in horror as the flames raced up the 24 stories of the Grenfell Tower in London, as firemen desperately tried to find and save individuals in the dense smoke, and where the death toll is now 79 (and may still be rising). Much has been written about this already, and with the inquiries now launched, more will be written. We will, hopefully, find out the details of this particular infrastructure failure. In the meantime there are two areas to consider.

Many of us watched in horror as the flames raced up the 24 stories of the Grenfell Tower in London, as firemen desperately tried to find and save individuals in the dense smoke, and where the death toll is now 79 (and may still be rising). Much has been written about this already, and with the inquiries now launched, more will be written. We will, hopefully, find out the details of this particular infrastructure failure. In the meantime there are two areas to consider.

1. Technical issues and organisation (this is probably our first departure point).

“Sprinklers would have saved lives. Fire stops that should have protected the internal means of escape may have been faulty or missing. The gas supply lines are under suspicion. The Grenfell Action Group had presciently warned of a lack of fire safety instructions. 999 operators fatally stuck to the official advice that people should stay in their homes, which makes sense when the building regulations are doing their job of containing fires within a single flat, but not when the whole building is engulfed. Compartmentalised thinking – the inability of any one agency to see the whole picture – played a role. It’s likely, as often in major disasters, that it was the cumulative and multiplying effect of several factors that made it so terrible.” Guardian columnist, Rowan Moore

cf. Post on The Titanic and Apollo 7 on June 13

2. Social Attitudes

“I have sat in council meetings where comments from leading majority councillors have shown a total lack of empathy or even respect for those not born to a world where basic human comforts and a good education are givens. I have heard – and noted – comments stating that social tenants should simply move away if they don’t like what they’ve been “given”. As if social housing was not a public good but some kind of privilege to which they are not really entitled. Alongside this has been a slow but deterministic programme of privatising and monetising public assets such as schools, libraries and community and public space.” Local Councillor, Emma Dent Coad, writing in The Guardian

cf Post on Gentrification in Infrastructure and Progress June 16.

.

Recent Comments